“`html

Core News Facts

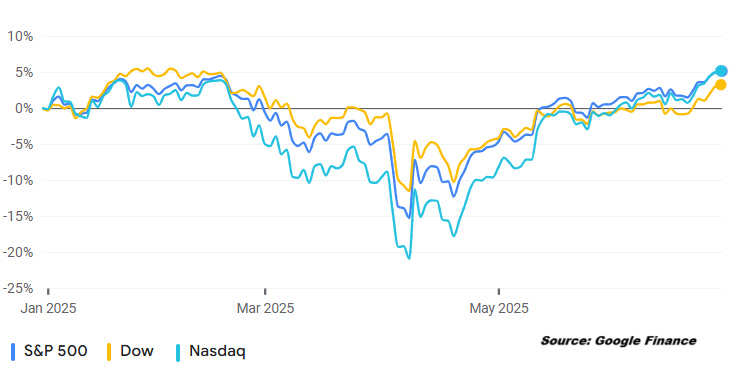

The U.S. stock market has shown significant volatility since the start of 2025, with the Dow Jones Industrial Average and S&P 500 experiencing corrections while the Nasdaq Composite briefly entered a bear market. Concerns over inflation have escalated primarily due to President Donald Trump’s trade policies and an accelerated growth of the M2 money supply, which has increased by 4% year-over-year as of May 2025, the highest rate since 2022.

Trump’s tariff strategy, which includes a sweeping 10% global tariff and higher reciprocal tariff rates, poses inflationary risks that may adversely impact U.S. corporate earnings. Additionally, the S&P 500’s Shiller price-to-earnings ratio reached its third-highest multi-decade level at over 30, raising alarms over future stock market declines as historical data indicates potential declines of 20% to 89% following similar valuation peaks.

Concerns extend beyond inflation, as the earnings quality of major corporations, such as Tesla and Apple, faces scrutiny. Tesla relies heavily on regulatory credits for significant portions of its income, while Apple’s growth has been masked by extensive share buybacks, raising doubts about the sustainability of its earnings growth.

“`