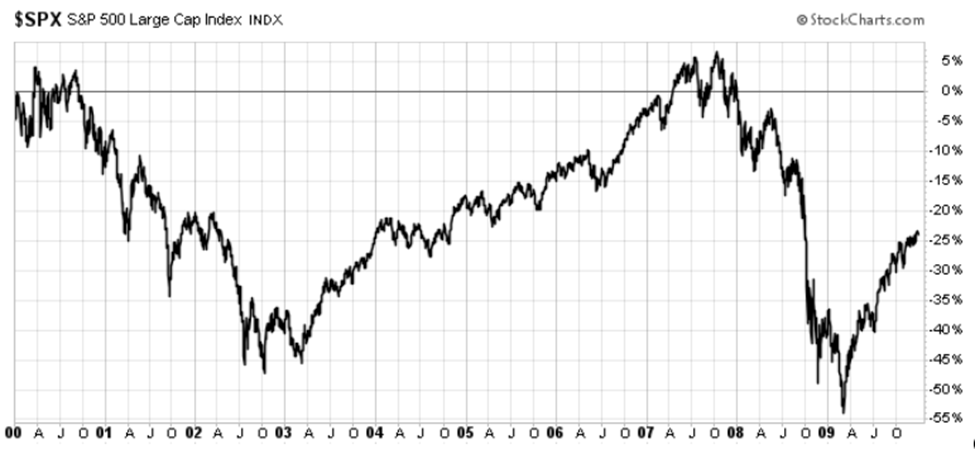

Louis Navellier, a veteran investor, warns of a potential “Hidden Crash” forming in the stock market by 2026. He argues that unlike traditional crashes marked by sharp declines, this upcoming risk involves stagnating earnings momentum among major stocks, which could trap investors in “dead money.” Historical context is provided by referencing the “Lost Decade” of 2000 to 2009, during which the S&P 500 made little progress, contributing to significant capital loss for those who failed to adapt.

Navellier highlights that, similar to the previous decade, current market leadership is increasingly concentrated among a few mega-cap companies. As growth slows and margins compress, the risk of capital stagnation rises. He specifically notes that stocks like Cisco and Intel languished during the last Lost Decade, urging investors to identify and exit positions that could become unproductive.

Key insights indicate the importance of recognizing shifting market dynamics early to avoid stagnation. Investors are encouraged to monitor earnings acceleration closely and seek out emerging opportunities in innovative sectors, which could provide more substantial returns as market leadership evolves.