The ability to adapt to markets is what separates the good traders from the great ones. Applying the right strategy that will outperform in a given market condition is paramount to trading success.

Options provide us with that flexibility, enabling us to tailor our strategy to the current market environment.

The benefit of increased market volatility is that option premiums become very rich. If we purchase an option, we will need to pay a higher premium due to high market volatility. But when we are the option seller, we’ll receive high premiums in the form of cash credited to our brokerage account.

Spreads are extremely effective when markets get range-bound. Option debit spreads are implemented by purchasing a call option and selling a related call option with a higher strike price. These types of trades are limited risk trades because the short option is ‘covered’ by the option purchase.

When done correctly, trading options provides huge profit opportunities with limited risk making options one of the most versatile investment vehicles.

Option Essentials

Before we analyze today’s trade, let’s review some option fundamentals as a refresher. There is no need to worry about complex mathematical formulas or equations. Over the years I’ve found that the more complicated a strategy is, the less likely it is to work over the long run.

Options are standardized contracts that give the buyer the right – but not the obligation – to buy or sell the underlying stock at a fixed price, which is known as the strike price. A call option gives the buyer the right to buy a particular security, while a put option gives the buyer the right to sell the same. The investor who purchases an option, whether a put or call, is the option buyer, while the investor who sells a put or call is the seller or writer.

These contracts are valid for a specific period of time which ends on expiration day. There are weekly options, monthly options, and even LEAPS options which are longer-term options that have an expiration date of greater than one year.

Options consist of time value and intrinsic value. In-the-money options consist of both components; at-the-money and out-of-the-money options consist only of time value. At options expiration, options lose all time value.

Below we’re going to explore a call option spread strategy.

Profiting From Pizza Delivery

Domino’s Pizza DPZ currently meets our criteria for initiating a bullish option spread position. DPZ is trending well and outperforming the market this year. The company is witnessing positive earnings estimate revisions, which our research has shown to be the most powerful force impacting stock prices. DPZ is hitting a series of 52-week highs on increasing volume.

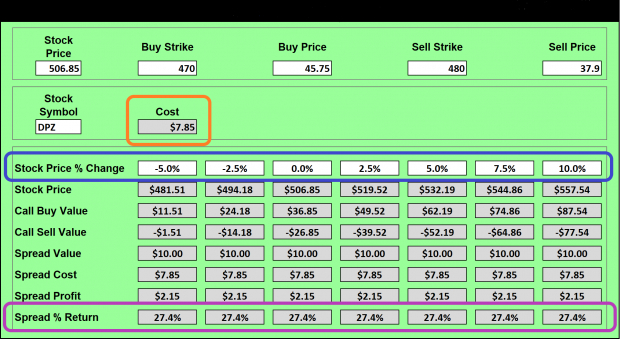

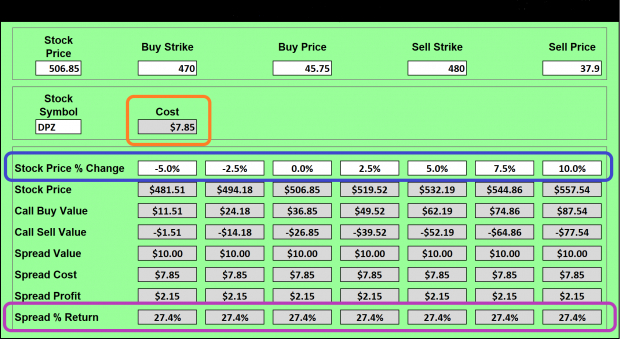

The table below displays the risk/reward profile for this trade. DPZ is trading at $506.85/share at the time of this writing. This trade involves purchasing the July 470-strike call at 45.75 points, and selling the July 480-strike call at 37.9 points for a total cost of 7.85 points. As option contracts represent 100 shares of the underlying security, this would represent a total cost of $785 per spread (orange box).

Image Source: Zacks Investment Research

The top (blue) row in the bottom section shows the performance of DPZ stock based on different percentage scenarios at expiration. The last (purple) row shows the corresponding percentage return for our debit spread trade. We can see that regardless of whether DPZ increases in price, remains flat, or even loses 5% from our entry, our option spread trade will produce a 27.4% return.

These are the types of odds I like to have in my favor when trading options.

Advantages of Spread Trading

1) The Option Sale Provides Downside Protection

The sale of a call option results in cash being credited to your brokerage account. This reduces the cost basis of the option purchase and provides downside protection in the event the price of the underlying stock declines.

2) Risk is Reduced

In the DPZ trade just presented, the sale of the 480-strike call reduced the risk of the 470-strike purchase from $4,575 to $785 per contract.

3) Allows Us to Maintain Positions During Volatile Markets

The downside protection provided by the call option sale helps us maintain our spread trade during heightened volatility. Naked option purchases may force us to sell early in order to prevent large losses.

4) Spreads Can Be Profitable If Stock Goes Up or Down

Option spreads can be profitable even if the underlying stock decreases or remains flat, providing us with an entirely new dimension of money-making opportunities.

The call option spread strategy is an excellent way to profit during periods of high market volatility. Remember that the call option sold through this strategy profits as the price of the underlying stock declines, providing us with a cushion during market pullbacks.

Option spreads are a safe way to use the leverage inherent in options. Your risk is limited to the price paid for the spread.

Volatile markets don’t have to be scary; instead, they can present a great opportunity to profit!

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Domino’s Pizza Inc (DPZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.