The Dynamics of Industrial Stocks

In an era dominated by digital advancements, the enduring relevance of physical operations underscores the enduring strength of industrial stocks. These equities are no strangers to the ebbs and flows of economic cycles, but several favorable conditions are aligning.

The period of inventory destocking triggered by the COVID-19 restrictions seems to have reached its conclusion. With shelves now cleared of the stockpiles amassed during the pandemic, it is anticipated that various companies will begin to ramp up their inventory orders – a development that bodes well for the manufacturing and industrial sectors. Moreover, the decelerating inflation rates have elevated hopes of an interest rate reduction by the Federal Reserve this year – a move that typically boosts consumer spending and enhances demand.

Truist’s industrial specialist Jamie Cook, a top-rated analyst positioned within the top 2% of Wall Street professionals, has been guided by these factors. Cook foresees promising growth opportunities within the industrial sphere.

“We are optimistic about the sector as we anticipate an unexpectedly robust industrial expansion in the latter half of 2024,” Cook remarked. “We believe that the sector is uniquely positioned for growth due to the resilience of earnings despite destocking challenges and a shift in demand patterns, partly supported by near-record backlogs which, although moderating recently. Moreover, industry players are benefiting from the proactive price adjustments made over the past few years to counter inflation, and concerns about potential rollbacks seem unfounded. In fact, these companies are increasing prices once more in 2024, albeit at more normalized levels.”

Expressing confidence in the sector, Cook has identified several industrial stocks as potential winners approaching the second half of 2024, sensing an emerging opportunity in these selections. Are other market analysts as enthusiastic about these prospects? Let’s delve into the TipRanks database to find out.

Deere & Company: Cultivating Success in Industrial Machinery

The initial contender on our list is a venerable player in the domain of agricultural and construction machinery. Even if you’re not directly involved in the farming or construction sectors, the green and yellow branding of John Deere is likely familiar, along with the company’s enduring slogan, ‘Nothing runs like a Deere.’ Leveraging a proven combination of quality offerings and effective marketing, the firm has secured a prominent position in the market, boasting a market cap of $106.7 billion.

The scope of Deere’s product portfolio is diverse and extensive. Renowned for its heavy agriculture machinery, the company produces an array of harvesters, planters, spreaders, sprayers, loaders, utility vehicles, and tractors of varying sizes, relied upon by farmers globally. Deere also manufactures heavy and compact construction equipment, including bulldozers, backhoes, excavators, and articulated dump trucks. For smaller-scale applications, the company is recognized for its compact tractors and landscaping equipment, encompassing various sizes of riding mowers.

Deere’s stature has been cultivated over its 187-year legacy; the company was founded in the mid-19th century and has been operational ever since. Headquartered in Illinois, at the heart of the US prairie farming belt, Deere presented financials of $12.19 billion in its recent quarterly report for fiscal 1Q24 (January quarter). Despite a 3.6% decline from the prior year, this figure exceeded expectations by $1.86 billion. Notably, the company reported a net income of $1.75 billion for the first quarter, translating to a GAAP earnings-per-share of $6.23, surpassing estimates by $1.02 per share.

Citing the company’s strong product lineup and adept management as pivotal factors, analyst Jamie Cook commended Deere, stating, “In our assessment, Deere stands out among industrial machinery firms due to its expanding technology narrative and revenue stream. Deere has consistently enhanced margins, returns, and cash flow throughout the business cycle, and we anticipate further opportunities for outperformance relative to peers. We anticipate that DE will demonstrate enhanced earnings and margins during the 2024 farm equipment downturn, reflecting a structural improvement from its historical performance.”

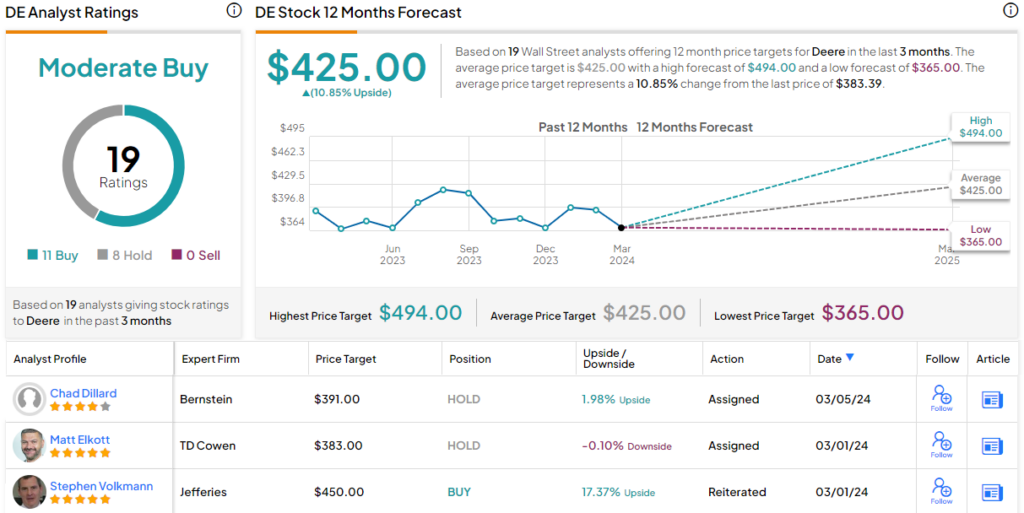

Anticipating a prosperous trajectory, Cook assigned a Buy rating to the stock, setting a price target of $494 that implies a 29% upside over the ensuing 12 months. The Street’s consensus on Deere is a Moderate Buy, derived from 19 reviews comprising 11 Buys and 8 Holds. Priced at $383.39, the shares boast an average target price of $425, suggesting an 11% upswing within a one-year timeframe.

CNH Industrial: Driving Innovation in Heavy Machinery

Turning our attention to the next prospect, we delve into the realm of heavy machinery once more. CNH Industrial operates within a parallel domain to Deere, focusing on the manufacturing of equipment for the construction and agricultural sectors. Tracing its origins back to 1842, CNH is a respected entity among its clientele of working farmers and builders, esteemed for its high-quality tractors, combines, tillers, and other specialized niche equipment.

Operating globally, with incorporation in the Netherlands, corporate headquarters in the UK, and operational presence across 32 countries, CNH markets its machinery through well-recognized brands such as New Holland, Case IH, and Steyr. These brands are marketed across CNH’s four primary geographical regions – North America, South America, Asia Pacific, and Europe-Middle East-Africa.

Last month, we witnessed CNH’s 4Q23 results, with consolidated revenues amounting to $6.79 billion. Falling short of projections by $60 million, this figure marked a 2.2% decline year-over-year. Notably, the net sales from industrial activities, constituting $6.02 billion of the total top line, demonstrated a steeper 5% drop year-over-year. Net income for the quarter tallied $617 million, while the non-GAAP EPS of 46 cents met expectations.

Despite the revenue setback, the company displayed robust cash generation during the quarter. Industrial free cash flow stood at $1.63 billion, with net cash from operational activities recorded at $1.51 billion.

In a recent intriguing development, CNH divulged that its investment arm had acquired a minority stake in the Brazilian startup Bem Agro. An existing supplier to CNH, Bem Agro is recognized for its AI imaging solutions that enhance agricultural field optimization.

Emphasizing the firm’s potential for value creation and growth opportunities, Cook outlined her evaluation of CNH in an initiation-of-coverage report, highlighting the company’s prospects for M&As and capital returns. Cook observed, “We believe that CNH possesses the capacity to enhance its margins consistently throughout the business cycle through simplification and internal initiatives, including its existing

Revolutionizing the Tractors: A Close Look at CNHI and AGCO Corporation

CNHI: A Leader in Agricultural and Construction Equipment

Case New Holland Industrial, or CNHI, stands out as a pioneer in the agricultural and construction equipment industry. The company has made significant strides in reducing Costs of Goods Sold (COGS) and Selling, General, and Administrative (SG&A) costs, paving the way for increased profitability. Furthermore, CNHI’s strategic investments in higher-return products and precision agriculture have positioned them as a frontrunner in the market.

With a robust balance sheet, CNHI possesses the flexibility to reward shareholders with cash returns and pursue strategic mergers and acquisitions that will further enhance its portfolio. Analysts, led by Cook, maintain a bullish outlook on CNHI, with a Buy rating and a target price of $18, signaling a potential 46% increase in the stock value over the next year.

Analyst Consensus and Forecasts

The consensus rating for CNHI is a Moderate Buy, based on 13 recent analyst reviews. This includes 6 Buy recommendations and 7 Holds, with an average price target of $15.91, indicating a projected 29% growth in the stock price within the next year.

AGCO Corporation: Innovating Agricultural Equipment

On the other end of the spectrum is AGCO Corporation, a Georgia-based company specializing in agricultural equipment manufacturing. AGCO boasts an impressive lineup of machinery under various brands, catering to all farming needs, from seeding and harvesting to logistics.

AGCO stays at the forefront of industrial technology through strategic acquisitions like JCA Industries, a developer of autonomous agricultural software. In a game-changing move, AGCO entered a joint venture with Trimble to leverage cutting-edge modeling and analytics technologies, propelling its product offerings to new heights.

Despite a slight revenue miss in the fourth quarter of 2023, AGCO remains a favorite among analysts like Cook, who commends the company for its potential to drive margins higher. With a Buy rating and a target price of $142, Cook anticipates a 22% upsurge in AGCO’s stock value over the next year.

Analyst Consensus and Forecasts

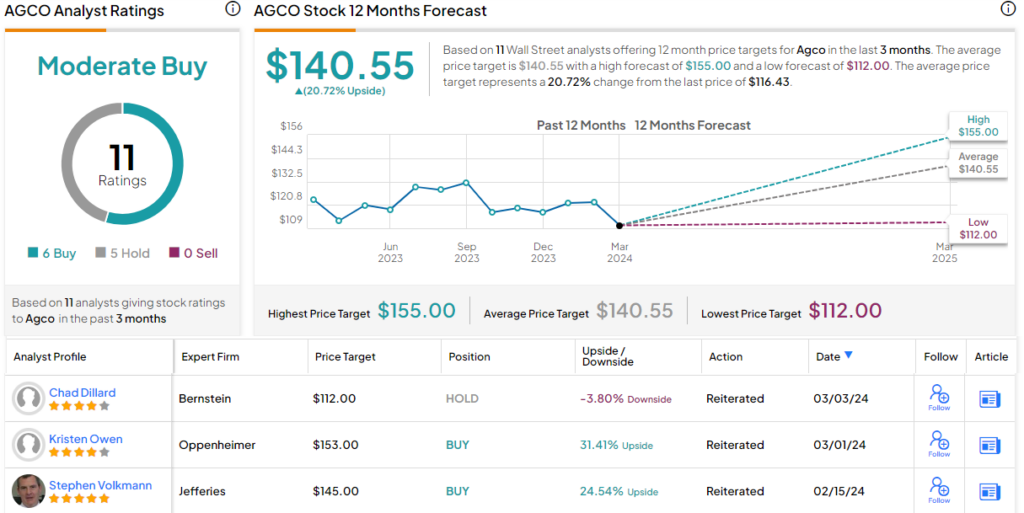

AGCO Corporation boasts a Moderate Buy consensus rating, with 6 Buy and 5 Hold recommendations from 11 recent analyst reviews. The average price target of $140.55 foresees a 21% increase in the stock price from its current value of $116.43 over the upcoming year.

To uncover promising investment opportunities, investors can explore Best Stocks to Buy on TipRanks, a comprehensive tool aggregating equity insights.

Disclaimer: This article reflects the opinions of the featured analysts and is intended for informational purposes only. Investors are advised to conduct their research before making any investment decisions.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.