Thermon Group THR reported fourth-quarter fiscal 2024 adjusted earnings per share (EPS) of 34 cents, which surpassed the Zacks Consensus Estimate of 32 cents. The bottom line fell 17% year over year mainly due to reduced volumes, product mix, spending and incremental interest expenditure, which were partially balanced by improved prices.

For the fiscal year ended Mar 31, 2024, adjusted EPS soared 16% year over year to $1.82, driven by the Vapor Power acquisition.

Revenues in the quarter totaled $127.7 million, beating the Zacks Consensus Estimate by 0.37%. The top line expanded 4% year over year owing to decarbonization projects and end market diversification strategy. The acquisition of Vapor Power in the fiscal fourth quarter was instrumental in generating $10.9 million in revenues.

For the full year, total revenues were $494.6 million, up 12% year over year, driven by steady traction in growth in power, food and beverage, commercial, rail and transit and chemical/petrochemical end markets. Among these, sales from power were up more than 170%, commercial grew almost 20% and food and beverage rose roughly 120% on a year-over-year basis. THR highlighted that its diversification strategy for end markets includes non-oil and gas unit which contributed 68% to total sales in 2024. The rapid adoption of Genesis Network, with the installed base expanding more than 204% during fiscal 2024, fuelled the top-line expansion.

Decarbonization revenues soared 48% in fiscal 2024 to $34 million due to the healthy adoption of THR’s sustainable decarbonization solutions.

Thermon Group Holdings, Inc. Price, Consensus and EPS Surprise

Thermon Group Holdings, Inc. price-consensus-eps-surprise-chart | Thermon Group Holdings, Inc. Quote

Other Details

Gross margin during the quarter was 41% compared with 42.1% in the prior-year quarter, contracting roughly 110 basis points (bps).

For fiscal 2024, the gross margin expanded 80 bps year over year to 42.8%.

Adjusted EBITDA for the quarter fell 6% year over year to $23.6 million due to strategic investments for driving long-term growth.

For fiscal 2024, adjusted EBITDA increased 12% year over year to $104.2 million. The uptick was driven by rising volume and enhanced prices.

During the March quarter, it delivered bookings of $117.0 million, down 12%, with 73% of orders stemming from diversified end markets. The book-to-bill ratio was 0.92.

For fiscal 2024, it delivered bookings of $472.1 million, up 3%, among which 72% of orders came from diversified end markets. The book-to-bill ratio was 0.95.

Cash Flow & Liquidity

As of Mar 31, 2024, the company had $48.6 million in cash and cash equivalents with $172.5 million of total debt compared with $35.6 million and $112.9 million, respectively, in the prior-year period.

For fiscal 2024, THR generated $66 million of cash from operating activities compared with $57.7 million in fiscal 2023.

Outlook

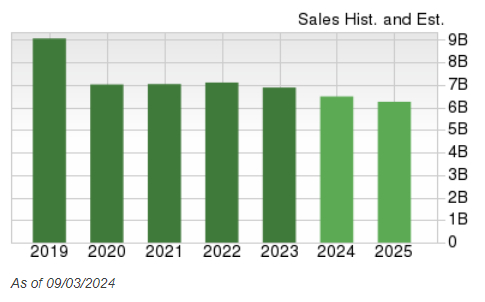

For fiscal 2025, revenues are projected in the range of $527-$553 million, implying year-over-year growth of 9% at the midpoint.

Adjusted EBITDA is expected to be in the band of $112-$120 million, suggesting 11% growth at the midpoint of the range.

Management anticipates GAAP EPS to be between $1.57 and $1.73 and adjusted EPS to be between $1.90 and $2.06.

Net sales from Vapor Power are expected in the range of $55-$59 million.

Capital Expenditure is estimated to be CAPEX 2.5-3.0% of revenues.

Depreciation and amortization expenses are estimated to be $21.5 million. Restructuring charges are estimated to be in the band of $2.8-$3.5 million.

Effective tax rate for fiscal 2025 is projected to be approximately 25%.

For fiscal 2026, management targets revenues between $600 million and $700 million, with more than 70% of sales derived from diversified end markets. EBITDA margins are expected to be nearly 24%.

Zacks Rank

THR currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Companies

BlackBerry’s BB fourth-quarter fiscal 2024 adjusted earnings of 3 cents per share beat the Zacks Consensus Estimate by 200%. The bottom line improved from the prior-year quarter’s non-GAAP loss of 2 cents per share.

BB has lost 48.6% in the past year against the sub-industry’s growth of 27.2%. In the last quarter, it delivered an earnings surprise of 200%.

Blackbaud BLKB reported first-quarter 2024 non-GAAP earnings per share of 93 cents, which surpassed the Zacks Consensus Estimate by 9.4%. The bottom line increased 29.2% year over year.

Shares of BLKB have gained 5.6% compared with the sub-industry’s growth of 27.2% in the past year. In the last quarter, it delivered an earnings surprise of 9.4%.

Cadence Design Systems CDNS reported first-quarter 2024 non-GAAP earnings per share of $1.17, which beat the Zacks Consensus Estimate by 3.5%. However, it decreased 9.3% year over year.

In the past year, CDNS has gained 26.3% compared with the Zacks sub-industry’s growth of 27.2%. It currently has a long-term growth expectation of 17.8%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Thermon Group Holdings, Inc. (THR) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.