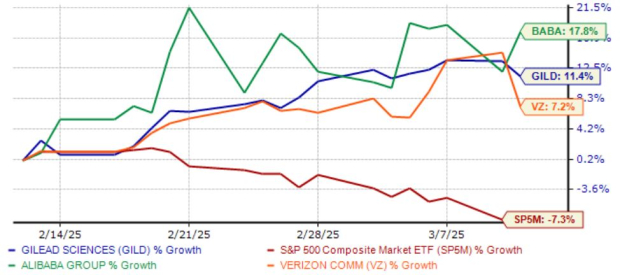

Stocks Like Verizon, Gilead, and Alibaba Show Resilience Amid Market Turmoil

The market has recently experienced turbulence, driven by tariff discussions and other economic uncertainties that have unsettled investor sentiment. However, some stocks, notably Verizon Communications (VZ), Gilead Sciences (GILD), and Alibaba (BABA), have managed to maintain their strength and stability through these challenging times.

Image Source: Zacks Investment Research

For investors seeking momentum opportunities, it’s worth examining each of these companies in detail.

Gilead Sciences: Strong Demand for Products

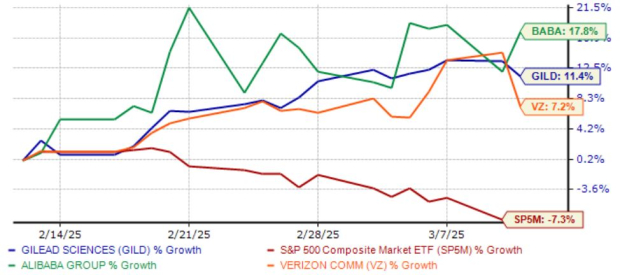

Gilead Sciences recently revealed quarterly results that surpassed expectations, exceeding Zacks Consensus EPS and Sales estimates by 14% and 7%, respectively. The company posted an 11% increase in earnings and a 6% rise in sales, indicating robust growth.

Notably, Gilead’s total product sales reached $7.5 billion, marking the seventh consecutive quarter of exceeding consensus expectations. This consistent performance highlights a positive trajectory for the company.

Image Source: Zacks Investment Research

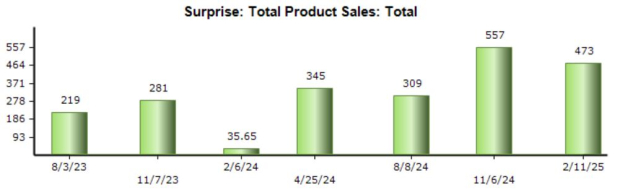

The company has benefited from significant margin expansion, with the gross margin for its products rising to 79% from 70.9% during the latest reporting period. The chart below tracks these values on a trailing twelve-month basis.

Image Source: Zacks Investment Research

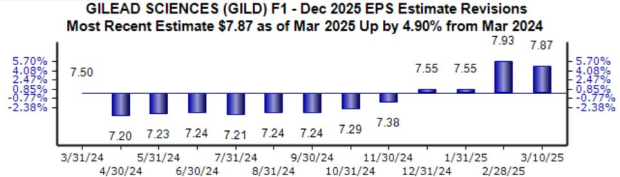

Following the earnings release, analysts have revised their current year EPS expectations upward, a bullish indicator suggesting further potential for positive price movements.

Image Source: Zacks Investment Research

Verizon: Strong Cash Flow and Dividend Stability

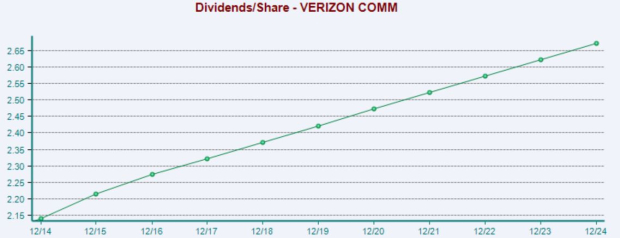

Verizon has positioned itself as a leader among income-focused investors, thanks to its impressive cash-generating capabilities. The company is on the verge of joining the elite Dividend Aristocrats, reflecting its history of increasing dividend payouts.

The chart below illustrates Verizon’s quarterly dividends per share. The free cash flow for FY24 is projected at $19.8 billion, representing a 6% increase year-over-year.

Image Source: Zacks Investment Research

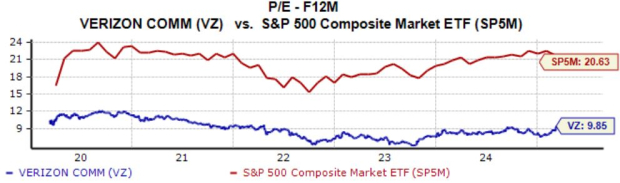

Valuation multiples remain attractive; Verizon’s current forward 12-month earnings multiple of 9.9X is a 52% discount compared to the S&P 500. This stock is primarily an income-driven investment rather than a high-growth option.

Image Source: Zacks Investment Research

In its latest quarterly results, Verizon exceeded both EPS and Sales estimates slightly. Continued customer growth has been a key driver, contributing positively to its expanding broadband market share.

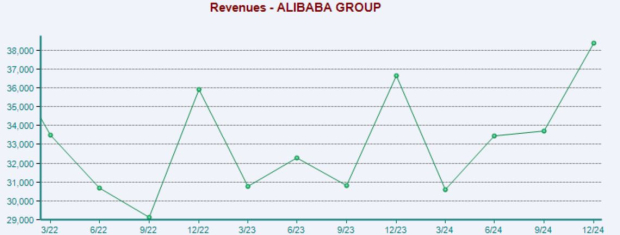

Alibaba: Positive Momentum Following AI Innovations

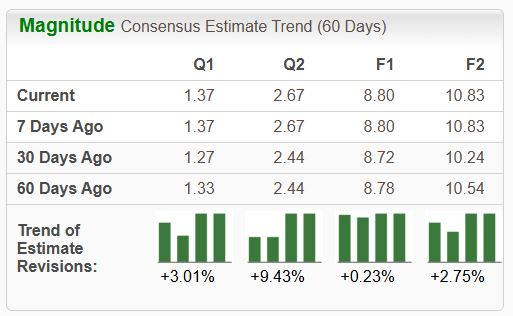

Alibaba’s stock has exhibited remarkable strength since late January, buoyed by the announcement of its new AI model that reportedly surpasses DeepSeek. The company maintains a bullish EPS outlook across the board, which is favorable for near-term stock performance.

Image Source: Zacks Investment Research

Impressively, revenue from AI-related products has shown triple-digit year-over-year growth for six consecutive quarters. BABA’s overall sales growth has also displayed modest acceleration recently.

Image Source: Zacks Investment Research

Recently, BABA’s positive momentum has been appreciated by shareholders following several years of unfavorable price action, with shares climbing nearly 75% in 2025 alone.

Conclusion

In spite of the market’s recent downturn, Verizon Communications (VZ), Gilead Sciences (GILD), and Alibaba (BABA) have demonstrated resilience and strength compared to the S&P 500. Investors interested in momentum should consider these stocks for closer inspection.

Zacks’ Research Chief Identifies “Stock Most Likely to Double”

Our experts have highlighted five stocks with the highest potential for a +100% gain in the coming months. Among these, Director of Research Sheraz Mian emphasizes one stock expected to achieve significant growth, standing out for its innovation and growing customer base, which has surpassed 50 million.

This top pick is poised for considerable gains, although past performance indicates variability among picks. Notably, previous selections like Nano-X Imaging achieved a remarkable 129.6% increase within nine months.

Free: see Our Top Stock And 4 Runners Up

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access this free report

Verizon Communications Inc. (VZ): Free Stock Analysis report

Gilead Sciences, Inc. (GILD): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.