Momentum Driving Investors

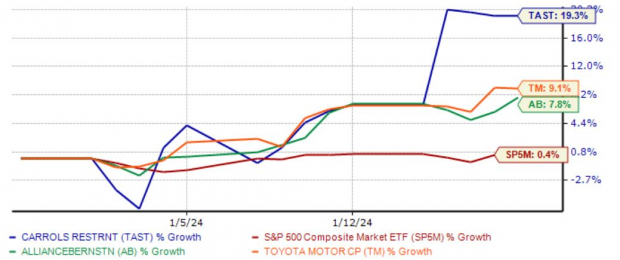

The stock market has seen a dramatic turnaround in the past year, and momentum investors have been reveling in the bullish trends. The year 2024 has stepped up to continue this euphoric ride for certain stock giants, which include Carrols Restaurant Group TAST, AllianceBernstein AB, and Toyota Motor TM. Their performance, year-to-date, is depicted in the chart below, with the S&P 500 serving as a benchmark.

Image Source: Zacks Investment Research

Carrols Restaurant Group – A Sizzling Delight

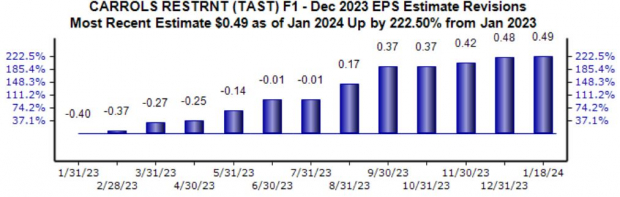

Carrols Restaurant Group, a Zacks Rank #1 (Strong Buy), boasts over 1,000 Burger King and 62 Popeyes restaurants, making it one of the largest restaurant franchisees in the United States. The company’s current fiscal year EPS Estimate of $0.49 indicates a remarkable turnaround from the -$0.40 per share loss projected a year ago.

Image Source: Zacks Investment Research

Following its latest quarterly report, Carrols saw significant investor interest, with its shares exhibiting impressive resilience. The company reported free cash flow of $33.9 million, a substantial improvement from the $14 million reported the previous year. The stock is reasonably priced given its projected growth, with a forward price-to-sales ratio marginally above the five-year median at 0.3X.

Image Source: Zacks Investment Research

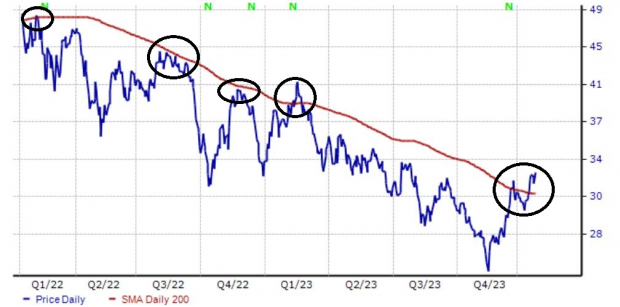

AllianceBernstein – A Solid Investment Beacon

AllianceBernstein, a premier global investment management firm, has seen a strong resurgence since their lows in November. With a substantial annual yield of 7.9%, easily surpassing the Zacks Industry average of 2.6%, AB shares are an attractive proposition for income-seeking investors. Moreover, AB exhibits a 3.5% five-year annualized dividend growth rate, further adding to its appeal.

Image Source: Zacks Investment Research

Toyota Motor – Revving Up Profits

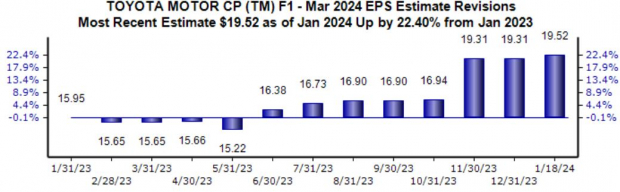

Toyota Motor, a Zacks Rank #1 (Strong Buy), is a global automotive powerhouse on an upward trajectory, with a 22% rise in the current fiscal year’s Zacks Consensus EPS Estimate. Benefiting from better-than-expected quarterly results and a surge in its electrified fleet, Toyota has consistently exceeded the Zacks Consensus EPS Estimate by an average of 46% in the last four releases, bolstering its strong share performance.

Image Source: Zacks Investment Research

Forecasted to achieve nearly 45% earnings growth in the current year on the back of 11% higher sales, Toyota’s electrifying performance is generating serious momentum in the market.

Summary

Momentum investors have been amply rewarded over the past year, and the trend looks set to continue well into 2024. For those seeking stocks that have continued to soar in the new year, Carrols Restaurant Group TAST, AllianceBernstein AB, and Toyota Motor TM are primed to deliver. Notably, all three stocks carry positive momentum and sound valuations, fueling the exhilaration of investors eager to benefit from the red-hot market streak.

Read this article on Zacks.com for a more in-depth analysis.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.