Guidance lifts commonly inject positivity into shares, with investors scrambling to get in and ride the momentum. Companies raise their outlooks when business is fruitful, sending a bullish message to shareholders.

Recently, several companies, including Coca-Cola KO, Eaton ETN, and Eli Lilly LLY, have raised their outlooks, with shares moving higher following the announcements.

For those interested in recent bullish activity, let’s take a closer look at each.

Coca-Cola

Beverage titan Coca-Cola posted EPS of $0.72, exceeding the Zacks Consensus EPS estimate by 4.5% and growing modestly on a year-over-year stack. Operating cash flow totaled $528 million, growing by a sizable $368 million from the year-ago period.

Following the release, KO updated its organic revenue guidance, expecting growth in a band of 8% – 9%. Shares have underperformed relative to the S&P 500 in 2024, gaining 6% compared to an 8% gain.

Image Source: Zacks Investment Research

Eaton

Eaton posted EPS of $2.40, growing 28% year over year and reflecting a quarterly record. Sales totaled $5.9 billion, reflecting another quarterly record and improving 8% from the year-ago period. Impressively, segment margins reached 23.1%, another quarterly record and a 340-basis-point climb from the same period last year.

The company topped off the robust results with positive guidance, raising its outlook for organic growth, segment margins, and EPS. Shares have been considerably strong performers in 2024, gaining 36% and crushing the S&P 500.

Image Source: Zacks Investment Research

Eli Lilly

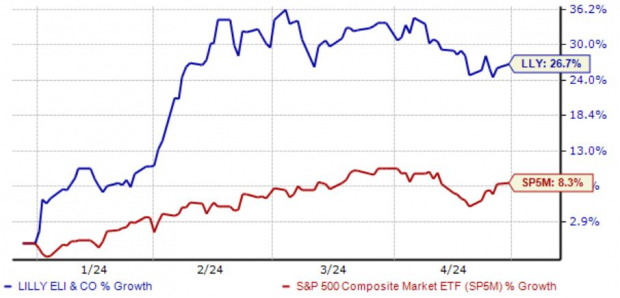

Eli Lilly posted EPS of $2.58, beating our consensus EPS estimate by 2% and growing considerably from the $1.62 per share reported in the same period last year. Revenue throughout the period grew 26% year-over-year, driven by strong demand within Mounjaro, Zepbound, Verzenio, and Jardiance.

The results impressed investors, helping add to LLY’s positive price action year-to-date. LLY upped its full-year revenue guidance by $2 billion, further displaying the strong demand.

Image Source: Zacks Investment Research

Bottom Line

Guidance lifts are among the most positive announcements shareholders can hear, injecting confidence in the long-term picture.

And recently, all three stocks above – Coca-Cola KO, Eaton ETN, and Eli Lilly LLY – have raised their outlooks, with shares moving higher following the announcements.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s an American AI company that’s riding low right now, but it has rounded up clients like BMW, GE, Dell Computer, and Bosch. It has prospects for not just doubling but quadrupling in the year to come. Of course, all our picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

CocaCola Company (The) (KO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.