Envision a thrilling race towards market dominance, with contenders like Amazon, Netflix, and Alphabet setting the pace and pushing the boundaries of success. These three FAANG giants collectively hold the key to invigorating the bull market, contributing a significant 8.1% to the weight of the S&P 500 index’s cap score.

Unleashing Alphabet’s Potential

Within the realm of technological innovation, Alphabet, Google’s parent company, stands at the forefront. Embracing the surge in artificial intelligence (AI), Alphabet is not merely a bystander in the face of evolving technologies. The company’s relentless spirit of progress has led to remarkable advancements, evident in the transformation of its AI tools like Bard into the formidable Google Gemini.

While grappling with challenges in the digital advertising sector due to economic headwinds, including high inflation and rising interest rates, Alphabet remains undeterred. Buoyed by the promise of a rebound in the advertising landscape, Alphabet is strategically positioning itself to capitalize on the intersection of technological expertise and market resurgence.

With a commanding 3.8% stake in the S&P 500 index, Alphabet exerts significant influence on the market’s trajectory, shaping the narrative of the ongoing bull run.

The Amazon Ascendancy

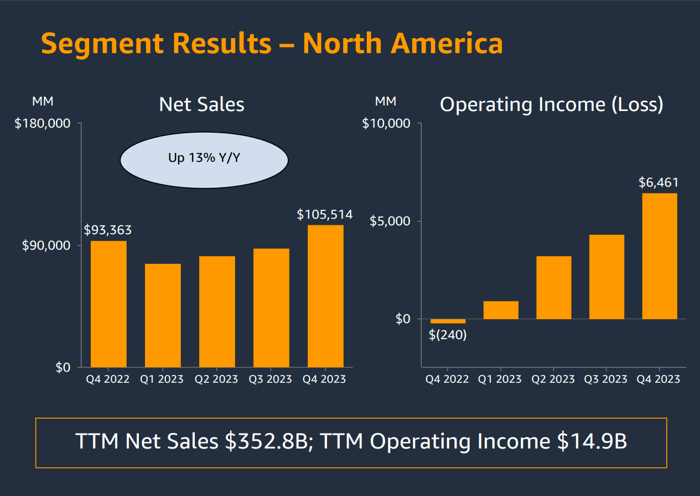

Diving into the economic landscape from a divergent angle, Amazon emerges as a pivotal player in the tech narrative. Riding on the waves of recovery in e-commerce, Amazon witnessed a resurgence in its retail sales, coupled with robust growth in its highly profitable Amazon Web Services (AWS) segment.

Embracing the potential of artificial intelligence across multiple layers of its business, including AI accelerators, LLM access, and innovative AI products, Amazon positions itself to reap substantial rewards from its comprehensive approach to AI services.

As a global leader in cloud-based computing services, Amazon’s strategic maneuvers are geared towards capitalizing on the evolving AI landscape, while leveraging the momentum of its e-commerce revival to bolster its position in the S&P 500 index.

The Netflix Revolution

Transitioning to the realm of media streaming, Netflix embarks on a transformative journey under new leadership. With a strategic pivot towards profitable revenue growth and enhanced cash flows, Netflix aims to redefine its subscriber-centric model, marked by innovative strategies such as lower-priced access plans and forays into the realm of video games.

Despite initial skepticism surrounding its revised business model, Netflix’s stocks surged, underscoring investor confidence in its long-term profitability. With a renewed focus on shareholder returns and market positioning, Netflix is poised to emerge as a significant player in the ongoing bull market narrative.

In the dynamic sphere of tech giants, Amazon, Netflix, and Alphabet carry the mantle of market leadership, steering the course of the bull run with unwavering determination and strategic foresight.