Warren Buffett — a name synonymous with wisdom in the investing world. The magnate at the helm of Berkshire Hathaway follows a straightforward investment approach. He picks sturdy, blue-chip companies that boast globally recognizable brands. These titans aren’t just about flashy logos — they churn out consistent cash flow, rewarding investors with dividends or buybacks.

Refreshing Opportunities with Coca-Cola

First in line? The iconic giant Coca-Cola (NYSE: KO). This beverage behemoth currently sports a P/E ratio of 24.4, a tad below the S&P’s 28.2.

Granted, Coca-Cola isn’t exactly a rollercoaster of growth. Nevertheless, it remains a Buffett favorite for decades. Beyond their carbonated creations, Coca-Cola boasts a diverse range of beverages – water, tea, coffee, you name it.

This varied portfolio has helped Coca-Cola traverse into new territories and buffer against shifts in buyer behavior or fads. Result? A long-standing legacy of rising sales and profits, aligning seamlessly with Buffett’s investment ethos.

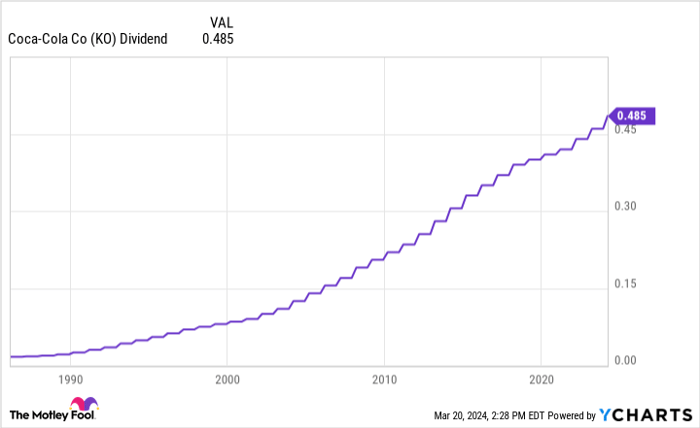

A testament to its endurance is Coca-Cola’s consistent uptick in dividends. As a member of the elite Dividend Kings club, Coca-Cola stands tall among businesses that have upped their dividends for over half a century.

Coca-Cola may not set the market ablaze, but its reliability is a touchstone that’s hard to ignore. In a world where consistency is king, Coca-Cola’s disparity in earnings multiples to the broader market could be a golden opportunity for savvy investors.

SiriusXM: Signals Crossing?

Next up – satellite radio aficionado SiriusXM (NASDAQ: SIRI). Bucking the trend of ad-reliant terrestrial radio, SiriusXM’s subscription-based model is a standout. With a substantial subscriber base of 34 million, SiriusXM stands tall with a strong brand and predictable revenue stream.

Trading at a modest P/E multiple of 12.5, SiriusXM appears to be a hidden gem of value. Buffett’s recent acquisition of 30 million shares may raise eyebrows, but beware the lurking shadows. Post-COVID churn concerns and evolving spending patterns in a climate of inflation and rising interest rates duly caution investors.

With the added pressure of consumer interest shifting towards podcasts, SiriusXM’s strategy echoes that of streaming rival Spotify. While the stock seems like a bargain-bin buy compared to the market at large, it might be a case of ‘buyer beware’ at the present juncture.

McDonald’s: Serving Up Long-Term Value?

Completing our trio is the fast-food sensation McDonald’s (NYSE: MCD). Now, if you scour Berkshire’s filings, no trace of McDonald’s ownership is evident. The Oracle, however, maintains a stake through a New England Asset Management subsidiary under Berkshire, providing a panoramic view of Buffett’s preferred plays.

McDonald’s mirrors Coca-Cola, boasting global outreach and a resilient business model adaptable to economic tides. Despite the inflationary gloom casting a shadow on consumer wallets, McDonald’s saw a robust 9% year-on-year jump in same-store sales.

With a 2.4% dividend yield and a P/E ratio of 24.5, McDonald’s stands on par with Coca-Cola by this measure. Such valuations may hint at a broader investor sentiment, viewing the food and beverage sector as a haven amid market uncertainties.

Consider this your cue to mull over McDonald’s as a long-term investment choice.

Is Coca-Cola your next $1,000 venture?

Before you dive into Coca-Cola stock, ponder this:

The Motley Fool Stock Advisor team pinpoints the 10 best stocks for investors today… and Coca-Cola isn’t among them. These select 10 could be a treasure trove of returns in the years to come.

Stock Advisor hands investors an easy roadmap to success, complete with portfolio building tips, regular analyst updates, and two fresh stock picks monthly. Since 2002, the service has tripled the S&P 500 returns*.

Explore the top 10 stocks today

*Stock Advisor returns effective from March 21, 2024

Adam Spatacco holds no positions in stocks discussed. The Motley Fool holds positions in and recommends Berkshire Hathaway and Spotify Technology. The Motley Fool maintains a disclosure policy.

The opinions and views expressed are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.