Post Holdings, Inc. POST is anticipated to showcase strong top-line growth in its upcoming first-quarter 2024 earnings to be announced on Feb 1. With quarterly revenues expected to reach $1.9 billion, marking a noteworthy 22.4% improvement from the same period last year, the company appears to be on a positive trajectory.

Conversely, the bottom line is expected to experience a decline year over year in the fiscal first quarter, with a consensus estimate for quarterly earnings per share (EPS) at $1.06, reflecting a decrease of 1.9% from the prior-year period.

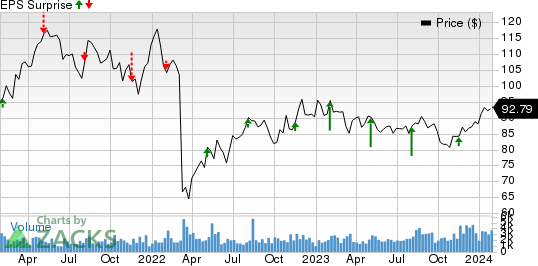

Post Holdings has been consistently surpassing earnings expectations, with a trailing four-quarter earnings surprise averaging 59.2%. The last reported quarter saw the company delivering an 18.1% earnings surprise.

Post Holdings’ Growth Trajectory

Post Holdings has been making strategic acquisitions, propelling its customer outreach. The company has also been implementing effective pricing strategies to counter inflationary pressures. Notably, the recent acquisition of Perfection Pet Foods business is expected to contribute to the company’s overall performance.

The Post Consumer Brands segment is also expected to display strength in the quarter under review, with the Zacks Consensus Estimate for its sales pegged at $951 million, indicating a substantial year-over-year increase of 74.5%.

Challenges Ahead for Post Holdings

Despite its growth trajectory, Post Holdings is grappling with supply-chain bottlenecks. During the recent earnings call, management acknowledged the gradual improvement in the supply-chain scenario and customer order fill rates but highlighted the need for significant enhancements. The company is also facing hurdles due to cost inflation, albeit showing signs of moderation.

Insights from the Zacks Model

According to our proven model, Post Holdings is likely to beat earnings estimates this quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) significantly increases the odds of an earnings beat. Post Holdings currently holds a Zacks Rank #3 and boasts an Earnings ESP of +1.70%.

Exploring Other Potential Stocks

Other companies worth considering in light of their favorable earnings combination are Church & Dwight Co., Inc. (CHD), Coca-Cola (KO), and TreeHouse Foods, Inc. (THS). These companies also demonstrate potential for earnings prospects based on analyst insights and market performance.

To stay ahead of upcoming earnings announcements, investors can refer to the Zacks Earnings Calendar, gaining insight into market movements and performance expectations.

Stay Informed with Expert Insights

Gain access to expert-driven stock recommendations for the next 30 days. Download the free report on 7 Best Stocks for the Next 30 Days and make informed decisions to enhance your investment portfolio. Make the most of hand-picked stocks that have demonstrated promising potential over the years.

For additional insights and access to more resources, visit Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.