Eli Lilly‘s (NYSE: LLY) has seen a remarkable surge in its shares as it solidifies its position in what could potentially grow to be a $100 billion drug market. The corporation offers two weight-loss prescription medications — Mounjaro and Zepbound — poised to become long-standing blockbusters.

In this competitive landscape, Lilly and its counterpart, Novo Nordisk, dominate, while various players, including small biotechs and major pharmaceutical companies, prepare to introduce products in the future. However, one specific statistic may guarantee Lilly’s continued dominance in the weight loss drug sector.

Image source: Getty Images.

Impressive Track Record of Lilly

First and foremost, it is crucial to acknowledge Lilly’s exceptional track record. Mounjaro, although approved for type 2 diabetes, is frequently prescribed for weight loss, generating over $5 billion in revenue last year. Similarly, Zepbound, exclusively approved for weight loss, raked in over $175 million in revenue within its initial few weeks of commercialization.

Undeterred, Lilly continues to push boundaries by currently testing potential breakthrough weight loss drugs in phase 3 clinical trials: an oral tablet candidate and another candidate interacting with three hormones (compared to the two in Mounjaro and Zepbound).

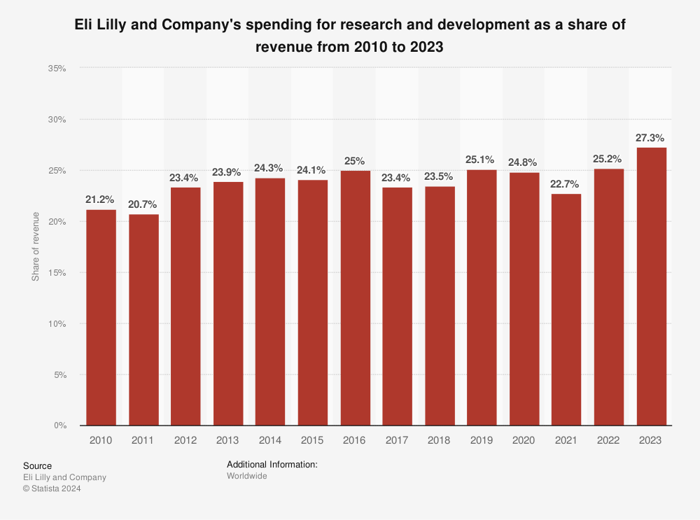

Now, let us delve into the one significant figure that could cement Lilly’s supremacy. As illustrated in the chart below, Lilly’s research and development expenses as a portion of its revenue have notably escalated over the past three years, surging from 22.7% to their highest level in at least 13 years, peaking at over 27% of revenue last year.

Image source: Statista.

This critical figure underscores Lilly’s unwavering commitment to delivering superior drugs in the weight loss arena and beyond, all of which are poised to translate into robust earnings growth.

What implications does this hold for Lilly’s stock? Despite the shares surging by nearly 120% in the past year, there remains ample opportunity for growth as current weight loss medications and potential future innovations bolster earnings. Consequently, Lilly stands as an excellent long-term investment option for discerning investors.

Is Investing $1,000 in Eli Lilly a Wise Choice?

Prior to investing in Eli Lilly, pause to consider this:

The Motley Fool Stock Advisor team of analysts recently pinpointed what they believe are the most promising 10 stocks for investors to consider now… and surprisingly, Eli Lilly did not make the cut. These chosen 10 stocks have the potential to yield substantial returns in the foreseeable future.

Stock Advisor equips investors with a user-friendly roadmap to success, offering guidance on portfolio construction, regular insights from analysts, and two fresh stock recommendations each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 index more than threefold*.

Explore the 10 stocks

*Stock Advisor returns as of April 4, 2024

Adria Cimino holds no position in any of the stocks discussed. Novo Nordisk is recommended by The Motley Fool. The Motley Fool maintains a disclosure policy.

The viewpoints and opinions expressed herein belong to the author and do not necessarily align with those of Nasdaq, Inc.