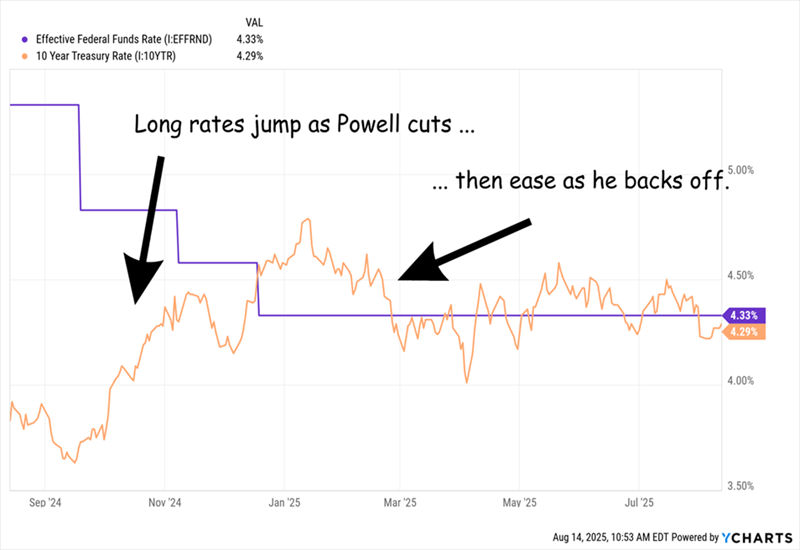

The Federal Reserve is expected to cut interest rates, which may paradoxically lead to a rise in long-term interest rates, specifically the 10-year Treasury yield. This scenario is highlighted by the Fed’s previous rate cut in September 2023, which resulted in an increase in the 10-year Treasury yield instead of the intended decrease.

Currently, July’s Consumer Price Index (CPI) report fell below expectations, potentially supporting a Fed rate cut while allowing long-term yields to rise. Mortgage Real Estate Investment Trusts (mREITs) like AGNC Investment Corp. are positioned to benefit from this environment, with AGNC offering a current yield of 15%. Analysts project earnings of $1.60 per share for AGNC this fiscal year, with the dividend comprising 90% of those earnings.

AGNC’s operational model allows it to profit from the spread between short-term borrowing costs and long-term mortgage rates. A decrease in short-term rates could enhance AGNC’s profitability, while its shares currently trade at 1.1 times book value, indicating potential for growth as the Fed adjusts rates.