The market landscape is abuzz with the humming excitement around artificial intelligence (AI). It seems everyone wants a slice of the AI pie, with technology stocks riding the wave of this fervor as the S&P 500 and Nasdaq Composite reach dizzying heights, setting records left and right. Amongst this digital cacophony, one stock stands out, not your typical tech titan, but a company blazing trails in AI without all the fanfare of the “Magnificent Seven.”

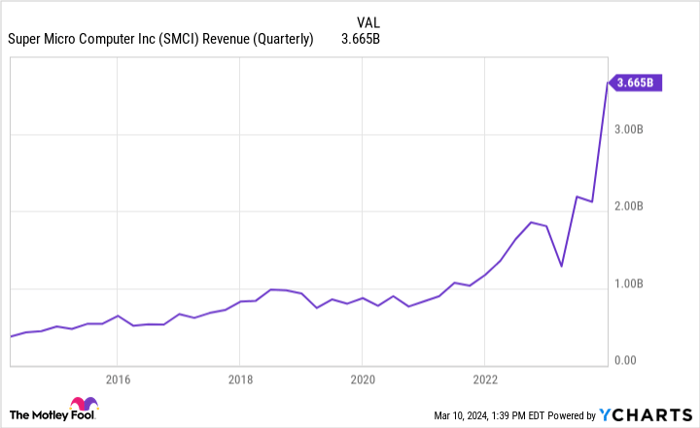

In just a span of five years, shares of Super Micro Computing (NASDAQ: SMCI) have skyrocketed an astonishing 5,830%. As of March 8, 2024, this year alone has seen a staggering 300% surge. The company’s recent inclusion in the prestigious S&P 500 index has become the latest accelerant in its already fiery trajectory.

Super Micro is carving a niche for itself in the AI realm, playing a pivotal role at the crossroads of semiconductors and artificial intelligence. Specializing in designing integrated systems for IT architecture, whether it be storage clusters or server racks, the company is well-positioned to leverage the rising demand for graphics processing units (GPUs) driven by industry giants like Nvidia and Advanced Micro Devices.

With an annual revenue growth exceeding 100%, fueled by the tailwinds of AI, Super Micro has caught the eye of Wall Street analysts, who have dubbed it a “stealth Nvidia.” However, beyond the impressive sales trajectory lies a more nuanced investment story that warrants a closer look.

The Facade of Success

While Super Micro’s ascent in the AI universe has been nothing short of remarkable, inherent vulnerabilities simmer beneath the surface. As an entity deeply entrenched in hardware operations, the company’s profit margins are far from stellar, standing at a modest 15.4% for the quarter ended Dec. 31. Management attributes this decline to aggressive investments in new designs and market share, a rationale that, despite its short-term benefits, raises questions about the sustainability of margin expansion and consistent cash flow in the long run.

Investing heavily to spur growth can only carry a company so far, and Super Micro Computer now faces the critical task of transforming these investments into tangible financial gains.

A Balancing Act: Reality vs. Perception

As the AI revolution unfolds, semiconductor stocks like Nvidia and AMD garner substantial attention, drawing investors seeking to capitalize on this burgeoning trend. Super Micro’s proximity to these chipmakers has introduced a speculative fervor around its stock that may be indicative of a misaligned valuation.

While comparisons with Nvidia are tempting, a closer examination reveals stark differences in business models, making Hewlett Packard Enterprise, Lenovo, Dell, and IBM more apt yardsticks for appraisal. Trading at a price-to-sales (P/S) ratio of 7, double that of IBM, Super Micro stands out as the priciest among its peers, showcasing a specialized business model that lacks the diversity seen in larger tech conglomerates.

While the allure of investing in an AI frontrunner persists, the widening chasm between the stock’s valuation and its underlying fundamentals raises red flags. Despite its recent milestone of joining the S&P 500, caution might be the wiser choice over frenzied buying. As passive funds and ETFs adjust their portfolios to accommodate the newly minted index constituent, a short-term surge in the stock price may occur, but long-term investors should exercise prudence while waiting for more compelling valuation opportunities.

If Super Micro Computer is indeed slated to be a linchpin in the AI narrative moving forward, astute investors may find better entry points in the future, aligning their investments with a more grounded valuation perspective.

Before diving into Super Micro Computer stock, investors should deliberate on the broader market landscape. The Motley Fool Stock Advisor analysts have pinpointed what they consider the top 10 stocks for investors, excluding Super Micro Computer from this list. These handpicked stocks hold the potential for substantial returns, reflecting a strategic approach to portfolio construction and investment guidance that has eclipsed the S&P 500 returns since 2002.

The decision ultimately lies with investors, who must evaluate the risks and rewards of investing in a company perched at the intersection of hype and potential, navigating the turbulent waters of AI’s uncertain yet promising future.

Adam Spatacco holds positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool maintains a disclosure policy.

The views and opinions expressed in this article are solely those of the author and do not necessarily mirror the views of Nasdaq, Inc.