Amidst the technological upheaval of recent times, the dominance of select tech giants like Apple, Microsoft, and Nvidia has led to unprecedented market surges. The AI fervor that fueled the Nasdaq Composite’s 40% leap last year is no secret, with companies like Amazon, Alphabet, Tesla, and Meta Platforms basking in its glow.

Despite this, the spotlight often blinds investors to hidden gems. In the labyrinth of stock market marvels lies Super Micro Computer (NASDAQ: SMCI), a company intricately linked with semiconductor behemoths Nvidia and Advanced Micro Devices. Its stock catapulted a staggering 812% over the last year, earning it the illustrious moniker of a “stealth Nvidia”.

But as the dust settles on its meteoric rise, one can’t help but ponder – does Super Micro harbor the same promise as Nvidia? To discern if it’s worth investing in this burgeoning entity, a closer scrutiny of its operations, market positioning, and valuation against industry peers becomes paramount.

The Symbiotic Relationship Between Super Micro and Nvidia

In the realm of high-end GPUs pivotal for quantum computing and generative AI, Nvidia and AMD reign supreme with their graphics processing units (GPUs). While Super Micro doesn’t engage in semiconductor fabrication, its forte lies in crafting IT infrastructures – a domain where it complements the GPU elite. The exponential GPU demand has undoubtedly buttressed Super Micro’s financial fortitude.

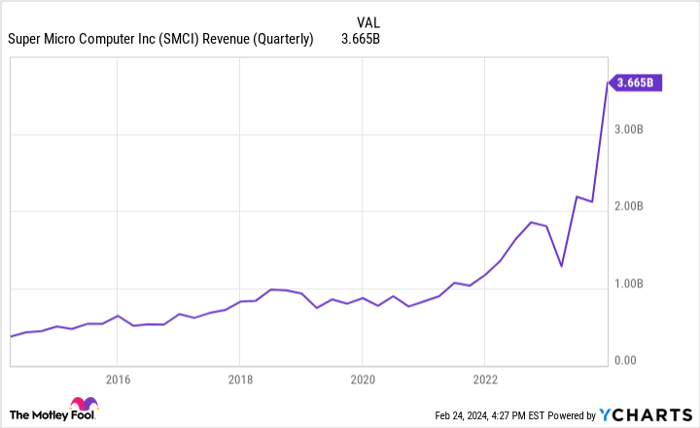

As evidenced by Super Micro’s revenue surge, depicted in the visually stunning graph above, the company’s trajectory is undeniably awe-inspiring. However, prudence dictates a deeper dive into the nuances before blindly plunging into investment waters.

Image source: Getty Images.

Navigating the Stock Market Terrain

An examination of Nvidia’s and Super Micro’s stock trajectories over the past year reveals a fascinating correlation. Both stocks have mirrored each other’s peaks and troughs, suggesting an intricate dance choreographed in parallel. Though such synchrony may have yielded bountiful profits, the underlying risks loom large.

One can draw a parallel to Arm Holdings, a smaller semiconductor entity that witnessed an exponential surge post an earnings bonanza and Nvidia’s newfound ownership entwinement. Super Micro and Arm Holdings, albeit distinct, share a common denominator – escalating investor fervor galvanized by their ties to Nvidia.

Cracking the Super Micro Investment Conundrum

In a realm where GPU supremacy reigns, Super Micro’s profitability is inexorably tethered to Nvidia’s fortunes. While this symbiosis holds promise amidst soaring GPU demand, a single-thread reliance on Nvidia poses a palpable risk.

The price-to-sales ratio chart above unravels a stark truth – Super Micro’s valuation stands at 5.3, nearly double that of its closest contender, International Business Machines. The disparity among legacy players like Hewlett Packard Enterprise, Dell Technologies, and Lenovo vis-a-vis Super Micro accentuates the valuation conundrum.

For Super Micro to ascend the market echelons, revenue and profit augmentation remain imperative. As the GPU sector diversifies, the company’s future hinges on fostering partnerships beyond the Nvidia-AMD realm to withstand the competitive onslaught from tech titans like Amazon.

While Wall Street’s romantic likening to Nvidia may hint at Super Micro’s latent prowess, wary investors must discern the divergent trajectories and risk landscapes separating these entities.

Before diving headlong into Super Micro Computer stock, consider the prudent insights offered by the Motley Fool Stock Advisor analyst team. The market horizon beckons a multitude of promising stocks poised to deliver astronomical returns, albeit sans the Super Micro glimmer.

Embark on a riveting investment journey with Stock Advisor – an unrivaled compass steering investors towards prosperity through astute stock picks and sage portfolio maneuvers. With a track record thrice that of the S&P 500 since 2002, Stock Advisor is no mere investment tool – it’s a beacon illuminating the path to financial success.

Witness the financial frontier with these groundbreaking stocks today

*Stock Advisor returns as of February 26, 2024

The author’s opinions are his own and do not represent Nasdaq, Inc.