Check Point Software Poised for Continued Growth in Cybersecurity

Check Point Software Technologies (NASDAQ: CHKP) might not be widely recognized in the cybersecurity sector, but it has already recorded a notable 15% rise in 2025. This positive trend suggests that the company is well-positioned to maintain its momentum moving forward. The increasing adoption of artificial intelligence (AI) tools within the industry is a key factor contributing to Check Point’s strengthening revenue pipeline. Let’s delve into Check Point’s recent performance to explore its potential for further growth.

Where to invest $1,000 right now? Our analyst team recently revealed their picks for the 10 best stocks to buy now. Learn More »

Potential for Improved Growth Rate at Check Point

Check Point concluded 2024 with $2.66 billion in total revenue, reflecting a 6% growth compared to the previous year. Its non-GAAP (adjusted) earnings per share grew at a quicker rate of 9%, reaching $9.16. While some investors might find this growth slow, it is important to recognize that an improving revenue pipeline suggests potential for more robust growth in the future.

Evidence of this potential is seen in the 12% year-over-year increase in remaining performance obligations (RPO) reported in Q4 2024, which doubled the pace of overall revenue growth for that quarter. RPO serves as an indicator, representing the total value of non-cancellable contracts for products and services that have yet to be recognized as revenue. As Check Point secures more contracts than it fulfills now, growth should accelerate as it works through its backlog.

A significant driver of these new contracts is the company’s focus on integrating AI tools into its offerings. Recent introductions, such as the Infinity AI Copilot, an AI-powered security assistant, aim to enhance the efficiency of security analysts in organizations.

With the adoption of generative AI in the cybersecurity arena projected to grow by 24% annually through the end of the decade, Check Point is strategically positioned by investing in AI-driven products. Notably, the company’s Infinity Platform experienced double-digit growth during the fourth quarter of 2024, validating these product developments.

Additionally, demand for Check Point’s Quantum Force AI-powered firewall is on the rise. The sales of products and licenses increased by 8% year over year last quarter, fueled by this growing demand. Although this increase may appear modest, it is noteworthy that the product and licenses segment had exhibited slower growth earlier in the year. This upward trend suggests that Check Point’s growth could accelerate and even exceed internal projections.

Attractive Valuation with Growth Potential

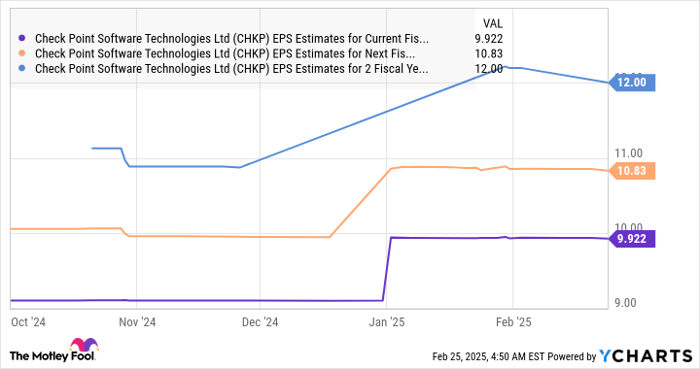

Looking ahead, Check Point anticipates its fiscal 2025 revenue will grow between 4% to 8%, while bottom-line growth is expected to be slightly higher, ranging from 5% to 11%. At the midpoint of these estimates, earnings could reach $9.90 per share.

While this guidance doesn’t promise explosive growth, the fact that new contracts are coming in at a faster rate than sales may lead to better-than-expected results. If Check Point delivers stronger performances, the market is likely to respond positively, creating additional value for investors.

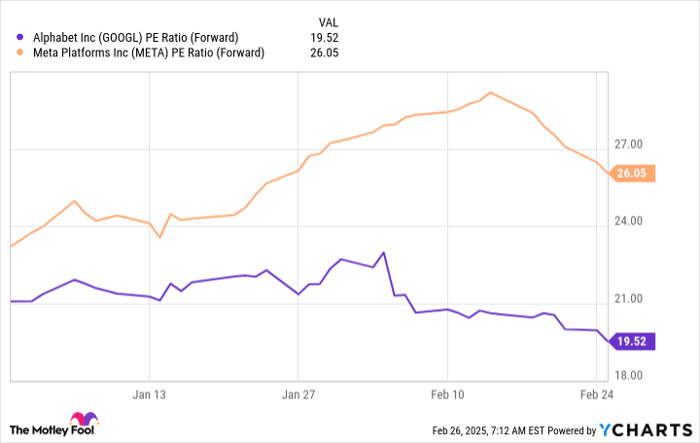

Furthermore, Check Point’s stock is currently trading at just 22 times its forward earnings, which is notably lower than the Nasdaq-100 index’s forward earnings multiple of 28, serving as a comparison for tech stocks. Analysts predict a uptick in Check Point’s earnings growth in the coming years, a target that appears to be attainable in light of the company’s current trajectory.

CHKP EPS Estimates for Current Fiscal Year data by YCharts

If Check Point can indeed achieve earnings of $12 per share by 2027 while trading in line with the Nasdaq-100 index’s forward earnings multiple, its stock price could rise to $342—a potential increase of 59% from current levels. Investors seeking a cybersecurity stock that is attractively priced and positioned for accelerated growth should consider Check Point Software.

A Second Chance at a Lucrative Investment Opportunity

Have you ever felt you missed the opportunity to invest in the most successful stocks? If so, there’s good news.

Our expert analysts occasionally issue a “Double Down” Stock recommendation for companies poised for significant growth. If you’re concerned you’ve already missed your chance to invest, now is an optimal time to buy before the opportunity slips away. Consider these examples:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d have $311,551!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,990!

- Netflix: If you had invested $1,000 when we doubled down in 2004, you’d have $519,375!

We are currently issuing “Double Down” alerts for three remarkable companies, and another chance may not come available anytime soon.

Continue »

*Stock Advisor returns as of February 28, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Check Point Software Technologies. The Motley Fool has a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.