Challenging the Giant: The Rise of the Underdog in Cloud Computing

While Amazon may soar high as an e-commerce titan, its true golden goose remains hidden in the clouds – Amazon Web Services (AWS). The cloud computing platform may only account for a fraction of Amazon’s total revenue, but it’s where the bulk of its profits come from. However, amidst this tech landscape dominated by the behemoth AWS, a smaller, lesser-known player has been making waves.

A Tale of Two Clouds: DigitalOcean’s Meteoric Growth

With a modest $693 million in revenue, DigitalOcean (NYSE: DOCN) might seem like a mere pebble next to the boulder that is AWS. Yet, don’t let its size deceive you. This underdog is growing at a breakneck pace, leaving its larger competitor in the dust. In 2023 alone, while AWS saw a 13% growth, DigitalOcean boasted a staggering 20% surge in revenue.

What sets DigitalOcean apart is not just its growth trajectory but its smart business model. The company has been steadily acquiring new customers, closing 2023 with a 5% increase in its customer base. Even more intriguing is the potential for increased revenue from existing customers, with a vast majority currently spending a mere $15 per month.

Embracing Cash Flow: DigitalOcean’s Winning Strategy

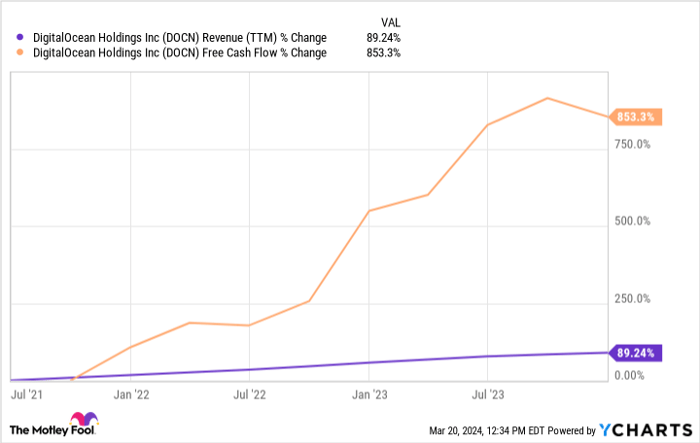

Despite its small stature, DigitalOcean is a rarity in the tech world – one that actually focuses on generating positive free cash flow. In 2023, its adjusted free cash flow margin spiked to 22%, a significant leap from the previous year. Such prudent financial management is a testament to DigitalOcean’s sustainable growth.

DOCN Revenue (TTM) data by YCharts

Assessing the Investment Landscape: Is DigitalOcean Worth a Bet?

While DigitalOcean shows promise, caution is warranted. The recent change in CEO raises uncertainties, and the conservative growth forecast for 2024 dampens the stock’s immediate appeal. With valuations reflecting the company’s growth rate, but failing to offer a bargain, prospective investors might want to tread carefully.

DOCN PS Ratio data by YCharts.

Final Thoughts: Keeping an Eye on the Cloudy Horizons

For current shareholders, DigitalOcean’s potential warrants holding onto the stock. However, for those eyeing a fresh investment, patience might be the key. Watching how the new leadership steers the ship and waiting for a more favorable valuation could prove prudent in the long run.

Before diving in headfirst, investors should consider the broader landscape and explore potential alternatives. While DigitalOcean shines as a hidden gem, there may be other stars in the vast investment universe waiting to be discovered.