Amidst the current record-high levels of the major stock market indices, shrewd investors are urged to delve deeper into the market dynamics at play. The S&P 500 and the Nasdaq have enjoyed significant gains, propelled by the surging large-cap growth stocks, particularly the elite “Magnificent Seven.” However, discerning eyes see undervalued gems in the small-cap and value stock realms that beckon as promising investment opportunities.

An intriguing vehicle for capitalizing on the dichotomy between small- and large-cap equities, as well as the distinction between growth and value stocks, is none other than the Vanguard Small-Cap Value ETF (NYSEMKT: VBR). Here’s a comprehensive look at why this ETF could be a market-beating champion in 2024 and beyond, leading me to eagerly fortify my own portfolio stakes come springtime.

A Glimpse into the Vanguard Small-Cap Value ETF

True to its name, the Vanguard Small-Cap Value ETF is an exchange-traded fund that homes in on an index of smaller stocks characterized by value, namely the CRSP U.S. Small Cap Value Index.

Adding a splash of color to the picture, this ETF holds 855 stocks, boasting a median market cap of $6.4 billion. Reflecting its orientation towards value stocks, the fund’s portfolio is notably heavy on industrials, financials, and consumer discretionary sectors, with modest exposure to technology and healthcare.

The indexed tracked by the fund is thoughtfully weighted, offering a high degree of diversification with its 855 holdings. This stands in stark contrast to ETFs mirroring benchmarks like the S&P 500 since the top 10 holdings in the Vanguard Small-Cap Value ETF constitute less than 6% of its total assets. Noteworthy stocks in the mix include Toll Brothers (NYSE: TOL), Williams-Sonoma (NYSE: WSM), Cleveland-Cliffs (NYSE: CLF), and Ally Financial (NYSE: ALLY), among others.

The ETF boasts an impressively low expense ratio of 0.07%, translating to a mere $0.70 in annual investment expenses for every $1,000 invested in the fund.

Identifying Market Disparities

As we gear up for spring, this ETF takes the crown in my books for several reasons. While the minimal expenses touted earlier are a definite perk, there are glaring disparities between large- and small-cap stocks at present, as well as between growth and value equities. The Vanguard Small-Cap Value ETF allows investors to position their portfolios to harness the benefits of both divides.

Entering 2024, small-cap stocks were fetching their lowest price-to-book multiples in 25 years relative to large caps. In the subsequent months, this valuation chasm only widened. In a telling divergence from the S&P 500 and Nasdaq indices, the Russell 2000 (small-cap benchmark index) still languishes 14% below its peak.

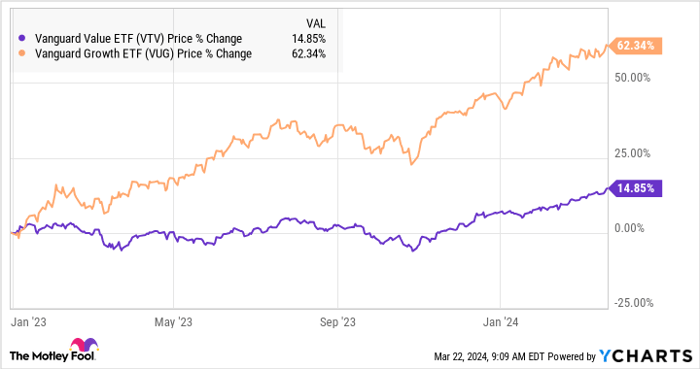

Moreover, value stocks have substantially lagged behind growth stocks in recent times. Since the onset of 2023, the Vanguard Growth ETF (NYSEMKT: VUG) has outshone the Vanguard Value ETF (NYSEMKT: VTV) by a staggering 47 percentage points.

VTV data by YCharts

The Vanguard Small-Cap Value ETF’s Prospects Against the S&P 500

While no crystal ball can guarantee if this ETF will outperform the market for the remainder of 2024 or when the discussed valuation rifts may start to close, potential catalysts lurk on the horizon.

As interest rates begin to recede, this could serve as an upward impetus for small-caps, as investors tilt towards more ‘speculative’ investments amid diminished risk-free yields. A soft economic landing, if materialized, might bode well for smaller firms, which rely more on a robust consumer base compared to their larger, mature counterparts.

All things considered, this value ETF currently teems with allure. With the average stock in its arsenal trading at a modest 13.7 times earnings and boasting a solid 12.5% earnings growth rate, this isn’t merely a tactical play but an opportunity to secure solid assets at an attractive valuation.

Considering an investment of $1,000 in the Vanguard Small-Cap Value ETF?

Before jumping into the fray, ponder this:

The Motley Fool Stock Advisor analyst team recently flagged what they deem the 10 best stocks for investors to snag now… and the Vanguard Small-Cap Value ETF didn’t make the cut. Those ten picks could deliver hefty returns in the years ahead.

The Stock Advisor service furnishes investors with a roadmap to success, offering insights on portfolio construction, regular analyst updates, and bi-monthly stock recommendations. Since 2002, Stock Advisor has more than tripled the S&P 500’s returns*

Peruse the 10 stocks

*Stock Advisor returns as of March 21, 2024

Ally Financial is an advertising partner of The Ascent, a Motley Fool company. I, Matt Frankel, hold positions in Ally Financial. The Motley Fool holds positions in and endorses Vanguard Index Funds – Vanguard Growth ETF, Vanguard Index Funds – Vanguard Value ETF, and Williams-Sonoma. The Motley Fool abides by a disclosure policy

The opinions articulated here are those of the author and do not necessarily mirror those of Nasdaq, Inc.