Alibaba(NYSE: BABA) initiated a significant move on April 2 by repurchasing $4.8 billion in shares during the first quarter of 2024, marking its second-largest quarterly buyback in history. This action serves as a precursor to the $25 billion expansion in the share buyback program, unveiled during its fourth-quarter 2023 earnings announcement in February.

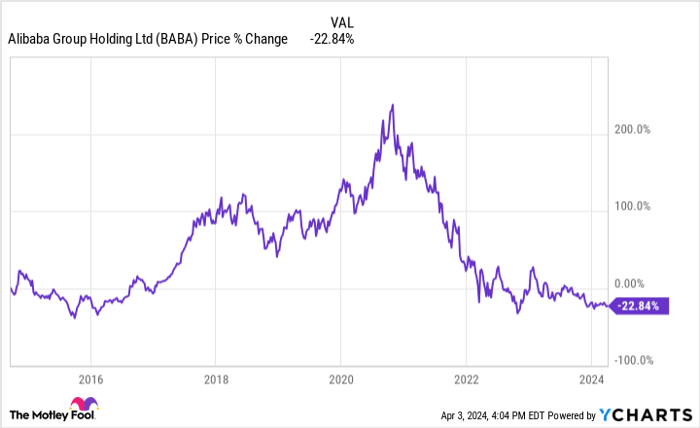

Upon the announcement, market response was lukewarm, with the stock price experiencing a decline in reaction. This downward trend is another chapter in Alibaba’s tumultuous journey, reflecting a net loss since its IPO back in 2014. Given this context, shareholders face a critical decision. Is this share repurchase the catalyst needed for a renaissance in the fortunes of the Chinese e-commerce giant and cloud services provider, or should investors exercise caution before diving in?

BABA data by YCharts.

Addressing Investor Skepticism Towards the Buyback

Upon closer inspection, the subdued investor response to Alibaba’s massive buyback should come as no surprise. The repurchase fails to alleviate the prevailing skepticism surrounding Chinese stocks, positioning it as an unattractive investment option for many. This sentiment originates from the fragile nature of U.S.-China relations.

The investment landscape was significantly impacted in 2022 when U.S. regulators issued warnings of potential delisting for Alibaba and other Chinese stocks unless access to Chinese companies’ auditing information improved. This added a layer of risk to Alibaba’s ADRs, reflecting indirect ownership of the company and underlying uncertainties in the market.

Although the crisis was averted through an agreement between the U.S. and China, the episode underscored the inherent volatility associated with owning Alibaba shares, further exacerbated by the company’s strained relationship with the Chinese government.

Alibaba’s challenges only multiply as tensions persist with the Chinese authorities. The antitrust probe that commenced in 2020 culminated in a hefty 18 billion renminbi ($2.8 billion) fine in 2021, while founder Jack Ma’s public criticism of the government not only led to his temporary disappearance but also contributed to the cancellation of Ant Group’s IPO, a major blow to Alibaba as a whole.

Deciphering the Alibaba Risk Premium

Despite the myriad challenges confronting Alibaba, there exists a valid argument for investors to consider whether the risks are adequately factored into the stock price. Over the past decade, Alibaba’s shares have depreciated, while the company’s revenue has surged from 19 billion renminbi ($2.6 billion) in 2013 to a staggering 260 billion renminbi ($36 billion) in 2023, showcasing a remarkable 13-fold increase over ten years.

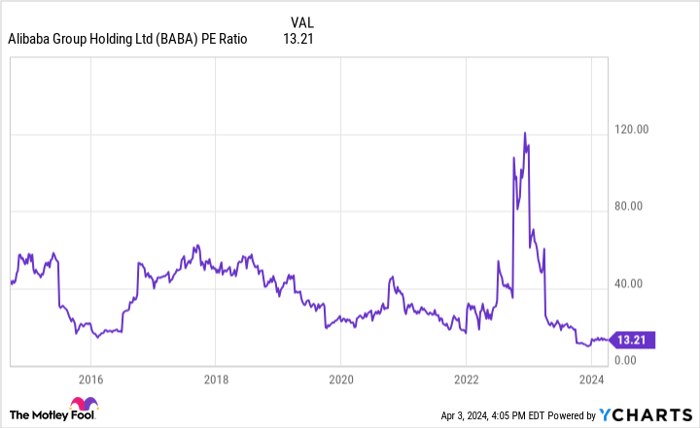

Furthermore, net income witnessed a robust ascent from 8 billion renminbi ($1.2 billion) in 2013 to 46 billion renminbi ($6.3 billion) in the previous year, representing over a fivefold surge. It is perplexing that despite this significant growth, the stock is valued at less than expected, as evidenced by a plummeting price-to-earnings (P/E) ratio, which dropped from over 40 to a mere 13.

While this P/E ratio factors in substantial risk discounts, the potential for a recovery hints at substantial gains for discerning investors, possibly justifying their interest in Alibaba’s share repurchase.

BABA PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Is Alibaba Stock a Viable Option Following the Repurchase?

Given the inherent geopolitical risks associated with Alibaba, risk-averse investors are best advised to steer clear of the stock. However, for those open to taking on more risk and delving into speculative ventures, investing in Alibaba could present an intriguing opportunity.

While risks must be duly considered, every risk premium has its limits, and Alibaba may have already surpassed that threshold. Fueled by robust financial growth that is not accurately mirrored in its market valuation, Alibaba stands poised to offer substantial returns by avoiding worst-case scenarios.

Contemplating an Investment in Alibaba Group

Prior to diving into Alibaba Group stocks, prospective investors should reflect on this:

The Motley Fool Stock Advisor‘s analyst team has singled out what they perceive as the top 10 stocks for potential investors to consider currently, with Alibaba Group not making the cut. These handpicked stocks hold the promise of delivering remarkable returns in the foreseeable future.

Stock Advisor equips investors with a user-friendly roadmap to success, offering insights on portfolio construction, regular analyst updates, and two new stock recommendations monthly. Since 2002, the Stock Advisor service has outperformed the S&P 500 index threefold*.

Explore the 10 highlighted stocks for potential investment

*Data on Stock Advisor returns as of April 8, 2024

Will Healy holds no position in any of the stocks discussed. The Motley Fool commends Alibaba Group as a recommendation. The Motley Fool is committed to transparency with its disclosure policy.

The thoughts and opinions expressed are those of the author and do not necessarily mirror those of Nasdaq, Inc.