Cybersecurity specialist SentinelOne (NYSE: S) has surged by a staggering 86% in the last year, marking a significant win for investors who capitalized on this high-flying growth stock before its remarkable rally began. At present, SentinelOne trades at 15 times sales following its impressive ascent, a valuation that might give some investors pause, especially compared to the S&P 500 index’s average price-to-sales multiple of 2.7.

Nevertheless, a deeper dive into the company’s exceptional growth trajectory and robust catalysts hints that it can maintain its valuation and offer substantial upside in the long haul. Here’s why.

Riding the Wave of a Red-Hot Tech Trend

When SentinelOne disclosed its fiscal 2024 third-quarter results in December 2023, the numbers painted a compelling picture: revenue surged by 42% year-over-year to $164 million for the quarter, and non-GAAP net loss contracted to just $0.03 per share from $0.16 per share in the same period last year. Moreover, the company raised its full-year revenue guidance to $616 million, up from its previous estimate of $605 million, indicating a 46% increase from fiscal 2023. This impressive performance is attributed to the substantial growth in customer count and increased customer spending.

The company’s overall customer count expanded by 28% year-over-year in fiscal Q3 to 11,500, with the number of customers generating annualized recurring revenue (ARR) exceeding $100,000 growing even faster at 33% to 1,060. This accelerated growth in the latter metric underscores SentinelOne’s ability to acquire new subscription and capacity customers, as well as expand relationships with existing customers, driven by robust demand for its AI-powered security solution.

In line with this, in April 2023, SentinelOne announced Purple AI, an innovative offering aimed at enhancing the efficiency of cybersecurity teams. This generative AI cybersecurity assistant is designed to streamline threat hunting, automate actions, and supercharge every stock and data analyst, promising to unlock efficiency and accelerate response. The product’s rollout has commenced, and SentinelOne plans to make this AI-powered cybersecurity tool widely available to customers in the current quarter. As a result, financial services firm BTIG predicts that SentinelOne is well-positioned to capture a larger market share in the cybersecurity domain, courtesy of its new products including Purple AI.

BTIG analyst Gray Powell, acknowledging the company’s potential to exceed Wall Street’s expectations, upgraded SentinelOne’s rating to buy from neutral last month. Furthermore, the ever-increasing adoption of generative AI in the cybersecurity landscape is poised to unlock long-term growth prospects for SentinelOne. Analysts anticipate a 40% compound annual growth rate (CAGR) in its bottom line over the next five years, potentially translating into a higher stock price.

Prospects for Further Stock Price Growth

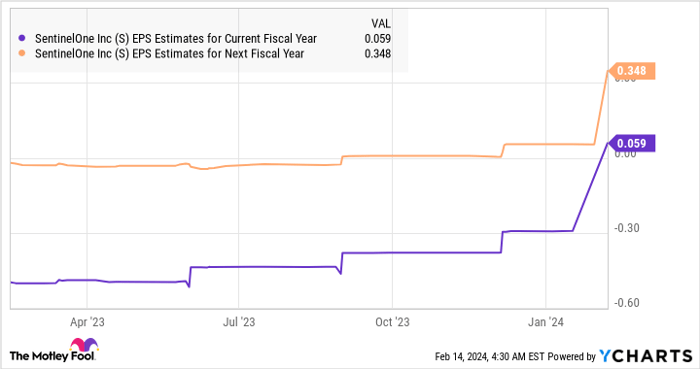

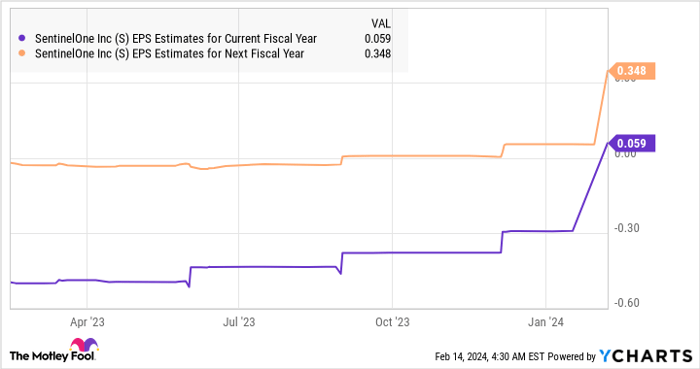

SentinelOne is anticipated to achieve non-GAAP profitability in the upcoming fiscal year following an estimated loss of $0.29 per share in fiscal 2024. Additionally, the chart below illustrates the projected acceleration in the company’s earnings growth:

S EPS Estimates for Current Fiscal Year data by YCharts

This trajectory signals the likelihood of SentinelOne delivering the strong long-term growth that the market anticipates. Moreover, the company’s revenue is projected to surpass the $1 billion mark within the next couple of years, indicating over 30% sales growth during that period. With the expansive opportunity in the generative AI cybersecurity space, this momentum is expected to be sustained over an extended duration.

Assuming SentinelOne achieves $1 billion in revenue by fiscal 2026 and maintains its current sales multiple of 15, its market capitalization could surge to $15 billion, representing a 73% leap from current levels within a couple of years. Hence, investors seeking exposure to an AI stock benefitting from the widespread adoption of this technology in the cybersecurity market may find compelling opportunities by closely evaluating SentinelOne at present.

Should you invest $1,000 in SentinelOne right now?

Before making an investment in SentinelOne, it is crucial to consider this:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks for investors to buy now, and SentinelOne didn’t make the cut. These 10 stocks are touted to potentially yield significant returns in the years ahead.

Stock Advisor offers investors an easy-to-follow roadmap for success, including guidance on portfolio construction, regular updates from analysts, and two new stock picks each month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by over threefold*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.