The “Magnificent Seven” stocks are typically known for their impressive growth rather than their dividend payouts. However, investing in leading tech growth stocks that eventually transition into paying dividends can provide significant financial rewards in the long run. Witnessing a high-growth stock evolve into a dividend-paying asset can signify the culmination of substantial appreciation, making even a modest yield a significant return on the initial investment.

Among the remaining Mag Seven companies yet to pay dividends, one particular standout appears poised to make the leap. Not only is this stock a likely candidate to initiate dividends, but its potential payout could potentially offer the highest yield among its elite peers.

Alphabet: Ripe for Dividend Distribution

Google parent company Alphabet emerges as a prime contender within the Magnificent Seven cohort to start paying dividends, standing shoulder to shoulder with industry giants like Apple and Microsoft. In 2023, Alphabet flexed its financial muscle by generating a substantial $74 billion in net income, ranking third amongst its elite peers. If we discount the $4.1 billion in operating losses from Alphabet’s “other bets” division, the company would almost match Microsoft’s stellar $82.5 billion profit in the preceding 12 months.

Not merely resting on its laurels, Alphabet boasts the largest financial cushion among the Mag Seven members. Closing out the year with a staggering $111 billion in cash versus a modest $13 billion in debt, Alphabet maintains the highest net cash levels within the group. This financial fortitude places Alphabet in a prime position to consider dividend payouts, especially given the company’s extensive share buyback activities.

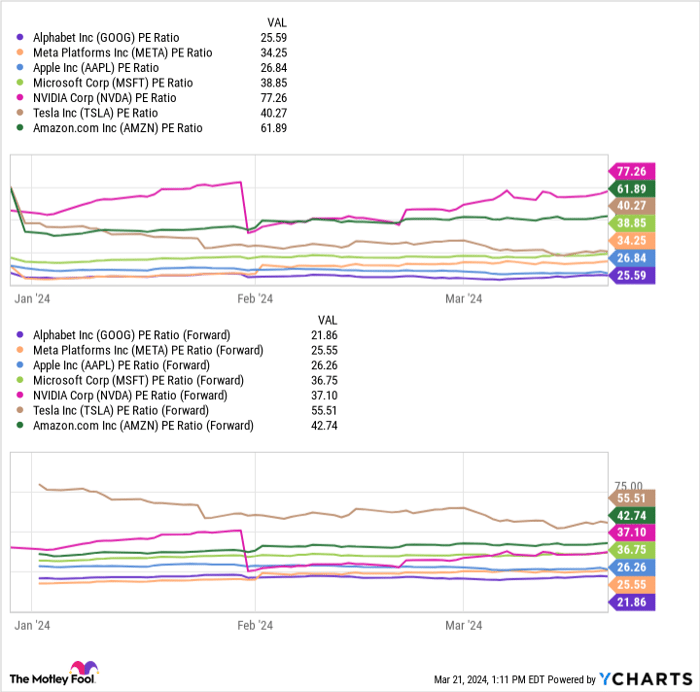

While share repurchases have been a common practice among the Mag Seven stocks, Alphabet’s frugality has positioned it as an attractive investment proposition. Despite being the most affordable stock in terms of valuation metrics within the elite group, Alphabet’s strategic shift towards dividends could herald a new era of growth for the tech titan.

Considering the potential for a dividend offering, investors may soon see Alphabet welcoming a broader investor base, including dividend-focused mutual and index funds. Opening up to new avenues of investment could elevate Alphabet’s status within the market and potentially unlock untapped shareholder value.

Weighing the Decision: Factors Influencing Alphabet’s Dividend Strategy

Alphabet’s management may exhibit prudent caution when contemplating the initiation of dividends, fueled by concerns over emerging technologies like generative artificial intelligence impacting its core business. However, as we navigate the nascent stages of the AI revolution, Alphabet continues to enhance its product suite, exemplified by the upgraded Gemini 1.5 language model.

Furthermore, the company seems well-positioned to capitalize on its AI advancements. While substantial investments in AI infrastructure and the Metaverse loom on the horizon, Alphabet’s financial prudence could undergo a paradigm shift with the introduction of dividends, signaling a shift towards responsible capital allocation.

While the reluctance to commence dividends may arise from critiques surrounding Alphabet’s lavish spending on moonshot projects and a bloated workforce, embracing a dividend distribution model could signal a pivot towards a more lean and efficient operational paradigm.

Anticipating the Future: A Dividend In the Cards?

As Alphabet’s AI initiatives gain traction and the company navigates its capital allocation strategy, a quarterly dividend offering could be on the horizon. While the precise timing remains uncertain, investors in Alphabet today stand poised to reap the benefits of a potential dividend commencement in the coming years.

As we witness Alphabet traversing the intriguing intersection of growth and dividends, investors are encouraged to tread cautiously and analyze the evolving landscape of this tech behemoth. The journey towards a dividend payment could mark a significant milestone in Alphabet’s financial trajectory, unraveling new opportunities for growth and shareholder value.

Source: Data sourced from Yahoo! Finance.