Investing in the auto industry is akin to navigating a treacherous, winding road filled with regulatory speed bumps, global competition potholes, and capital-intensive tolls. Many emerging automakers veer off course, vanishing into the rearview mirror of failure.

Over the past decade, the auto industry has lagged behind the S&P 500 in terms of stock performance. General Motors has only managed meager 8.1% growth in the last ten years, while Ford has plummeted by over 20%. In this challenging terrain, U.S.-based Tesla emerges as a star performer, while globally, Ferrari shines with a remarkable 600% growth over the last decade.

Driving into a New Era

Since surpassing General Motors as the world’s largest automaker by volume in 2008, Toyota — represented on the stock exchange as Toyota (NYSE: TM) — has been treading cautiously. Despite facing stiff competition and the looming threat of electrification, Toyota’s stock has silently accelerated, surging over 20% in the past three months and nearly 60% in the last year. With a market cap exceeding $305 billion, Toyota now ranks second only to Tesla in global automakers.

Toyota stands out from the pack, outperforming the S&P 500 in the past year with a higher yield and a more attractive valuation. Despite these achievements, the question lingers: is Toyota still a dividend stock worth investing in, even after its recent rally?

Image source: Getty Images.

Accelerating to Record Heights

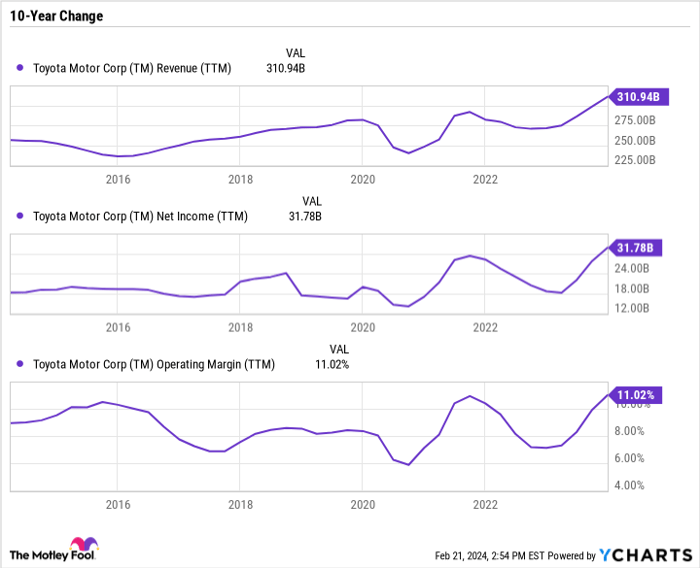

Toyota’s revenue and net income have hit all-time highs, with an operating margin resting at a respectable 11%. This may seem modest, but for Toyota, with its massive sales figures, this signifies a significant achievement.

TM Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Ferrari, known for its stellar management, boasts an operating margin of 26.9%, albeit with much lower sales volume. On the other hand, Tesla, previously the margin king, has witnessed a slump down to 9.2% due to various cost-related challenges.

To maintain this impressive performance, Toyota has adeptly blended high sales volume and profit margins, surpassing its competitors in the race to success. Instead of veering off-road, Toyota has refined its product offerings within its niche, gearing towards a brighter electric-motor future without abandoning its gas-powered past.

The Hybrid Advantage

Besides excelling in high sales and profitability, Toyota has carved a niche at the intersection of gas-powered vehicles and electric cars through hybrid technology. Hybrid EVs, plug-in hybrids, battery EVs, and fuel cell EVs constitute a whopping 35.9% of Toyota and Lexus sales for fiscal 2024, with hybrids alone claiming 33.5% of sales. During this period, Toyota’s operating margin stood strong at an impressive 12.5%.

Toyota’s strategic pivot heavily leans on hybrids in the short to medium term while investing in EVs for the long run. With plans to unveil a full battery EV lineup by 2026 and target 3.5 million units annually by 2030, Toyota remains ahead of the curve. The company’s recent $8 billion investment in Toyota Battery Manufacturing North Carolina and a $1.3 billion boost in its Kentucky facility underscore Toyota’s commitment to electrification.

In essence, Toyota emerges as a resilient player, capable of navigating short-term fluctuations in consumer trends and seizing opportunities in both the medium and long term. Whether EV adoption accelerates or decelerates, Toyota seems prepared for all eventualities, poised to maintain its lead by 2026.

The Top Auto Stock in the Market

Investing in Toyota isn’t a drive towards perfection; however, the stock presents an alluring value proposition. With a modest 10.2 price-to-earnings ratio, Toyota outshines the S&P 500 at 26.9. Additionally, boasting a 1.8% dividend yield compared to 1.5% for the S&P 500, Toyota has surged by 58.3% over the past year and 47.3% over the last three years — surpassing the S&P 500’s 21.4% and 26.8% growth over the same periods.

While Toyota operates in a cyclical industry that may deter some investors, it remains the cream of the crop for those eyeing the auto sector and an electrified future built on a structured transitional approach.

Is now the time to invest $1,000 in Toyota Motor?

Before diving into Toyota stock, ponder this:

The Motley Fool Stock Advisor team has unearthed what they consider the 10 best stocks primed for a bright future, with Toyota Motor missing the cut. Backed by an impressive track record of outperforming the S&P 500 since 2002, the Stock Advisor service offers a roadmap to substantial returns, featuring regular analyst updates and two new stock selections monthly.

Discover the 10 stocks today

*Stock Advisor returns as of February 20, 2024

Daniel Foelber holds no position in any of the stocks mentioned. The Motley Fool has stakes in and endorses Tesla. The Motley Fool recommends General Motors and suggests long January 2025 $25 calls on General Motors. The Motley Fool adheres to a disclosure policy.

The opinions and views expressed herein are solely those of the author and may not represent the views of Nasdaq, Inc.