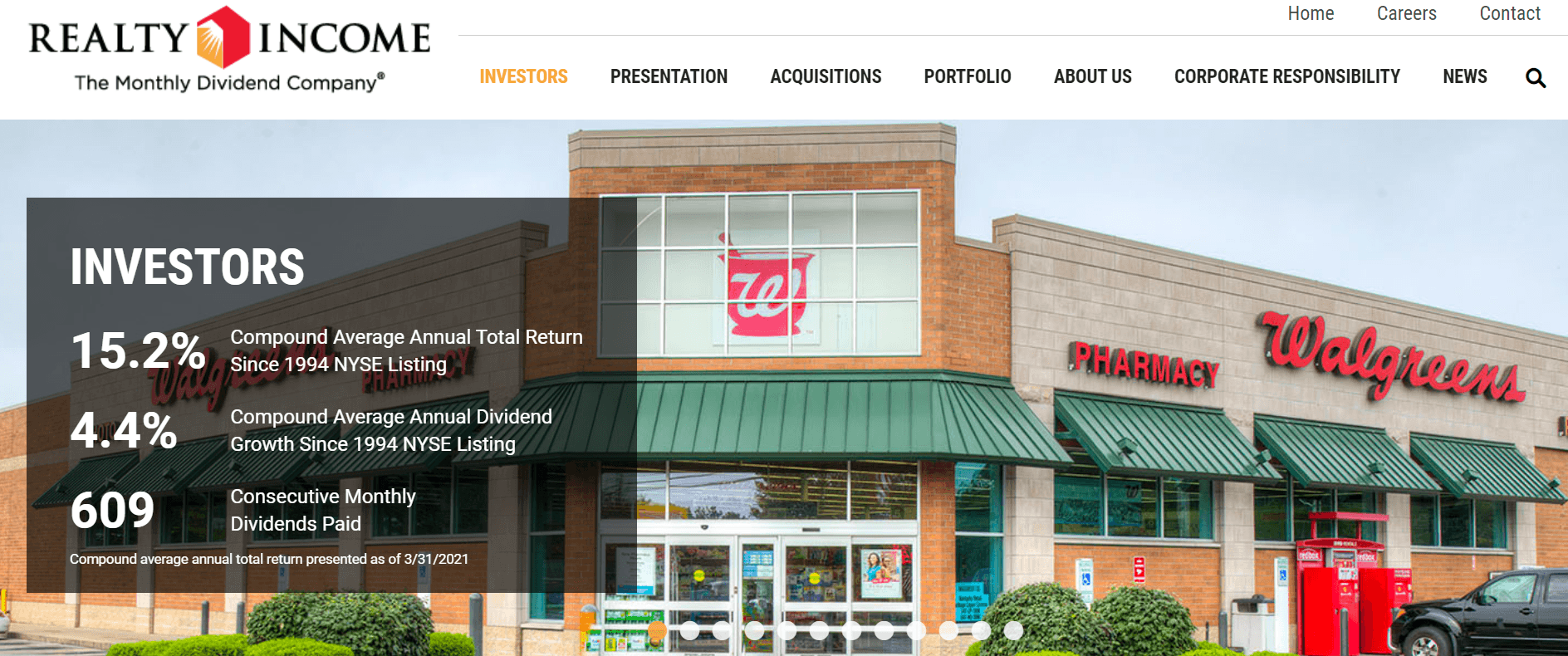

Realty Income (O) has long been a powerhouse in the real estate investment trust (VNQ) arena, but things are not quite as rosy as they once were for this widely renowned company. While it has a celebrated track record of almost 30 years of consistent dividend growth and impressive average annual returns, recent market dynamics have caused some cracks to surface in its facade.

It’s true that past success can be inspiring, but it’s not always a reliable indicator of future performance. Realty Income’s historic growth was bolstered by a smaller size, minimal competition, and access to cost-effective capital, enabling the acquisition of properties at advantageous rates. However, the landscape has shifted dramatically in recent times, with the company now grappling with challenges presented by its massive market cap, increased competition, rising interest rates, and diminished spreads.

Essential Properties Realty Trust (EPRT) emerges as a compelling alternative to Realty Income, with a significantly brighter future. Since its public offering, EPRT has outpaced Realty Income and shows no sign of slowing down. There are several key factors that make EPRT a more enticing investment prospect.

Reason #1: Far Better Growth Prospects

EPRT has delivered approximately three times the returns of Realty Income since its public debut in 2018, establishing itself as a growth powerhouse in the REIT sector. EPRT’s ability to expand its FFO per share at a rate triple that of Realty Income is a testament to its remarkable growth trajectory.

EPRT’s smaller market cap allows each new investment to exert a more significant impact, serving as a distinct advantage over Realty Income’s enormity, which necessitates an exponentially larger volume of acquisitions to effect meaningful growth.

| Essential Properties Realty Trust (EPRT) | Realty Income (O) | |

| Market Cap | $4 billion | $50+ billion (post-SRC merger) |

Furthermore, EPRT’s strategic focus on net lease properties occupied by smaller middle-market companies has proven to be a winning strategy, providing access to properties at higher cap rates, increased rent escalations, and more robust lease terms, underpinning its superior growth potential compared to Realty Income.

Contrary to common assumptions, smaller tenants do not necessarily pose a higher risk. In EPRT’s case, they balance this by structuring stronger leases, accessing property-level financials, securing corporate guarantees, and implementing master lease protections. This approach, combined with acquiring properties at discounted values, mitigates downside risk – a stark contrast to common market practices where investors often pay a premium for tenant credit quality that may deteriorate over time.

In a telling sign of the times, Realty Income’s principal tenant, Walgreens, recently faced a credit downgrade, precipitating a decline in the value of its properties.

Essential Properties Realty Trust: A Vision of Stability Amidst Market Turbulence

Essential Properties Realty Trust (EPRT) has weathered the storm of financial uncertainty with the resilience of a seasoned sailor in the World War II. The evidence of its mettle is apparent in its performance during the catastrophic pandemic, a crisis that tested every entity on the financial battleground. Yet, in a remarkable feat, EPRT not only withstood the tempest but also continued to generate a steady cash flow, surpassing Realty Income, its formidable rival, in growth during such tumultuous times.

Rethinking Property Sizes

There is a pertinent question to be pondered: why has Realty Income abstained from pursuing these properties? The answer lies in their minimal impact on the company’s financial scale. With an average ticker size of $3 million, these properties simply do not register on the radar of a corporation with a staggering $50 billion market cap. It’s like trying to impress a giant with a pebble.

Cushion Against Interest Rate Volatility

EPRT’s potential for continued outperformance over Realty Income can also be attributed to its robust balance sheet, presenting a stark contrast in the face of fluctuating interest rates. The company’s prudent management is discernible in its substantially lower debt burden. In addition, with fewer looming debt maturities on the horizon, EPRT stands resilient against the impending tumultuous waves of interest rate fluctuations. The uneven terrain that Realty Income must navigate pales in comparison, with significant debt maturities slated for the immediate years to come.

Equitable Growth, Without the Premium

Despite wielding a stronger balance sheet and exhibiting a substantially swifter growth trajectory, the valuations of both REITs remain strikingly analogous. When adjusted for EPRT’s lower leverage, it becomes apparent that it may even be marginally more cost-effective than Realty Income. It’s akin to acquiring a sports car for the price of a family sedan. The value-conscious investor is thus not paying a premium for faster growth, fostering a compelling case for EPRT to maintain its outperformance in the foreseeable future.

| Essential Properties Realty Trust (EPRT) | Realty Income (O) | |

| FFO Multiple | 14.5x | 14.3x |

Realty Income’s enduring, almost cult-like following has preserved its valuation at a level virtually comparable to sturdier peers, despite their more remarkable growth. The absence of an upcharge for faster advancement lays the groundwork for EPRT to continue eclipsing its competition in the days to come.

In Conclusion

Investors, tread lightly. While Realty Income has charted an illustrious course in the past, the future holds no guarantee of similar triumphs. Undoubtedly, it will navigate the future waters with some degree of success. However, anchoring investment decisions solely on its historic eminence would be injudicious. The prevailing outlook for Realty Income appears bleak, and in the looming shadows, its close counterparts, including EPRT, emerge as more promising beacons of financial performance.