Cloudflare’s stock has been on a tear, surging an impressive 40% in the last three months. The company’s latest quarterly results, released on Feb. 8, have only added fuel to the fire, with the stock jumping 20% in a single day. What’s driving this impressive rally? The answer seems to lie in Cloudflare’s successful embrace of artificial intelligence (AI) and its promising growth prospects in this domain.

Cloudflare’s Financial Performance

Cloudflare’s fourth-quarter revenue painted a rosy picture, shooting up by 32% year over year to an impressive $362 million, surpassing the consensus estimate by a comfortable margin. Moreover, the company’s full-year revenue surged by the same percentage to hit $1.3 billion.

This solid topline performance was complemented by a significant jump in adjusted earnings, which soared from $0.06 per share in the year-ago quarter to $0.15 per share. The full-year earnings also witnessed a remarkable surge, climbing to $0.49 per share from a mere $0.13 in 2022.

Cloudflare’s stronghold in the market is evident from its growing customer base, with the company closing 2023 with 189,000 paying customers, marking a hefty 16% rise from the previous year. The growth doesn’t stop there, as the number of large customers generating over $100,000 in annualized revenue for Cloudflare surged by 35% to reach 2,756.

More impressively, the company witnessed a 56% increase in customers with annualized revenue exceeding $500,000 and observed a remarkable 39% surge in customers with annualized revenue greater than $1 million. Yet, the company is barely scratching the surface of its potential, given the massive $164 billion addressable market in 2024, expected to balloon to $204 billion by 2026. Cloudflare is leveraging the potential of AI to capitalize on this market opportunity, and the results seem promising.

The AI Opportunity

In September 2023, Cloudflare introduced Workers AI, a platform that enables developers to build AI applications on its network without the need to invest in expensive infrastructure. This innovative offering has gained remarkable traction among Cloudflare customers, as evidenced by a staggering 9x increase in daily Workers AI requests from its launch to December of the same year.

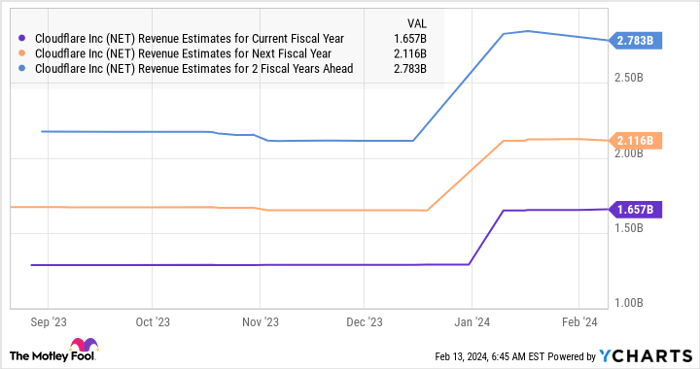

Furthermore, Cloudflare’s ambition to deploy AI GPUs in nearly every city on its global network could position it to make the most of the fast-growing AI-as-a-service market. This strategic move is expected to bolster the company’s growth, with revenue projected to surge by 27% to $1.65 billion in 2024, and the bottom line expected to increase at a remarkable compound annual growth rate of 62% over the next five years.

Based on its 2023 earnings, Cloudflare’s bottom line could potentially reach $5.47 per share in five years, and factoring in a forward price-to-earnings multiple of 30, the stock could witness a 60% surge to hit $164 in five years.

These exceptional growth prospects have undoubtedly piqued the interest of investors. However, it’s worth taking a step back to evaluate the risks and rewards before considering investment in Cloudflare.

Should you invest $1,000 in Cloudflare right now?

Before you make a move, remember that the Motley Fool Stock Advisor just released its list of what it considers the 10 best stocks for investors to buy now, and Cloudflare didn’t make the cut. This isn’t to say that Cloudflare won’t deliver solid returns, but it’s essential to weigh all your options carefully. After all, the stock market is a dynamic and unpredictable arena, and fortunes can change in the blink of an eye.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cloudflare. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.