Crocs Stock: A Tale of Soaring Profits

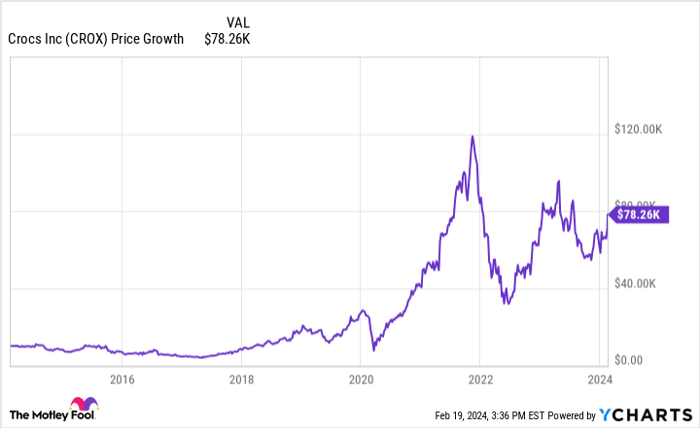

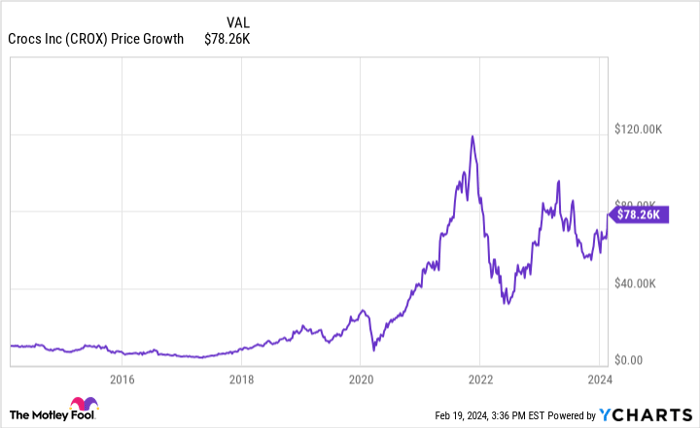

Despite the controversial reputation of Crocs (NASDAQ: CROX) shoes, one thing remains undisputed – the remarkable performance of its stock. Over the last decade, a $10,000 investment in Crocs would have ballooned to a staggering $78,000. A feat that few stocks can rival.

Since 2013, Crocs has witnessed a meteoric rise in its profits. Back then, operating income stood at a modest $63 million. Fast-forward to 2023, and the company hit a record high operating income of $1 billion. A testament to its exceptional growth trajectory that has left investors reaping the rewards.

CROX data by YCharts.

The Profitability Paradigm

Crocs recently unveiled its financial results for 2023 along with insights into the road ahead in 2024. While revenue growth projections for the coming year hover around a modest 3% to 5%, concerns over growth are offset by the company’s robust profitability figures.

What sets Crocs apart is its attractive valuation. With a market capitalization of $7.2 billion, shares trade at a mere 7 times its operating profit. This favorable pricing has opened avenues for the company to enhance shareholder value through strategic financial maneuvers.

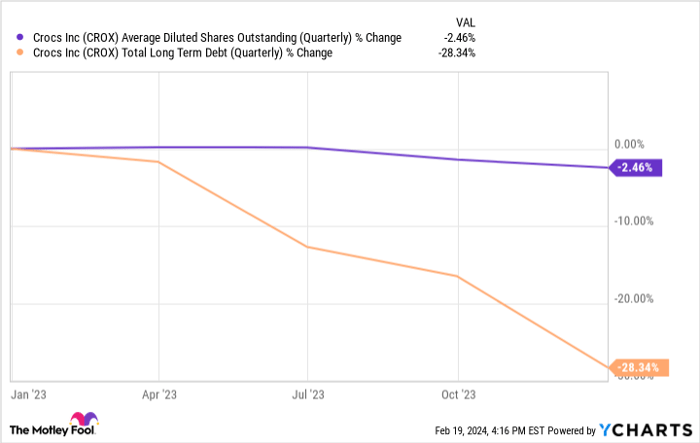

One such move includes the aggressive debt repayment strategy post the acquisition of Heydude in 2022. The acquisition, which cost Crocs $2.5 billion, bore fruit in 2023, adding nearly $1 billion to the company’s revenue and $236 million to the adjusted operating profit. The subsequent debt repayment of almost $700 million indicates a commitment to strengthening the company’s financial foundation.

CROX average diluted shares outstanding (quarterly) data by YCharts.

A Bright Horizon for Crocs Stock

With mounting efforts to ease the debt burden, Crocs is gearing up for a phase of share repurchases to further enhance shareholder value. A staggering $875 million authorization for stock repurchases presents a significant opportunity, allowing shareholders to potentially enjoy a 12% boost in the value of their holdings.

Despite conservative revenue forecasts, stable operating margins paint a promising picture. The expectation of consistently surpassing the $1 billion adjusted operating income mark in 2024 signifies stability and reliability in Crocs’ business model. This consistency in churning out healthy profits bodes well for long-term investors.

While growth may be on pause, Crocs’ solid foundation and profit-generating mechanism make it an attractive investment option. The company’s proven ability to compound profits coupled with efficient financial management positions it favorably for sustained shareholder rewards in the foreseeable future.

Are Crocs shares worth investing in right now?

Before diving into Crocs stock, it’s essential to weigh your options. The Motley Fool Stock Advisor analysts have pinpointed the 10 best stocks for potential growth, excluding Crocs among them. This list promises exciting returns in the years to come.

Stock Advisor extends a roadmap for success, offering expert guidance on portfolio construction, regular market updates, and bi-monthly stock recommendations. Since 2002, the service has nearly tripled the returns of the S&P 500*.

Explore the top 10 stocks now

*Stock Advisor returns as of February 20, 2024

Jon Quast holds positions in Crocs. The Motley Fool endorses Crocs. The Motley Fool upholds a stringent disclosure policy.

The insights shared here are the author’s and do not necessarily echo the views of Nasdaq, Inc.