“`html

UPS Stock Overview

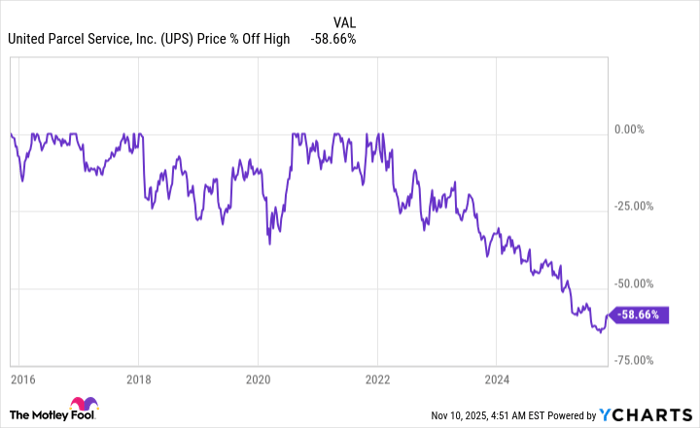

United Parcel Service (NYSE: UPS) is currently experiencing a significant decline, with shares down over 50% since early 2022. The company’s dividend yield stands at 6.8%, but its dividend payout ratio exceeds 100%, indicating potential risks as the company undergoes a business reset.

Valuation and Market Position

UPS’ price-to-sales ratio is approximately 0.9x, down from a five-year average of 1.4x, while its price-to-earnings ratio is just under 15x compared to a long-term average of around 18x. Despite Wall Street’s pessimism, management is focusing on operational efficiency, and recent results show revenue per piece in the U.S. market increased by 5.5% in Q2 2025 and 9.8% in Q3 2025.

Future Outlook

The ongoing overhaul includes cutting unprofitable business lines and investing in technology, indicating a turnaround for UPS that may appeal to aggressive investors. As these changes take effect, the stock could appreciate, presenting an opportunity to buy before the market adjusts.

“`