# Market Reflections: April’s Challenges and May’s Potential

Editor’s Note: April did not deliver the traditional market gains investors have come to expect. Instead, challenges like tariff issues, inflation concerns, and political uncertainty ruled the month.

However, as the adage goes, April showers bring May flowers.

With that in mind, I’d like to share insights from a Market 360 piece by my colleague Louis Navellier, who explored the emerging opportunities beneath the current market clouds.

He underscores that now is a time for strategic thinking rather than panic, and with the right perspective, today’s market uncertainty can transform into tomorrow’s opportunity.

Over to you, Louis…

April typically ranks as the second-strongest month of the year, with the S&P 500 averaging a 1.7% increase in post-election years since 1950.

Unfortunately, April 2025 defied this trend, primarily due to tariff-related complications.

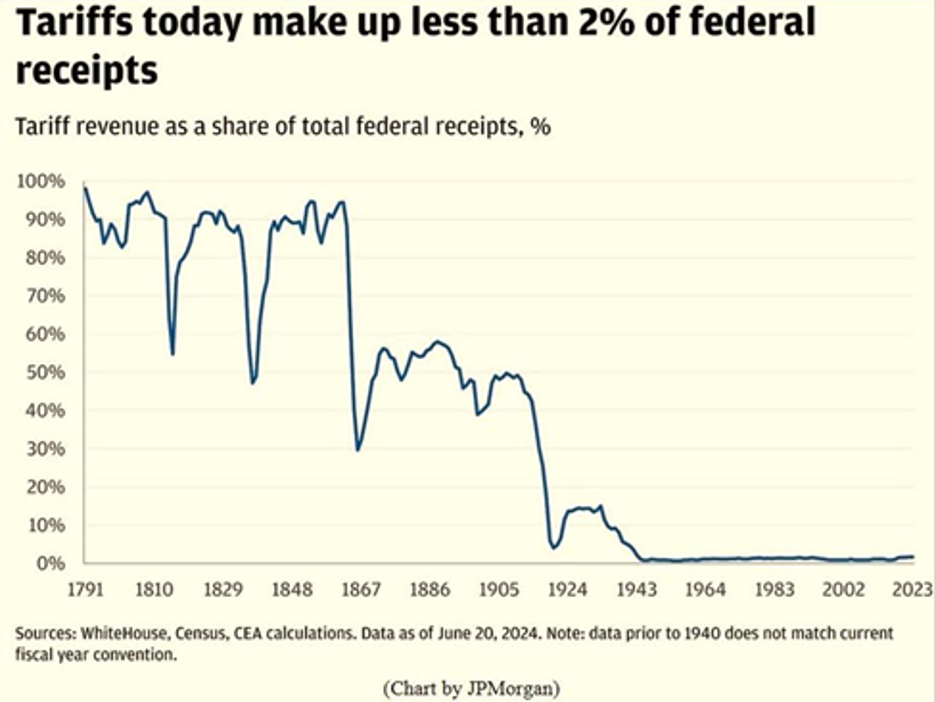

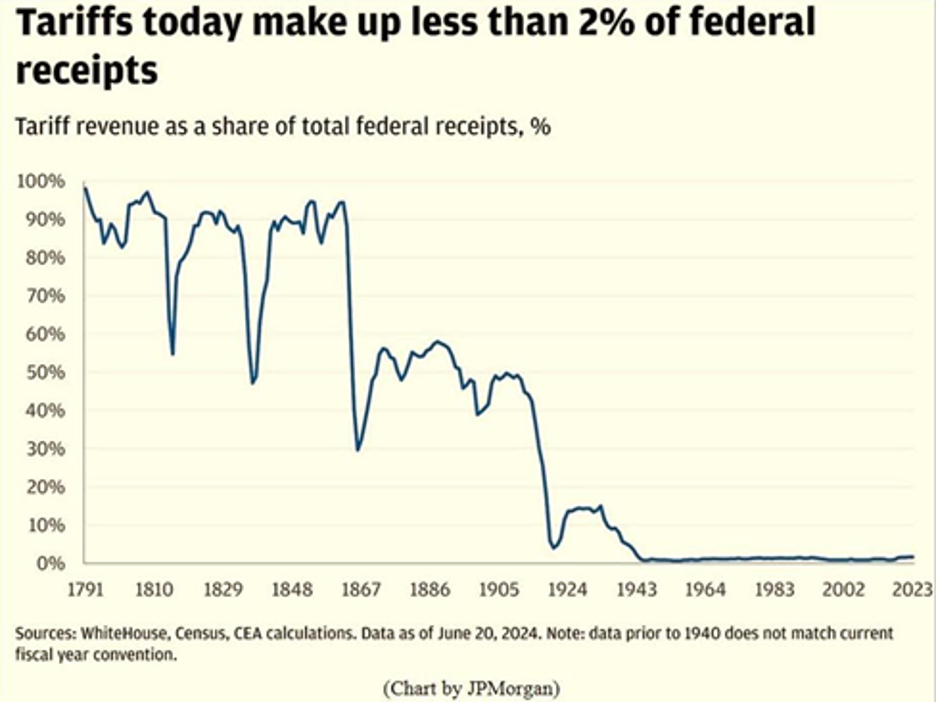

The reasons for this downturn are clear: tariffs.

I recognize the anxiety many investors are feeling regarding tariffs. Nonetheless, I believe that the market’s reaction has been disproportionate.

While President Trump continues his approach, I suggest watching Treasury Secretary Scott Bessent for more reliable insights during these tumultuous times.

The recent negativity spread by financial media has significantly contributed to the market’s uncertainty. Particularly, foreign outlets have blamed the Trump administration for issues in their own struggling economies.

When American investors see these bleak headlines each morning, it’s no surprise that their sentiments turn gloomy.

Yet, as the saying goes, April showers bring May flowers. I foresee some promising developments emerging in the market this May, especially among my Growth Investor stocks. Let’s discuss some positive signs already appearing.

Green Shoot #1: Easing Tariff Tensions

The trade war between China and the U.S. escalated significantly in early April.

China intensified the situation by halting all rare earth exports to the U.S., impacting essential sectors like electric vehicles (EVs), technology, and aerospace. Additionally, China suspended deliveries of Boeing Co. (BA) jets, leaving ten new 737 Max jets grounded.

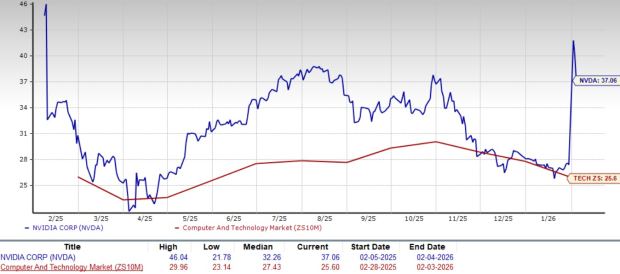

In response, the Trump administration banned NVIDIA Corporation (NVDA) from supplying its H20 GPUs to China—developed specifically after AI chip shipment restrictions were imposed by the Biden administration.

Recently, Treasury Secretary Bessent indicated that this tariff deadlock cannot persist for long. He emphasized the need for the two largest economies to find a path toward de-escalation.

During a press conference, President Trump suggested that final tariffs on China will likely be significantly lower than current levels, asserting that if an agreement can’t be reached, he may still reduce key tariffs. He emphasized, “we’re going to be very nice” in negotiations.

On top of this, the U.K., the European Union (EU), and approximately 130 other countries are negotiating new trade agreements with the U.S., further promoting freer trade.

This means we could see a reduction in trade barriers moving forward.

Green Shoot #2: Powell’s Job Security… for Now

This year, the Federal Reserve’s inaction has led to rising concerns about the job security of Fed Chair Jerome Powell, particularly in light of President Trump’s frustrations.

During an appearance at the Economic Club of Chicago, Powell acknowledged that tariffs might prompt higher prices and increased unemployment. He pointed out how challenging this situation is for the Fed, as attempts to address inflation could negatively impact employment, and vice versa.

Powell remarked on the complexities the central bank faces in the current economic landscape.

Nonetheless, recent data shows that both consumer and wholesale inflation declined in March. Additionally, the market has seen deflationary pressures due to the lowest crude oil prices in four years.

The fear regarding inflation appears unwarranted, indicating that both Powell and the Fed might be overreacting.

While Powell’s expertise is vital, one can argue that he’s navigating turbulent waters without a clear course.

# Market Stability Grows With Powell’s Tenure and Strong Earnings Reports

Recent market fluctuations sparked concerns about Fed Chair Jerome Powell’s position, with some suggesting that “Powell’s termination can’t come quickly enough.” Though his term is set to expire in 2026, the speculation surrounding President Trump’s potential to dismiss him contributed to Monday’s market volatility.

However, Trump alleviated these concerns during a press conference on Tuesday. He clarified that he has “no intention” of firing Powell. Despite his frustration with the Fed for not lowering key interest rates this year, it appears Powell will complete his term as Chair.

Positive Indicator #1: Strong Earnings Beat Expectations

The most promising development currently is the earnings reports. Initial quarterly announcements often set a positive tone, and this season has been no exception. So far, 71% of the S&P 500 companies that have reported earnings have surpassed analysts’ expectations, achieving an average surprise of 6.1%. FactSet projects that the S&P 500 will see at least a 7.2% average earnings growth for the first quarter.

Particularly noteworthy is how these early earnings results demonstrate that “earnings are working.” Companies with strong fundamentals that outperform analysts’ estimates see their stocks rise significantly. For example, in Growth Investor, two of our recommended stocks surged by more than 4% and 8% following their earnings beats last Tuesday. Additional gains were observed on Thursday, as another pair of stocks climbed similarly after exceeding expectations.

Consequently, we anticipate a continuous stream of better-than-expected sales and earnings, likely pushing fundamentally strong stocks higher in the weeks ahead.

Looking Ahead: Economic Optimism for Spring

With favorable progress in tariff negotiations and improving U.S.-China relations, I foresee a continued reduction in trade barriers. This positive environment should bolster the U.S. economy, alongside the benefits of improving earnings and potentially lower interest rates. Together, these factors could create a potent combination, driving fundamentally superior stocks significantly higher.

Ultimately, spring is here, and an optimistic outlook is warranted.

This leads to the question: where can investors discover stocks with strong fundamentals?

That’s where the insights from my Growth Investor service are beneficial.

The stocks I recommend in this service exhibit robust fundamentals. Notably, our Buy List stocks boast an average annual sales growth of 24% and an impressive average annual earnings growth of 81.1%. In comparison, the S&P 500 is projected to achieve only 4.6% revenue growth and 7.2% earnings growth for the first quarter.

Additionally, it is worth noting that analysts have raised earnings estimates for these stocks by an average of 3.8% in the last three months, reflecting strong optimism in the analyst community.

Sincerely,

Louis Navellier

Editor, Market 360

Disclosure: As of the date of this email, the Editor owns the following securities mentioned in this commentary:

NVIDIA Corporation (NVDA)