The Nasdaq has been on a continuous rally since April, primarily attributed to advancements in AI and robotics replacing human labor. Major tech companies such as Amazon (AMZN) and Microsoft (MSFT) have announced layoffs linked to increased automation, while the Nasdaq remains robust.

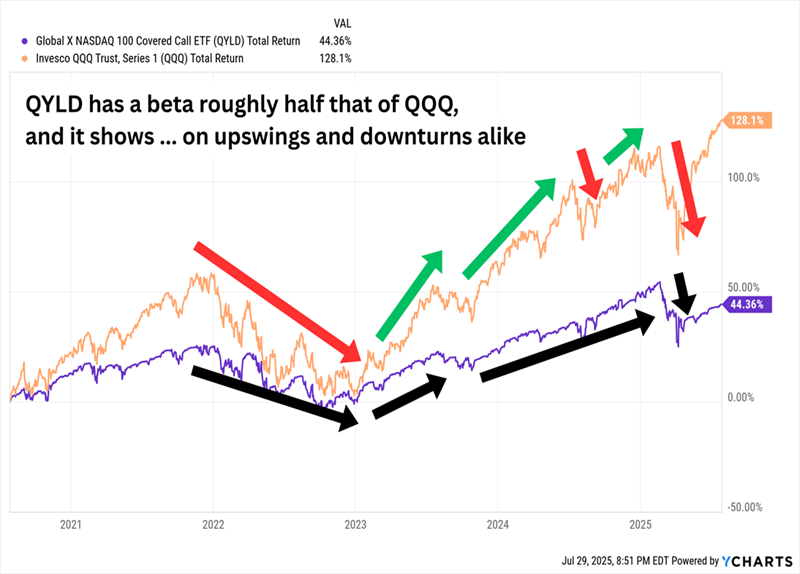

Three investment options linked to this trend include: Global X Nasdaq 100 Covered Call ETF (QYLD) with an 11.2% dividend yield, JPMorgan Nasdaq Equity Premium Income (JEPQ) offering a 10.8% yield, and Columbia Seligman Premium Technology Growth Fund (STK) with a distribution rate of 6.0%. Both QYLD and JEPQ utilize covered call strategies on Nasdaq stocks to provide income, while STK focuses more on technology firms and aims for higher growth by actively managing its portfolio.

The Nasdaq-100, comprising the 100 largest non-financial companies on the Nasdaq, leans heavily towards tech, which makes up about 60% of its weight. The shift towards automation, marked by these dividend-yielding funds, appeals to investors looking for stability amid changes in the employment landscape.