Investors Eye Undervalued Stocks in Consumer Discretionary Sector

The consumer discretionary sector is currently showing major opportunities for investors to buy undervalued stocks. This presents a chance for those looking to capitalize on potentially smart investments.

The Relative Strength Index (RSI) serves as a useful momentum indicator by comparing the strength of a stock’s gains to its losses. According to Benzinga Pro, stocks are generally deemed oversold when their RSI falls below 30. This provides traders with key insights into short-term price movements.

Below is a list of several key companies in the consumer discretionary sector, each exhibiting RSIs around or below that important 30 mark.

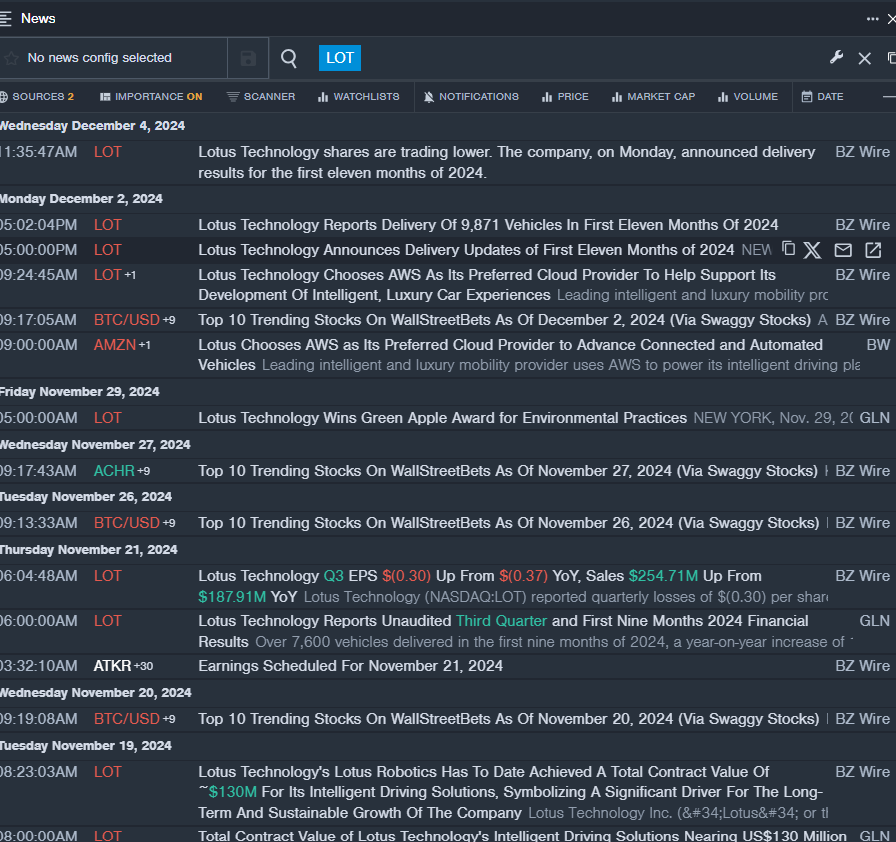

Lotus Technology Inc – ADR LOT

- On December 2, Lotus Technology disclosed the delivery of 9,871 vehicles for the first eleven months of 2024. The stock price has decreased by around 16% in the last month, reaching a 52-week low of $3.35.

- RSI Value: 26.97

- LOT Price Action: The stock closed at $3.64 after a 0.6% drop on Wednesday.

- Real-time updates from Benzinga Pro highlighted recent developments regarding LOT.

Hamilton Beach Brands Holding Co HBB

- On October 30, Hamilton Beach Brands reported a third-quarter earnings drop to 14 cents per share, down from 74 cents per share during the same period last year. The stock has decreased 11% over the past five days, with a 52-week lows of $14.34.

- RSI Value: 29.54

- HBB Price Action: The stock ended Wednesday at $17.66 after falling 0.8%.

- Benzinga Pro’s charting tools provided insights into HBB’s stock performance.

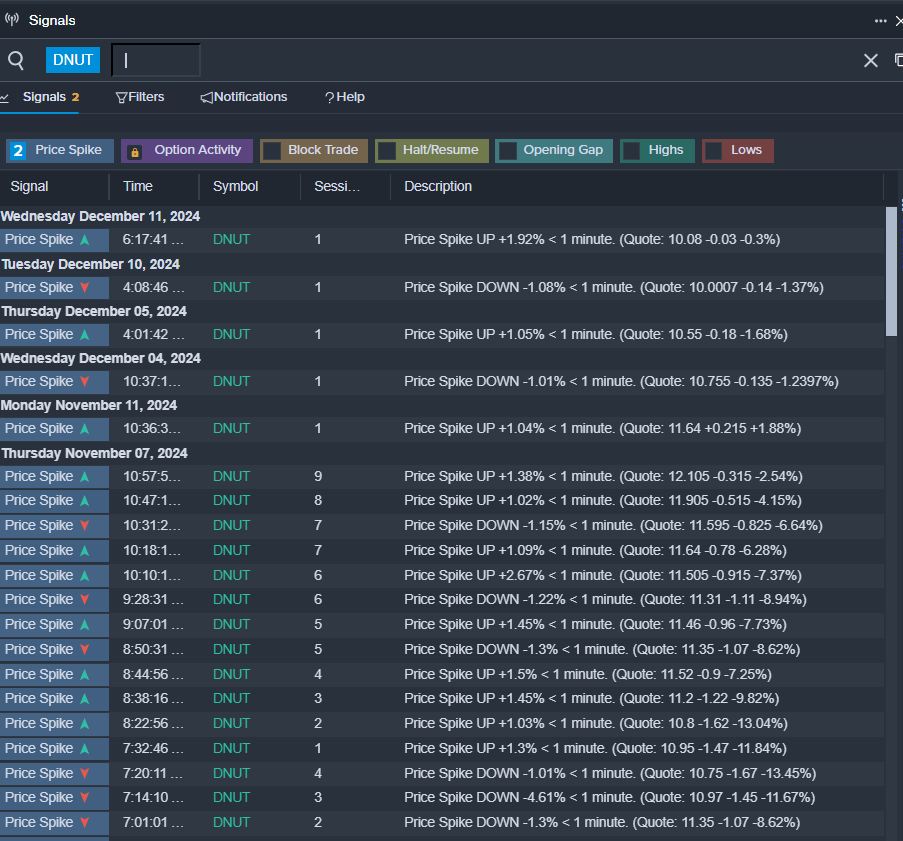

Krispy Kreme Inc DNUT

- On November 7, Krispy Kreme announced that its third-quarter earnings resulted in a loss of one cent per share, missing analyst expectations of one cent in profit. The company is maintaining its FY24 net revenue guidance of $1.65 billion to $1.685 billion, slightly below the street’s estimate of $1.675 billion. The stock has dropped around 11% in the last month, with a 52-week low of $9.18.

- RSI Value: 29.21

- DNUT Price Action: Shares closed at $10.03 on Wednesday, down 0.8%.

- Benzinga Pro’s alerts indicated potential for a breakout in DNUT shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs