Explore Undervalued Stocks in the Consumer Staples Sector

The recent overselling of stocks in the consumer staples sector reveals potential buying opportunities for investors looking to acquire undervalued companies.

To evaluate stock strength, the Relative Strength Index (RSI) serves as a momentum indicator. It measures a stock’s performance during price increases versus its performance during price declines. According to Benzinga Pro, a stock is generally classified as oversold when its RSI falls below 30. This analysis can provide traders valuable short-term insights into stock performance.

Here are the latest oversold stocks in the consumer staples sector, featuring RSIs near or below 30.

S&W Seed Co SANW

- On February 13, S&W Seed reported disappointing second-quarter earnings. CEO Mark Herrmann stated, “We have undertaken significant steps to realign S&W for future success, focusing on our core Americas-based operations and high-margin Double Team sorghum solutions.” The company’s stock has fallen around 43% in the last month, with a 52-week low of $2.11.

- RSI Value: 27

- SANW Price Action: Shares of S&W Seed dropped 3.7%, closing at $4.58 on Tuesday.

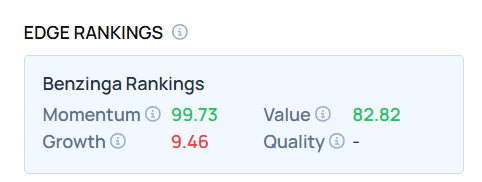

- Edge Stock Ratings: Momentum score of 99.73, with a Value score of 82.82.

Beeline Holdings Inc BLNE

- On April 15, Beeline Holdings reported a year-over-year revenue decline for FY24. CEO Nick Liuzza remarked, “Our 2024 performance highlights the strength of our model and the pace of our transformation.” The stock has fallen approximately 18% over the past month, hitting a 52-week low of $0.89.

- RSI Value: 22.2

- BLNE Price Action: Beeline Holdings shares increased by 17.1%, closing at $1.37 on Tuesday.

- Benzinga Pro’s charting tools helped identify trends regarding BLNE stock.

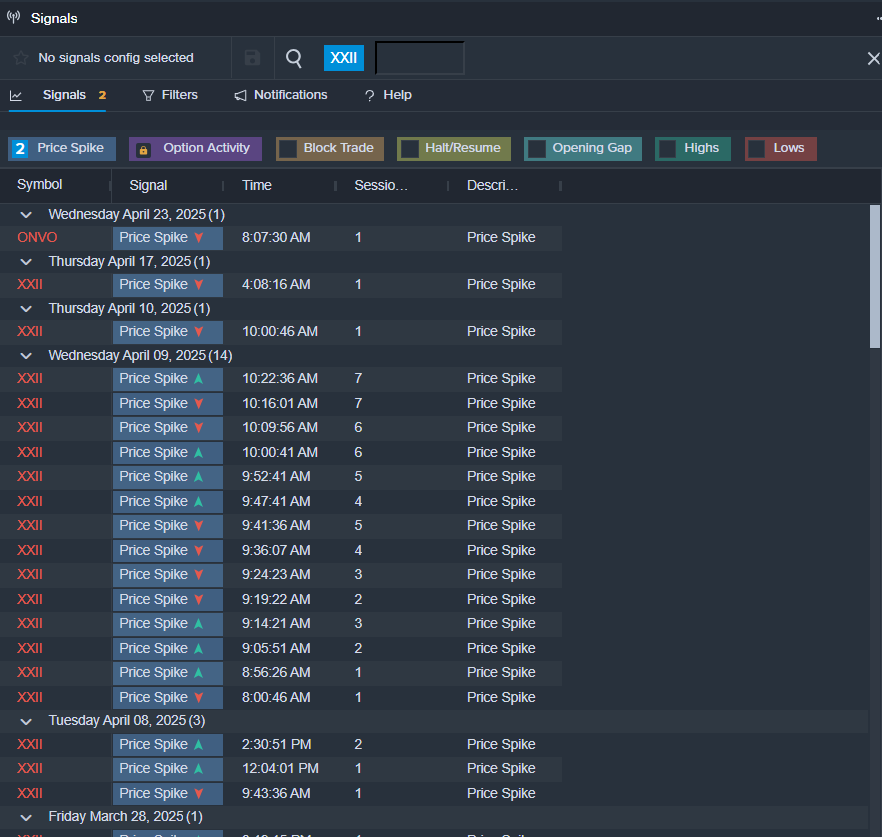

22nd Century Group Inc XXII

- On April 17, 22nd Century announced a notice of pendency and proposed settlement regarding stockholder derivative actions. The company’s stock has seen a steep decline of about 56% in the last month, reaching a 52-week low of $0.70.

- RSI Value: 21.5

- XXII Price Action: Shares of 22nd Century Group closed at $0.76 on Tuesday.

- Benzinga Pro’s signals indicated a potential breakout in XXII shares.

For further insights, explore BZ Edge Rankings to access scores for additional stocks in the consumer staples sector and to see how they compare.

Read This Next:

Photo via Shutterstock