Strategies for High-Yield Income & Stability in Investing

As we approach the end of 2024 and navigate potential market fluctuations, retirement planning may not be your main concern right now. However, it’s essential to remain focused on the long-term horizon, particularly with income investing, which has historically trended upward.

Investing in closed-end funds (CEFs) provides a unique advantage: high, regular income. The average CEF currently offers an 8% yield, comparable to the long-term average return of the S&P 500 on a yearly basis, but received as dividend cash.

This additional level of confidence from consistent dividend cash is why CEFs are particularly appealing at this time. Even with gains across various sectors this year, select CEFs still present valuable opportunities. Let’s explore three key CEFs that can build a lucrative mini-portfolio.

Building a Portfolio with 8% Income Yield

We won’t just identify these CEFs; we will combine them into a mini-portfolio designed to yield an outstanding 8% annually. It’s a straightforward investment strategy.

Diversification is another advantage. The three identified funds provide exposure to stocks, bonds, and real estate, spreading risk across a multitude of assets throughout the nation.

Understanding Your Savings Potential

To highlight the significance of an 8% return: if you have a $1 million investment, that translates to an annual income of $80,000, or over $6,600 monthly. This income could significantly supplement or even replace your current earnings.

If you’re nearing retirement with a million in savings and unsure about your future, consider that many individuals manage to retire with less and thrive.

Matching the Average American Income

The average American earns around $60,000 a year. To replicate this income solely through dividends from our three funds, you’d need approximately $750,000 invested. This illustrates how accessible income investing can be—you may already have enough to retire comfortably.

Let’s take a closer look at our three CEF selections.

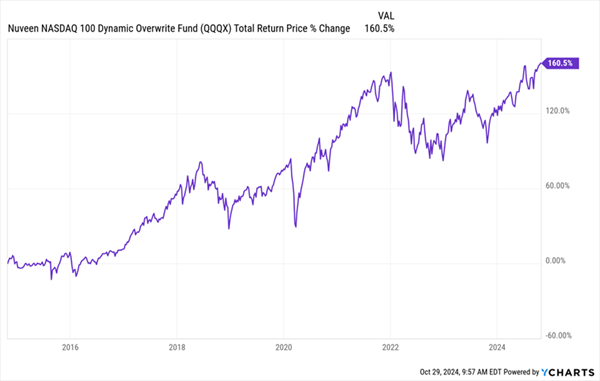

Fund Pick No. 1: Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

First, we have QQQX, yielding 6.6% and currently trading at a 10.8% discount to its net asset value (NAV). Discounts like this are unique to CEFs.

QQQX primarily invests in U.S. stocks, closely tracking the NASDAQ 100, which has contributed to its stable performance and reliable dividends over time, despite a period of stagnation.

Risk-Managed Income Strategy

QQQX generates its hefty dividends by selling call options on its stocks. This strategy limits potential gains but provides steady income, especially useful as we face potential market volatility.

Fund Pick No. 2: PIMCO Access Income Fund (PAXS)

Next is PAXS, offering an incredible 11.5% yield. This fund holds 325 bonds, which ensures substantial diversification. PIMCO is well-regarded for adeptly managing interest rate changes to find undervalued bonds.

Consistent Monthly Income

Source: Income Calendar

PAXS launched in January 2022, a challenging time due to rising interest rates, yet it has delivered around 8.2% returns since inception. The dividend payouts have also increased, supported by a special distribution in late 2022.

PAXS trades close to its NAV, a common trait for PIMCO funds, which often appreciate beyond face value due to the firm’s impressive track record.

Fund Pick No. 3: Cohen & Steers Quality Income Realty Fund (RQI)

Finally, RQI offers a diverse real estate portfolio, investing in shares of over 100 companies that own thousands of properties. With a yield of 7.1%, RQI taps into the reliable income potential of real estate without requiring direct landlord responsibilities.

Reliable Returns and Value in Real Estate

Over the past five years, RQI has achieved a 34% return. While this is modest next to the S&P 500’s performance, it indicates that the real estate investment trusts (REITs) included in RQI remain undervalued.

Combining Our Choices for Income and Growth

Together, these three funds form a portfolio with an appealing 8.4% yield from high-quality diversified assets.

This setup positions investors to match or exceed the average American’s salary with approximately $750,000, potentially generating around $63,000 annually. This reinforces the notion that retirement could be within reach sooner than expected.

Maximizing Monthly Dividend Payments

For income-driven investors, maintaining an 8%+ income stream is crucial, especially given current uncertainties in the market.

The advantage of receiving these payments monthly allows for quicker reinvestment and the flexibility to seize opportunities during market downturns.

PAXS and RQI offer monthly distributions, but many other CEFs provide similar benefits with attractive yields.

Click here to learn more about five monthly dividend CEFs that are currently recommended (average yield: 10.5%), along with a complimentary Special Report detailing each fund.

Further Reading:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.