# Wall Street Fixated on Economic Uncertainty Amid Tax Reform Plans

Current media and Wall Street focus heavily on economic uncertainty.

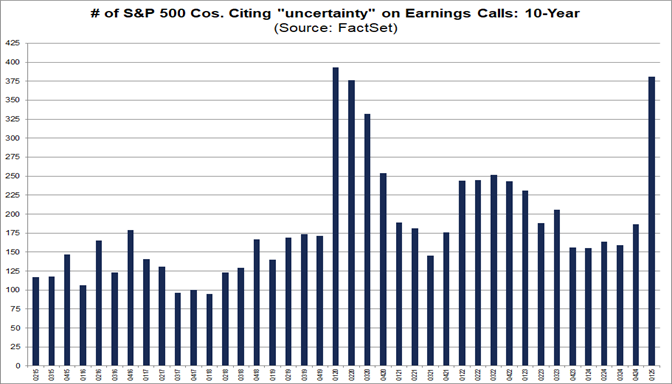

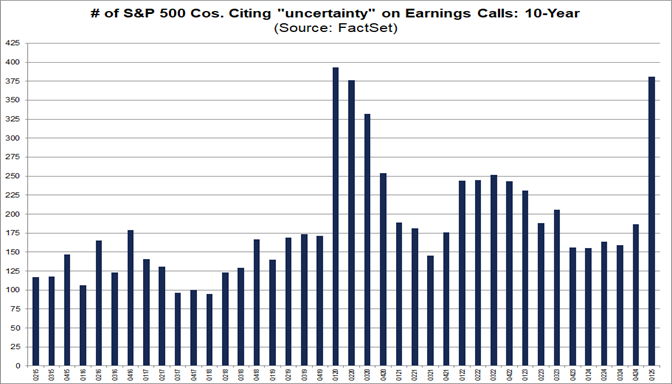

In recent earnings calls, 84% of S&P 500 companies mentioned “uncertainty.” This term also influenced Moody’s decision to downgrade U.S. debt.

The Federal Reserve’s April 2025 “Beige Book” cited “uncertainty” 80 times, a sharp increase from 11 instances in April 2024.

While the term has its uses, it can also breed complacency:

- Media can easily shift blame onto an “invisible enemy.”

- Investors may feel automatically resigned to a lack of clear outcomes.

- CEOs can deflect responsibility for underperformance.

However, some facts remain clear in this climate. Today’s Market 360 will address three certainties connected to President Trump’s three-part economic plan and their implications for investors.

Tax Reforms Under Trump’s Plan

President Trump’s “Big, Beautiful Bill,” focusing on tax reforms, recently passed the House. Here are three primary changes:

- Middle-Class Tax Cuts: Reductions include lowering the 15% income tax bracket to 12% and the 25% bracket to 22%. Additionally, there will be no taxes on tips or overtime, fulfilling a campaign promise.

- Enhanced Family Benefits: The child tax credit will remain at $2,000 per child, with the introduction of MAGA savings accounts featuring a $1,000 federal contribution for newborns.

- Health Savings Expansion: Health savings accounts (HSAs) may now cover fitness memberships and direct primary care, beyond just medical expenses.

Trump aims to allocate revenue from tariffs to further reduce taxes for individuals earning $150,000 or less. These modifications could significantly benefit the middle class and overall economy. The House Ways and Means Committee reports that such reforms could contribute trillions to GDP growth over the next decade.

Senate approval is needed for the bill to become law.

Technology Sector Trends

The advancing field of artificial intelligence will drive higher electricity demands this year.

Last November, NVIDIA Corporation (NVDA) launched its Blackwell chip, boasting performance improvements but increased power consumption. Each B200 GPU requires 1,200 watts, up from 700 watts for previous models.

The production of these chips remains limited, causing delays even for major companies like Oracle Corporation (ORCL) and Microsoft Corporation (MSFT).

During its recent earnings call, Microsoft’s CEO noted potential profit increases hindered by hardware shortages.

This situation could persist until mid-2026 as more Blackwell chips are manufactured, stressing the existing U.S. energy grid further.

Moreover, AI innovation continues with OpenAI’s recent launch of the GPT-4.1 model, which enhances coding capabilities by approximately 20% compared to its predecessor.

# Alphabet Introduces Advanced AI Tech Amid Nuclear Energy Push

## Alphabet Inc. Launches New AI Capabilities

On May 20, 2023, **Alphabet Inc. (GOOG)** introduced various AI-powered products at its I/O developer conference. This event featured improvements such as a series of new AI models, AI-generated films, advanced smart glasses, and wearable tech.

Most notably, Alphabet unveiled a new AI model, code-named “Deep Think,” showing over twice the accuracy of OpenAI’s leading models on some tasks. This growing competition in AI is likely to boost demand for Blackwell chips, essential for many AI operations.

## Energy Executive Orders from President Trump

On his first day in office, President Trump signed three significant executive orders aimed at enhancing U.S. energy independence:

– **Executive Order 14154, “Unleashing American Energy”:** This order promotes the expansion of energy production on federal lands and ending the electric vehicle (EV) mandate to offer consumer choice. It also mandates a review of regulations that hinder energy production.

– **Executive Order 14156, “Declaring a National Energy Emergency”:** This order allows federal agencies to use emergency powers to boost energy development. It includes initiatives to streamline leasing processes and expand energy infrastructure.

– **Executive Order 14153, “Unleashing Alaska’s Extraordinary Resource Potential”:** This focuses on increasing resource development in Alaska and reinstating oil and gas leasing in specific national areas.

These initiatives could significantly influence America’s economic prosperity, tapping into over $100 trillion of energy resources within the country.

## Trump’s “Liberation Day 2.0” Economic Strategy

The economic strategy labeled **”Liberation Day 2.0″** encompasses tax, tech, and energy liberation as key areas for growth. On a recent Friday, Trump signed executive orders aiming to position the U.S. as a leader in nuclear energy. The regulations are set to increase nuclear capacity from 100 gigawatts to 400 gigawatts by 2050 and advance the construction of ten new large reactors by 2030.

Following this announcement, nuclear stocks experienced a surge, correlating with the increasing need for energy due to advancements in AI. A notable company in this sector is **Vistra Corp. (VST)**, based in Irving, Texas. Vistra generates around 37,000 megawatts of power from various sources and serves about 4 million customers across multiple states.

In March 2024, Vistra acquired Energy Harbor for $3.4 billion, positioning itself as the second-largest U.S. nuclear power provider, maintaining a “B” rating in investment evaluations.

Investors keen on nuclear energy opportunities should consider examining Vistra Corp’s potential in the context of “Liberation Day 2.0.”

## Upcoming Investment Insights

Additional insights on investments related to **”Liberation Day 2.0″** will be shared during an upcoming summit, scheduled for 1 p.m. Eastern time. During this summit, discussions will include:

– Key sectors expected to perform well, alongside top buy recommendations.

– Sectors facing challenges in the new economy.

– Strategies for achieving significant investment returns.

Investors interested in further details should act promptly to secure their spot.