# Wall Street’s Focus on Uncertainty Hides Key Economic Shifts

## Wall Street’s Obsession with Uncertainty

Recent financial headlines have highlighted “uncertainty” as a primary concern. CEOs reference it for poor business performance, and it frequently appears in economic forecasts. The Federal Reserve, for instance, mentioned “uncertainty” 80 times in its April Beige Book report alone.

While discussions about potential pitfalls abound, analysts often overlook significant trends that are currently shaping the market.

## Key Economic Shifts Ahead

Investor Louis Navellier identifies three major shifts that could affect the market positively. He refers to these developments as **Liberation Day 2.0**, which he elaborated on during a recent event. The movements are happening in real-time, and one lesser-known stock may capitalize on these changes.

## The Rise of “U”: Uncertainty

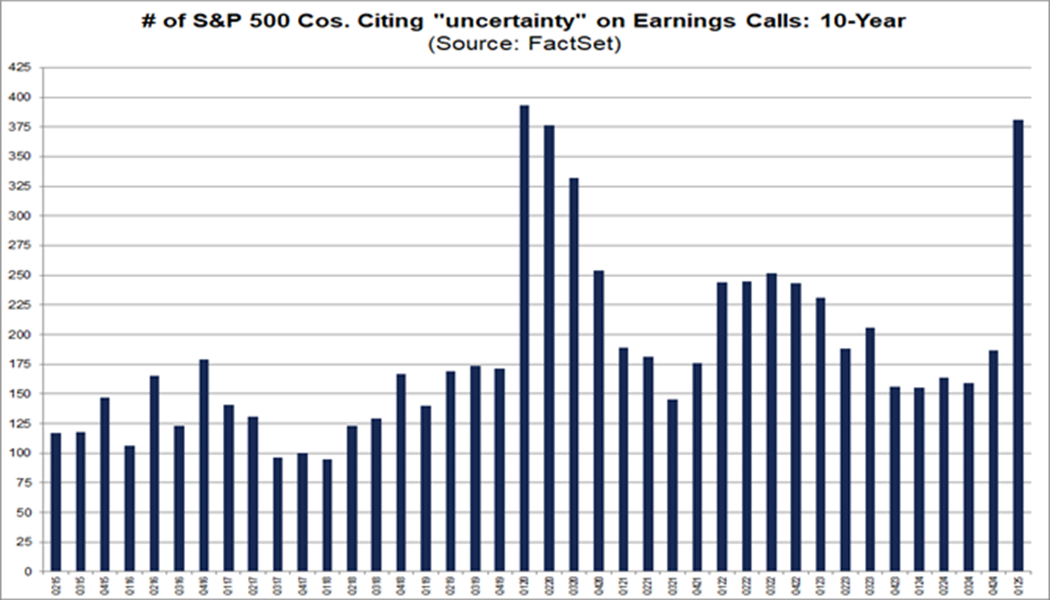

The term “uncertainty” has permeated the financial landscape, with 84% of S&P 500 companies mentioning it during their latest earnings calls. Moody’s even cited it to justify a recent downgrade of U.S. debt.

Interestingly, the Federal Reserve’s April “Beige Book” saw this term’s usage soar from just 11 mentions the prior year. Although “uncertainty” serves a purpose, it is becoming a crutch for various stakeholders—be it the media, analysts, or corporate leaders.

## Three Certainties for Investors

### 1. Tax Reforms

Recently, President Trump’s legislative proposal passed the House, introducing significant tax reforms:

– **Permanent Middle-Class Tax Cuts**: Individual income tax rates would drop for various brackets, eliminating taxes on tips and overtime.

– **Expanded Family Benefits**: The child tax credit will be permanently set at $2,000 per child, along with new savings accounts for newborns.

– **Health Savings Expansion**: Health savings accounts will now cover fitness memberships and other wellness expenses.

Trump also aims to use tariff revenue to lower taxes for those earning $150,000 or less, potentially impacting the economy positively. The House Ways and Means Committee noted past tax cuts led to wage increases and substantial business investments.

### 2. Tech Advancements

Artificial intelligence is poised to demand more energy this year. NVIDIA Corporation’s release of its Blackwell chip has enhanced AI performance significantly, making it crucial for market growth.

—

These developments set the stage for informed investment decisions as the economic landscape shifts. Stay tuned for updates on potential stock opportunities that align with these trends.

Nvidia’s GPU Power Surge Strains U.S. Energy Grid Amid AI Race

Increased Power Consumption Raises Concerns

Each B200 GPU unit by Nvidia consumes 1,200 watts, comparable to a household toaster, marking a 70% rise from its predecessor’s 700 watts. However, this surge will not immediately translate to a proportional increase in electricity demand, as production of Blackwell chips remains constrained. Major cloud firms like Oracle Corporation (ORCL) and Microsoft Corporation (MSFT) are already experiencing supply delays.

During Microsoft’s first-quarter earnings call, CEO Satya Nadella indicated that lack of hardware limited profit potential. By mid-2026, more Blackwell chips will become available, replacing older Nvidia Hopper chips, and new facilities will be built. The increased chip production may further strain the U.S. energy grid.

AI developers, however, continue to push forward. In April, OpenAI introduced its GPT-4.1 model, which enhances coding efficiency by about 20% compared to GPT-4. Shortly thereafter, OpenAI launched Codex, an agent capable of writing and debugging code.

On May 20, Alphabet Inc. (GOOG) showcased several AI innovations at its I/O developer conference, including a new AI model, “Deep Think,” which reportedly surpasses OpenAI’s models in accuracy for select tasks. This ongoing AI competition is expected to drive demand for Blackwell chips, compelling power-generation companies to prepare for substantial demand.

Energy Policies Aim for Independence

President Trump initiated three significant energy executive orders aimed at enhancing U.S. energy independence and development.

- Executive Order 14154, “Unleashing American Energy”: This order focuses on increasing energy production from federal lands and offshore, enhancing domestic mineral mining, and streamlining regulations to boost energy development.

- Executive Order 14156, “Declaring a National Energy Emergency”: This order allows federal agencies to expedite energy resource development and infrastructure enhancement, promoting energy independence.

- Executive Order 14153, “Unleashing Alaska’s Extraordinary Resource Potential”: This order aims to expand resource development opportunities in Alaska, focusing on energy production and infrastructure improvements.

These executive orders could significantly impact the country’s wealth, as the U.S. possesses an estimated $100 trillion in energy and natural resources—capable of exceeding national debt threefold.

Focus on Nuclear Energy Expansion

Trump’s ongoing economic policies also emphasize nuclear energy. On May 23, he signed orders intending to shore up U.S. nuclear capacity from 100 gigawatts to 400 gigawatts by 2050 and develop ten new reactors by 2030.

Nuclear power stocks reacted positively to this news. Among them is Vistra Corp. (VST), one of the largest power producers in the U.S. with a capacity of approximately 37,000 megawatts across various energy sources. The company has provided dependable power to 4 million customers in 20 states and Washington, D.C.

In March 2024, Vistra completed a $3.4 billion acquisition of Energy Harbor, becoming the second-largest U.S. nuclear power provider. It ranks a “B” in my Stock Grader system, and I see potential in investing in it.

In summary, trends in energy and AI are shaping investment landscapes, indicating critical opportunities for stakeholders looking to capitalize on emerging sectors.