“`html

Investors have notably leaned towards a “buy the dip” strategy since the Global Financial Crisis, which has been bolstered by government interventions during market downturns, including the recent COVID-19 pandemic.

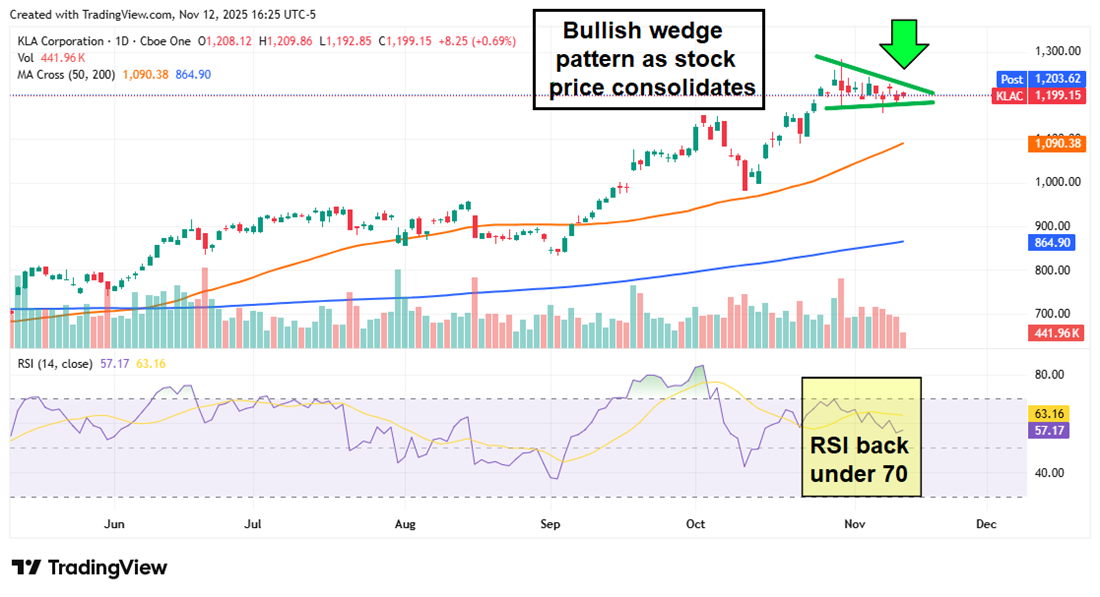

Currently, companies such as KLA Corporation (NASDAQ: KLAC), ARM Holdings (NASDAQ: ARM), and Vertiv Holdings (NYSE: VRT) are gaining attention for their significant roles in the AI and semiconductor sectors. KLA forecasts $925 million in revenue from advanced packaging services for fiscal Q1 2026, marking a 70% year-over-year growth. ARM, while reporting over 34% year-over-year revenue growth, has reached a 25% penetration rate in the data center CPU market. Vertiv boasts that its liquid-cooling technology is 3,000 times more efficient than traditional systems, with a market forecast growing at 20% CAGR this decade.

Despite stock price fluctuations, these companies are positioned to capitalize on ongoing advancements in technology and efficiency, making them potential opportunities for investors during market corrections.

“`