The Zacks Leisure and Recreation Products industry, affected by ongoing tariff issues and economic uncertainty, is witnessing strong demand for fitness-related products amidst heightened health awareness. Key players like Academy Sports and Outdoors, Inc. (ASO), Peloton Interactive, Inc. (PTON), and Playboy, Inc. (PLBY) are expected to benefit from these trends. Despite a challenging economic environment, the fitness product sales trend remains positive.

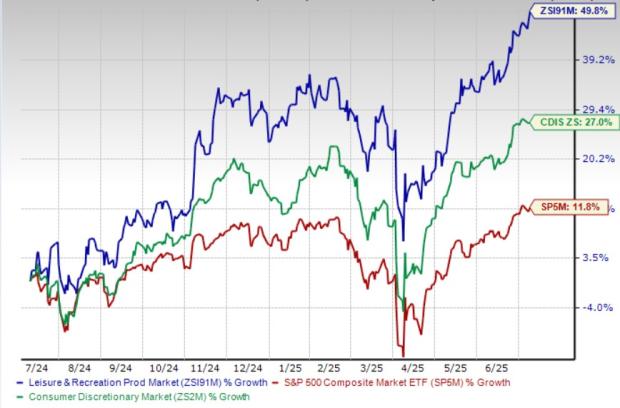

The industry currently holds a Zacks Industry Rank of #204, placing it in the bottom 17% of over 246 Zacks industries, indicating poor near-term prospects. Aggregate earnings estimates for the industry have dropped by 13.6% since January 31, 2025, due to waning confidence in growth potential. Conversely, the industry has collectively outperformed the S&P 500, growing 49.8% over the past year, compared to the S&P 500’s 11.8% rise.

Peloton reported a fiscal 2025 earnings growth forecast of 72.9%, while PLBY has seen a 137.5% stock increase over the past year, benefiting from a shift to an asset-light model. ASO, although having faced a 2.3% decline in share price, continues to pursue growth strategies through new partnerships and digital enhancements.