Ripe for Investment: Oversold Stocks in Communication Services Sector

The communication services sector is currently home to several oversold stocks, presenting a potential opportunity for investors to acquire undervalued companies.

The Relative Strength Index (RSI) serves as a momentum indicator, helping traders assess the strength of a stock’s price movements over time. Typically, an RSI below 30 indicates that a stock is oversold, according to Benzinga Pro.

Below is a list of key oversold stocks in this sector, which are currently trading with RSIs close to or below the 30 threshold.

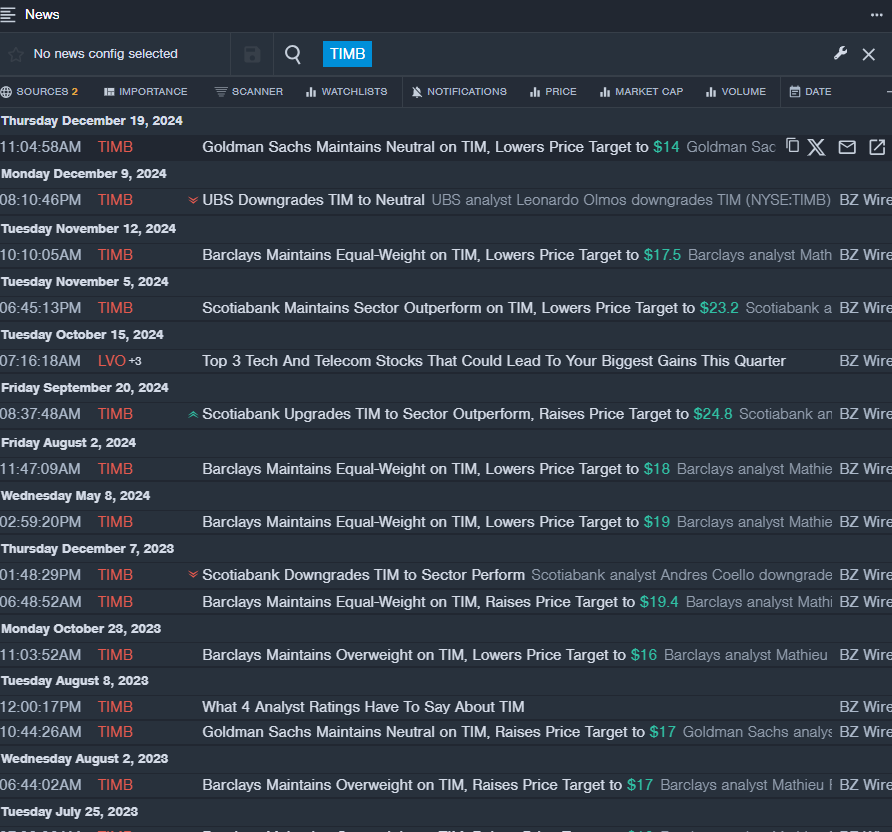

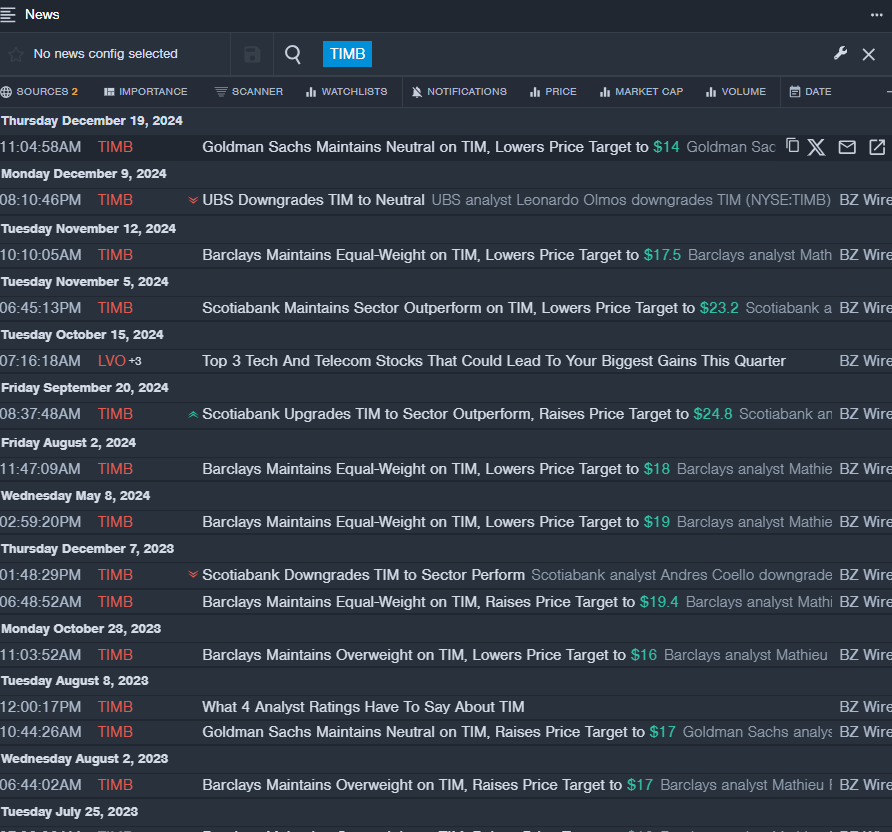

Tim SA TIMB

- On December 19, Goldman Sachs analyst Vitor Tomita maintained a Neutral rating on TIMB, lowering the price target from $16.20 to $14. Over the past month, the stock has dropped approximately 14%, hitting a 52-week low of $11.76.

- RSI Value: 28

- TIMB Price Action: TIMB shares fell by 2.2%, closing at $11.81 on Thursday.

- Benzinga Pro’s real-time newsfeed highlighted recent developments concerning TIMB.

Gray Television Inc GTN

- On December 18, Gray Media partnered with the Atlanta Braves to simulcast 15 regular season games. The stock has experienced a decline of about 28% over the last month, with a 52-week low of $2.91.

- RSI Value: 24

- GTN Price Action: GTN shares increased by 3%, ending Thursday at $3.12.

- Benzinga Pro’s charting tool aided in identifying the trend in GTN stock.

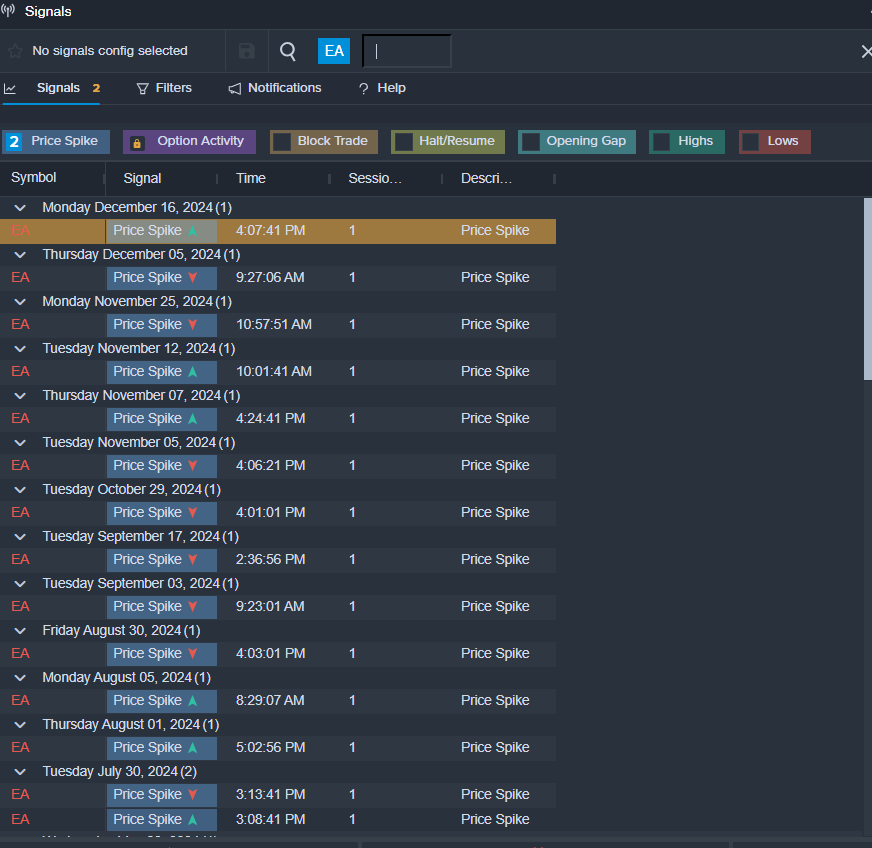

Electronic Arts Inc EA

- On December 18, Stifel analyst Drew Crum downgraded Electronic Arts from Buy to Hold, while keeping the price target steady at $167. The company’s stock dipped about 9% over the past month and reached a 52-week low of $124.96.

- RSI Value: 26

- EA Price Action: EA shares edged down by 0.1%, closing at $149.07 on Thursday.

- The Benzinga Pro signals feature indicated a potential breakout for EA shares.

Read This More:

Market News and Data brought to you by Benzinga APIs