“`html

Key Points

-

Machine vision adoption will increase with AI integration.

-

Aircraft manufacturer backlogs indicate strong growth prospects for suppliers.

-

Tobotaxis and self-driving solutions are crucial to business investments.

Cognex (NASDAQ: CGNX), Hexcel (NYSE: HXL), and Tesla (NASDAQ: TSLA) have shown sound fundamentals but all three saw share price declines in the first half of 2025. Despite near-term challenges, these stocks are considered good long-term investments.

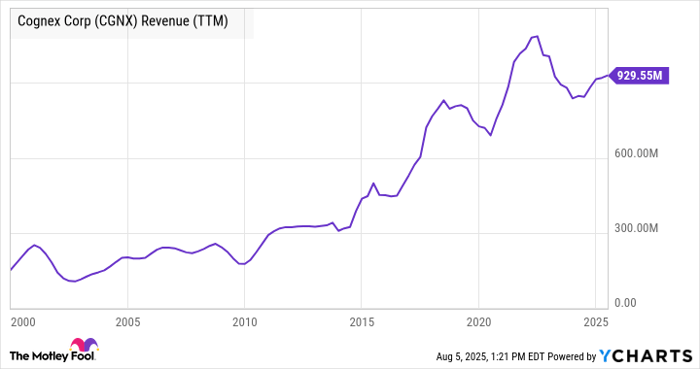

Cognex’s Machine Vision

Cognex is recovering from cyclical weakness in key markets such as automotive and consumer electronics. The rise of AI-infused machine vision systems is expected to enhance productivity, aiming for 10% to 11% annual organic growth.

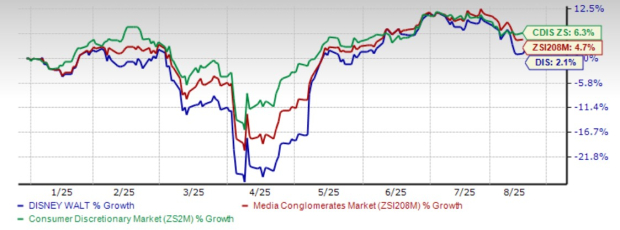

Hexcel’s Market Position

Hexcel benefits from major aircraft deliveries, with Airbus and Boeing having backlogs of 8,754 and 5,900 planes, respectively. The company is well-positioned for future growth, though it faces near-term challenges tied to production ramp issues.

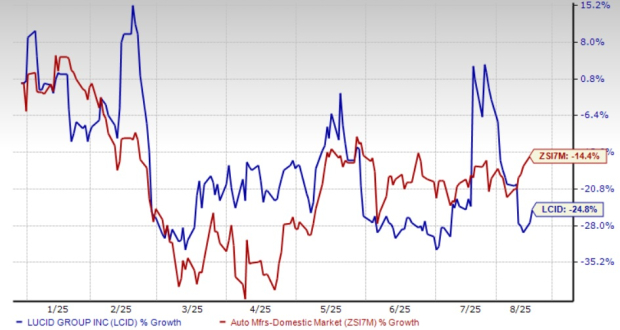

Tesla’s Future Prospects

Tesla’s EV sales have declined, but growth is anticipated from its robotaxi rollout and advancements in full self-driving technology. Continued regulatory approval and data collection are critical to its success in these areas.

“`