Real Estate Sector Stands Out with Oversold Stocks for Savvy Investors

Identifying undervalued companies can lead to smart buying opportunities.

The Relative Strength Index (RSI) serves as a momentum indicator by evaluating a stock’s performance during price increases compared to declines. This analysis provides traders with insights into short-term potential. An RSI below 30 typically indicates that a stock is oversold, according to Benzinga Pro.

Below is a recent list of major oversold stocks in the real estate sector, featuring RSI values near or below 30.

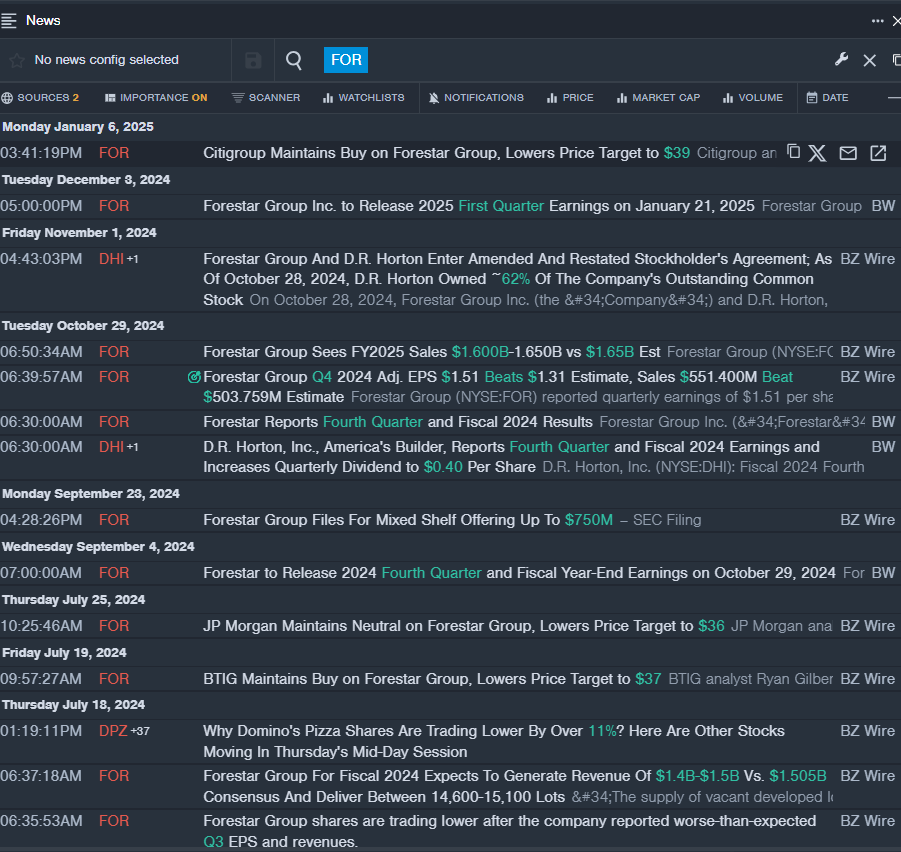

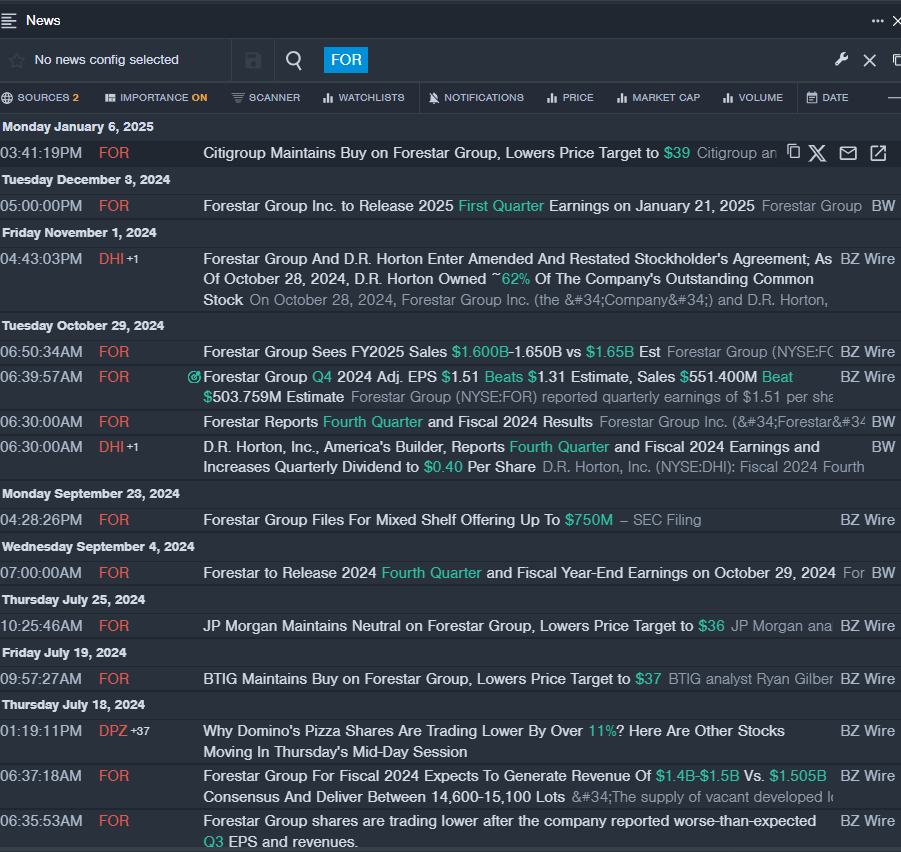

Forestar Group Inc FOR

- Citigroup analyst Anthony Pettinari reaffirmed a Buy rating for Forestar Group on January 6, reducing the price target from $43 to $39. The stock has experienced a decline of approximately 10% in the past month and reached a 52-week low of $24.81.

- RSI Value: 20.5

- FOR Price Action: On Friday, Forestar Group’s shares dropped 2.5%, closing at $25.10.

- Latest news is available through Benzinga Pro’s real-time newsfeed.

American Assets Trust, Inc AAT

- American Assets Trust is set to announce its fourth quarter and year-end 2024 earnings following the market close on February 4. In the last five days, the stock has dropped around 10%, reaching a 52-week low of $20.03.

- RSI Value: 22.7

- AAT Price Action: The shares declined by 3.2%, closing at $23.56 on Friday.

- Benzinga Pro’s charting tool has tracked AAT stock’s recent trends.

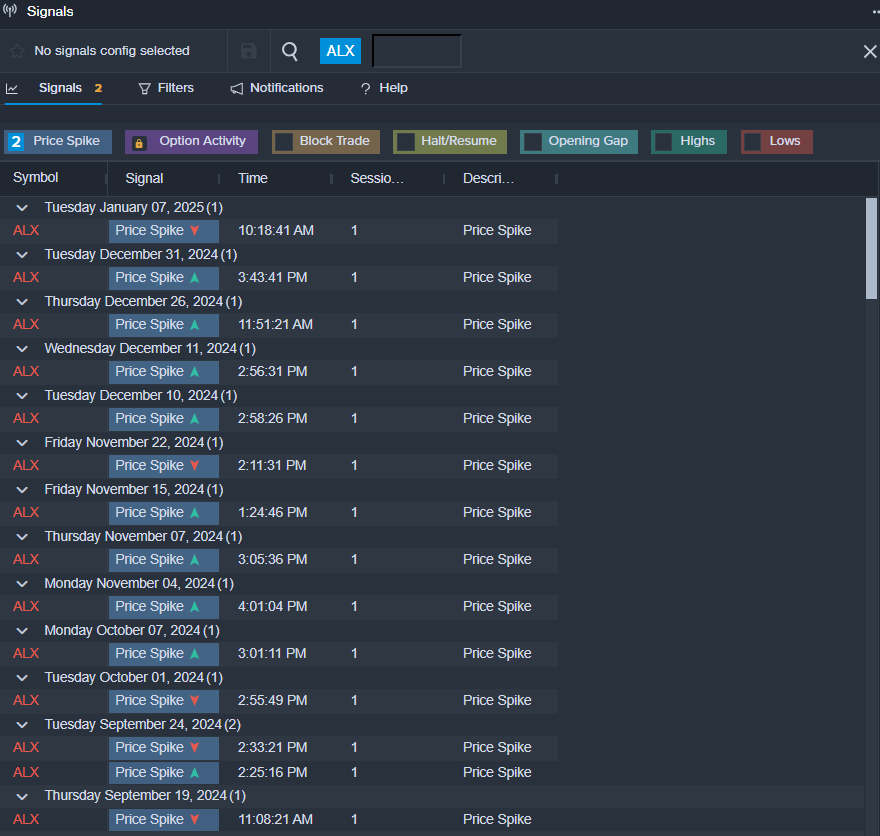

Alexander’s Inc ALX

- On November 4, Alexander’s Inc reported quarterly results that surpassed expectations. Despite this, the stock has fallen roughly 12% over the past month, hitting a 52-week low of $185.00.

- RSI Value: 25.9

- ALX Price Action: The stock declined by 6.6% to close at $186.88 on Friday.

- Potential breakout signals for ALX shares were noted by Benzinga Pro.

Read This Next:

Market News and Data brought to you by Benzinga APIs