Key Highlights

-

Demand for Nvidia GPUs remains strong.

-

Alphabet is trading at a low valuation compared to its peers.

-

Meta Platforms is investing in AI talent.

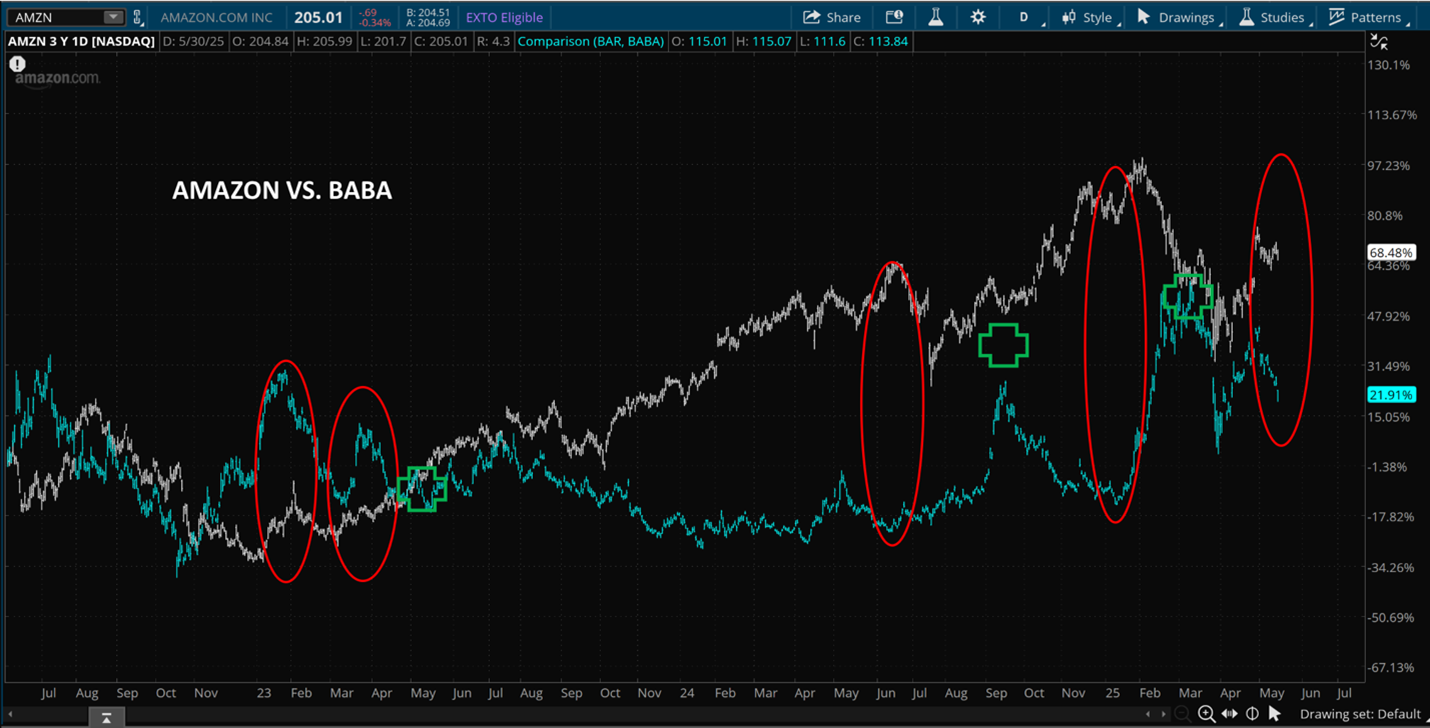

Bank of America Global Research’s chief investment strategist, Michael Hartnett, identified the “Magnificent Seven” tech stocks that have driven the U.S. market in recent years, which includesNvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA). Key stocks expected to outperform include Nvidia, Alphabet, and Meta Platforms.

Nvidia Performance

Nvidia is currently the world’s largest company by market cap, benefiting from a 69% year-over-year revenue growth in Q1 and forecasted growth of 50% in Q2, attributed to high demand for GPUs in AI applications. This is notable for a company of its size.

Alphabet Insights

Alphabet’s Google Search revenue rose 10% year-over-year in Q1, and with a forward earnings multiple of 18.6, it trades at a discount compared to its peers who average around 30 times. This suggests potential for valuation correction and upside for shareholders.

Meta Platforms Strategy

Meta is heavily investing in AI to improve advertising tools across its platforms, including Facebook and Instagram. This investment in AI talent is aimed at enhancing operational efficiency and ensuring better returns for advertisers, potentially leading to significant shareholder value growth.