Market Momentum Returns Amid Geopolitical Easing and Tariff Adjustments

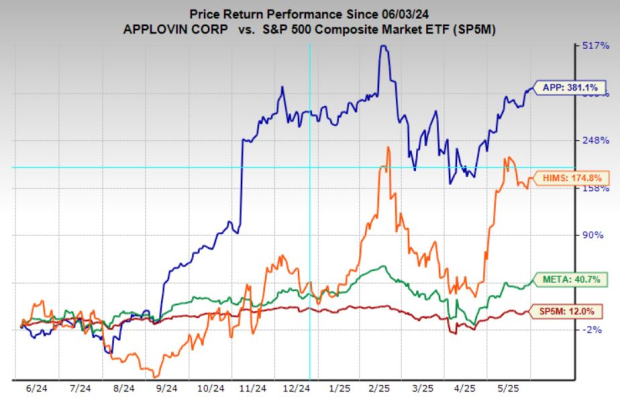

After months of extreme volatility caused by geopolitical concerns and fluctuating tariff policies, market momentum has rebounded. Easing tariff policies, positive economic growth forecasts, and accelerating AI-driven productivity have encouraged investors to embrace risk once more.

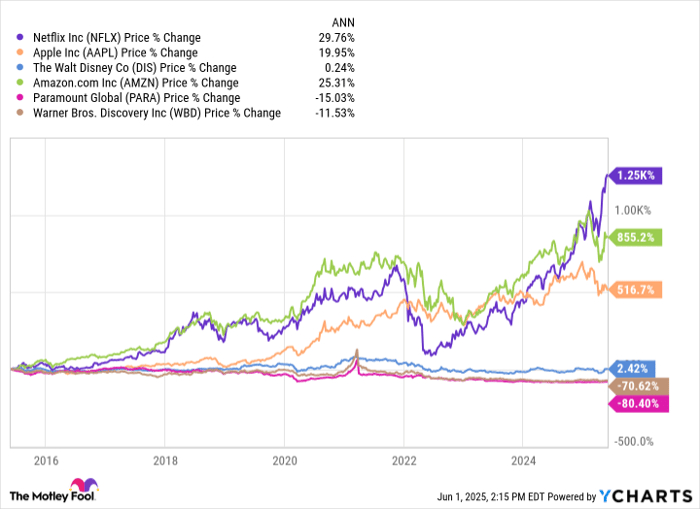

In this revitalized market, select stocks with strong fundamentals are making notable gains. Three highlighted companies, Hims & Hers Health (HIMS), AppLovin (APP), and Meta Platforms (META), exhibit strong technical momentum and promising growth outlooks, making them appealing investment options.

Image Source: Zacks Investment Research

AppLovin: Stock Approaches New Highs

AppLovin, a mobile marketing technology firm, has emerged as a leading market performer over the past two years. The stock has benefitted from consistent earnings growth and an attractive valuation, drawing considerable interest from institutional investors.

Holding a strong position within the Zacks Rank, AppLovin has seen significant positive revisions in earnings estimates. Fiscal Year (FY) 2025 estimates have increased by 22%, while FY 2026 estimates rose by 26.4%, reflecting renewed investor confidence. AppLovin currently holds a Zacks Rank #1 (Strong Buy) rating.

Technically, APP is demonstrating notable momentum. After recent consolidations, the stock is now positioned beneath a key resistance level at $400. A move above this threshold may indicate a breakout toward new all-time highs.

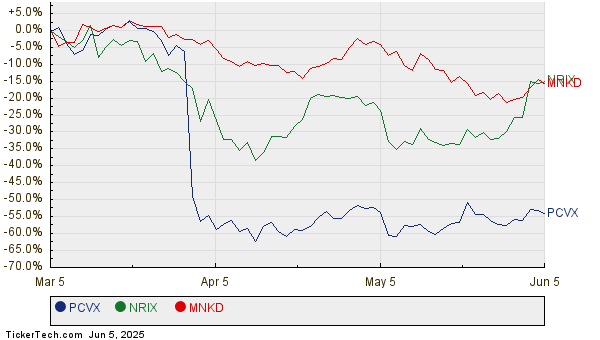

Image Source: TradingView

Hims & Hers Health: Shares Surge on Earnings Upgrades

Hims & Hers Health, focused on telemedicine and wellness products, has garnered attention as a standout performer. Rapid growth in various product lines, especially weight-loss treatments, has positioned Hims to capitalize on a burgeoning market for GLP-1-related services.

Analysts forecast an impressive compound annual earnings growth rate of 36.5% for Hims over the next three to five years. The company currently holds a Zacks Rank #2 (Buy), fueled by recent upgrades in earnings estimates. Current-quarter EPS estimates have risen by 21.4%, and FY 2025 and 2026 estimates have increased by 14.4% and 11.6%, respectively.

From a technical viewpoint, HIMS is in breakout mode. Recently breaking above significant resistance, the stock is moving toward all-time highs. Should shares maintain above this breakout point, further upside seems probable.

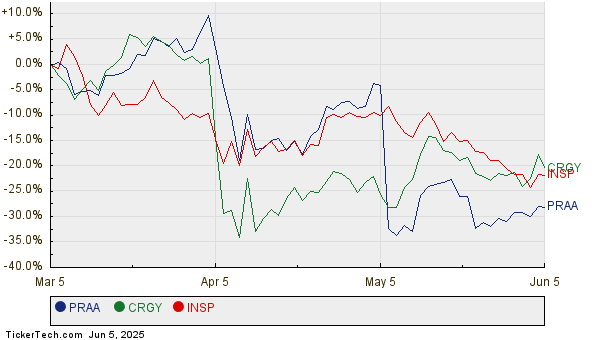

Image Source: TradingView

Meta Platforms: Stock Surges Following AI Developments

Meta Platforms (META) has excelled as both a major digital platform and an agile innovator. With billions in free cash flow and over 3 billion daily active users across platforms like Facebook, Instagram, and WhatsApp, Meta operates with significant scale while maintaining a startup-like pace.

The stock recently broke out from a multi-week consolidation period, propelled by positive developments in AI. Earlier this year, Meta introduced an AI-driven advertising platform that automates several campaign aspects, leading to improved ad engagement and accelerating revenue growth. Recently, the company announced plans to fully automate ad-buying processes by year-end, solidifying its position in AI-driven marketing technology.

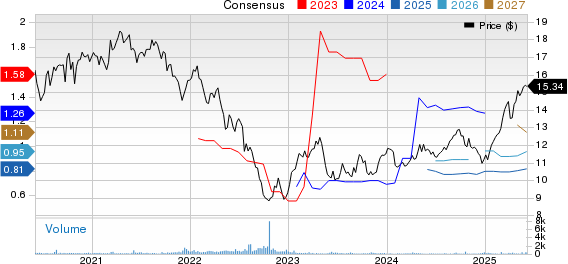

Meta’s Mixed Analyst Ratings and Growth Outlook

Meta Platforms, Inc. (META) currently has a Zacks Rank #3 (Hold), indicating mixed analyst revisions recently. The company’s shares are valued at 25.4 times forward earnings, which aligns with its historical median valuation. Analysts project Meta’s earnings to grow by 16.1% annually over the next three to five years.

Image Source: TradingView

Investment Opportunities: META, APP, and HIMS

Investors may find value in Meta, AppLovin Corporation (APP), and Hims & Hers Health, Inc. (HIMS). These companies share strong fundamentals and accelerating earnings momentum, driven by sectors like AI, digital advertising, telemedicine, and personalized health. They may be promising options for those looking to capitalize on a renewed bull market.

Zacks Research Highlights Top Stock to Watch

The Zacks team has identified five stocks with the potential to gain over 100% in the coming months. Among these, Director of Research Sheraz Mian has spotlighted one stock as having the highest potential for growth.

This top pick belongs to a fast-growing financial firm with over 50 million customers and a range of innovative solutions. While not all recommended stocks succeed, this one could significantly outperform previous recommendations like Nano-X Imaging, which increased by 129.6% in just over nine months.

For details on this leading stock and four others, you can find their analyses available for free.

This article was originally published by Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.