“`html

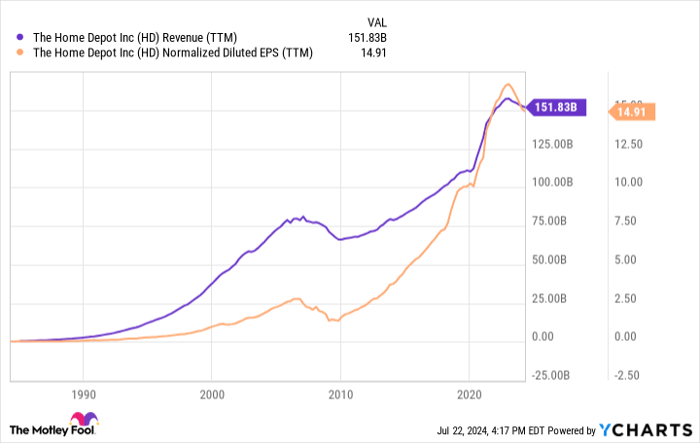

Home Depot (NYSE: HD) reported over $150 billion in annual sales, making it the largest home improvement retailer in the U.S. With an impressive 34% return on invested capital and continual dividend increases for 15 years, analysts project a long-term earnings growth of 6%. The total U.S. home improvement market is valued at approximately $867 billion, indicating significant expansion potential.

Coca-Cola (NYSE: KO), the world’s largest non-alcoholic beverage company, plans to capitalize on the fact that only 30% of consumers in developed markets drink its products weekly. It has maintained 62 consecutive annual dividend raises with a current yield of about 3%. Analysts estimate a 6% annual earnings growth moving forward.

Procter & Gamble (NYSE: PG), known for brands like Tide and Old Spice, has a solid track record of paying and increasing dividends for 68 consecutive years. The company is targeting an 8% annual earnings growth as it continues to streamline its business and leverage its strong brand portfolio, offering a current dividend yield of 2.4%.

“`