Picking Up the Best Bargains: Oversold Tech Stocks to Watch

In the information technology sector, some stocks are being overlooked, presenting potential buying opportunities for savvy investors.

The Relative Strength Index (RSI) serves as a vital momentum indicator, allowing traders to compare how a stock performs on up days versus down days. Typically, when the RSI drops below 30, the stock is deemed oversold, according to Benzinga Pro. This indicator can help traders gauge short-term performance trends.

Here is a snapshot of some key tech companies that currently show an RSI near or below 30.

Endava PLC – ADR DAVA

- On September 19, Endava reported quarterly sales that did not meet expectations. According to CEO John Cotterell, the past fiscal year has been tough, with revenue down by 4.5% in constant currency. Challenges stem from heavy exposure to the UK market and the payments industry. However, the company aims to diversify further and enhance its global delivery capabilities. Endava’s stock has dropped about 23% in the last month, hitting a 52-week low of $23.50.

- RSI Value: 25.95

- DAVA Price Action: Endava shares decreased by 3.8%, closing at $23.59 on Wednesday.

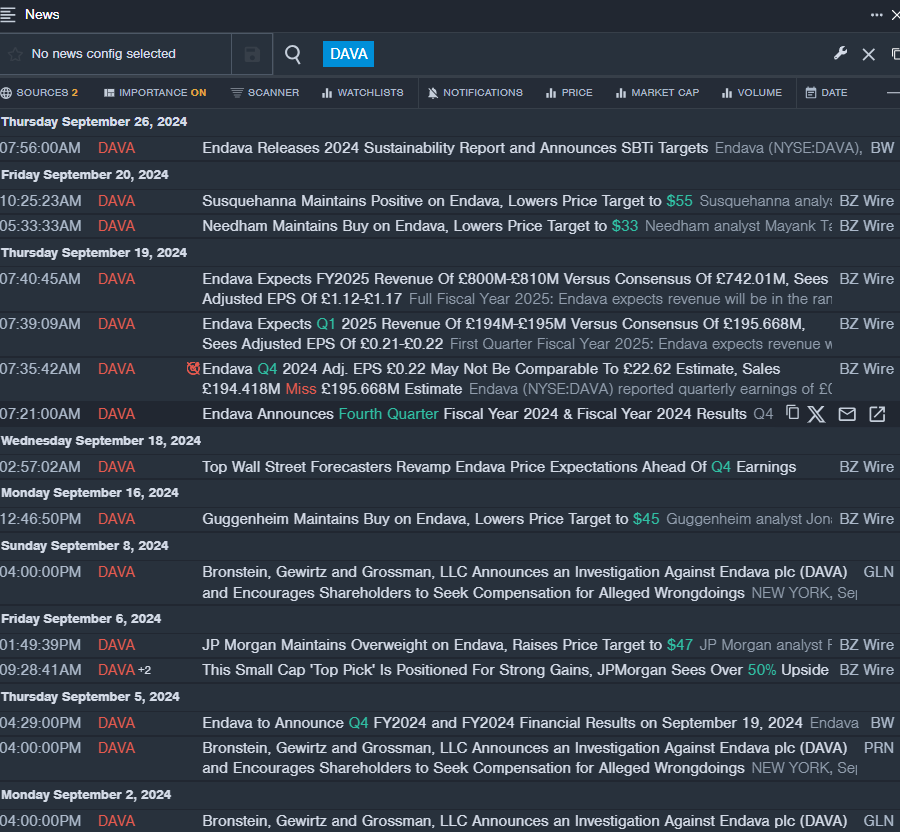

- Benzinga Pro’s real-time newsfeed updated on pertinent DAVA developments.

Verint Systems Inc. VRNT

- On September 26, Wedbush analyst Daniel Ives reaffirmed his Outperform rating for Verint Systems and set a price target of $38. The stock has declined about 9% over the last month, reaching a 52-week low of $18.41.

- RSI Value: 25.50

- VRNT Price Action: Verint shares fell 1.6%, closing at $23.60 on Wednesday.

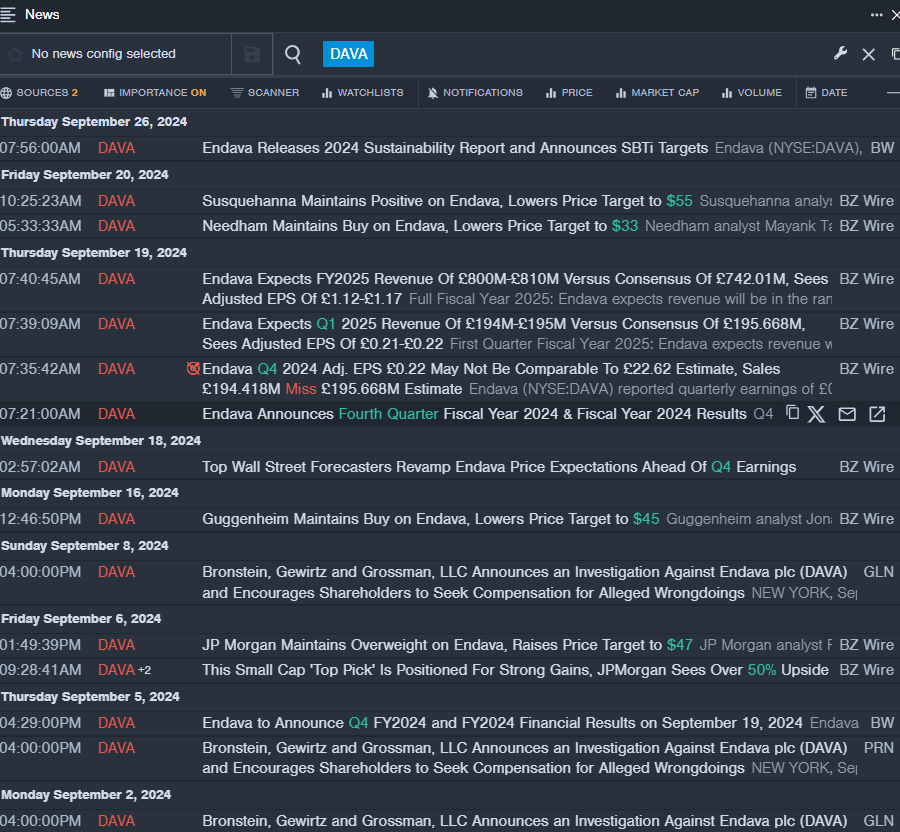

- Benzinga Pro’s charting tool monitored the VRNT stock trend.

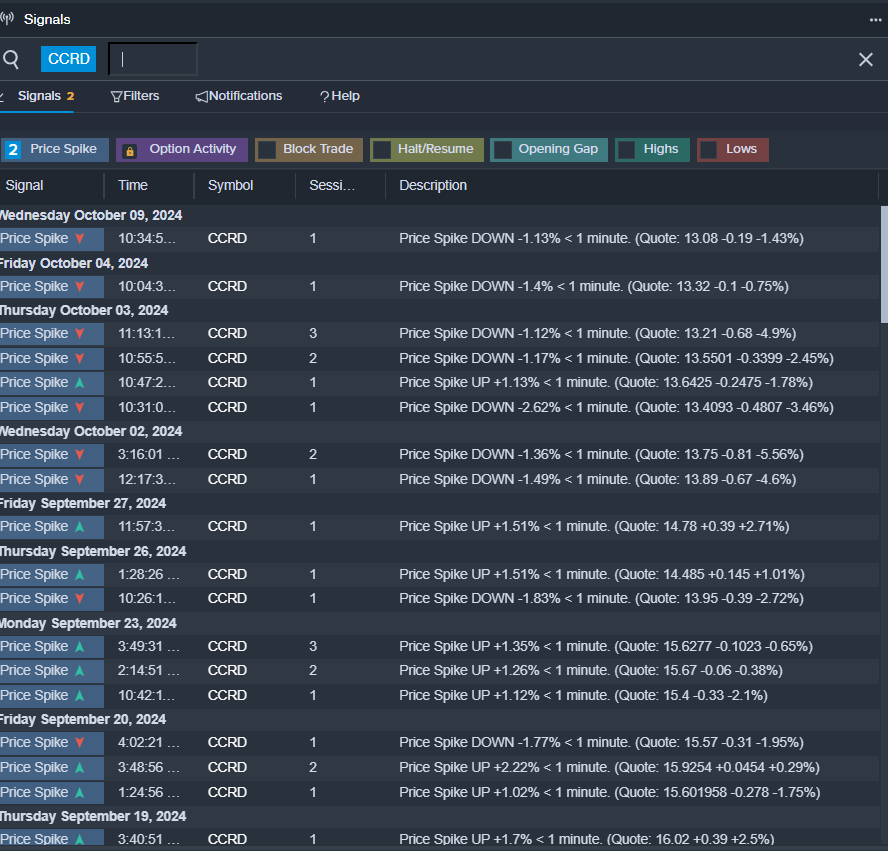

CoreCard Corp CCRD

- CoreCard reported second-quarter earnings exceeding expectations on August 1, with total revenue at $13.8 million. CEO Leland Strange noted that this aligns with their outlook, but revenues have dipped compared to last year mainly due to lower license and processing revenues from Kabbage. The stock has decreased roughly 11% in the past month, with a 52-week low of $10.02.

- RSI Value: 28.61

- CCRD Price Action: CoreCard shares dropped 2.5%, closing at $12.94 on Tuesday.

- Tools from Benzinga Pro signaled a potential breakout for CCRD shares.

Read Next:

Market News and Data brought to you by Benzinga APIs