Technology Sector Leads Market Gains with Notable Stock Performances

The Technology & Communications sector is the top performer as of midday Thursday, with a notable rise of 3.5%. Key players such as ServiceNow Inc (Symbol: NOW) and Microchip Technology Inc (Symbol: MCHP) have excelled, achieving gains of 15.0% and 12.3%, respectively. Among technology ETFs, the Technology Select Sector SPDR ETF (Symbol: XLK) mirrors this performance, climbing 3.5% today but remains down 11.65% year-to-date. Meanwhile, ServiceNow Inc is down 11.83% year-to-date, while Microchip Technology Inc has seen a 17.13% decline over the same period. Collectively, NOW and MCHP constitute approximately 2.7% of the holdings in XLK.

Trailing closely behind is the Materials sector, which has risen by 2.6%. In this category, Freeport-McMoran Copper & Gold (Symbol: FCX) and DuPont (Symbol: DD) stand out with gains of 6.6% and 4.8%, respectively. Additionally, the Materials Select Sector SPDR ETF (Symbol: XLB) is currently up 2.1% during midday trading while experiencing a slight decline of 0.65% for the year. However, Freeport-McMoran Copper & Gold is down 0.74% year-to-date, and DuPont has seen a decrease of 12.77%. Both FCX and DD together represent approximately 8.3% of the ETF’s underlying holdings.

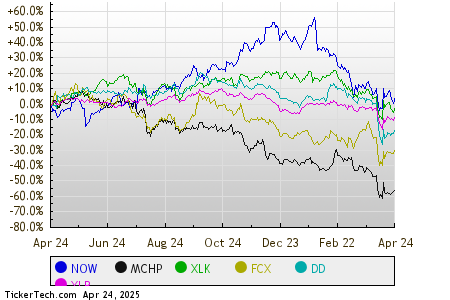

For a comprehensive view of performance, a comparative chart displaying a trailing twelve-month price performance for these stocks and ETFs is presented below. Each symbol is color-coded for ease of reference:

The S&P 500 components across various sectors also reflect gains in afternoon trading on Thursday. Notably, all sectors are recording positive changes, with nine sectors up and none down.

| Sector | % Change |

|---|---|

| Technology & Communications | +3.5% |

| Materials | +2.6% |

| Industrial | +2.1% |

| Energy | +1.7% |

| Healthcare | +1.3% |

| Financial | +1.3% |

| Services | +1.1% |

| Utilities | +0.5% |

| Consumer Products | +0.1% |

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.