Technology Sector Struggles Amid Broader Market Gains on Thursday

During Thursday afternoon trading, the Technology & Communications sector was the poorest performer, showing a slight uptick of just 0.1%. Notably, Super Micro Computer Inc (Symbol: SMCI) and NVIDIA Corp (Symbol: NVDA) are key players in this sector, with losses of 4.2% and 3.9%, respectively. In terms of technology ETFs, the Technology Select Sector SPDR ETF (Symbol: XLK) is down 0.3% for the day and has lost 16.69% year-to-date. In contrast, Super Micro Computer Inc is up 0.26% year-to-date, while NVIDIA Corp has dropped 25.24% year-to-date. Combined, these two companies represent roughly 12.5% of XLK’s underlying holdings.

The Industrial sector follows as the next slowest performer, gaining 0.3%. Among major Industrial stocks, Global Payments Inc (Symbol: GPN) and Snap-On, Inc. (Symbol: SNA) are noteworthy laggards, showing declines of 17.9% and 8.6%, respectively. The Industrial Select Sector SPDR ETF (Symbol: XLI) is up 0.8% in midday trading but has decreased by 4.38% year-to-date. Global Payments Inc has faced a significant drop of 38.18% year-to-date, while Snap-On, Inc. has declined by 9.98% year-to-date. Importantly, Snap-On represents about 0.5% of the holdings in XLI.

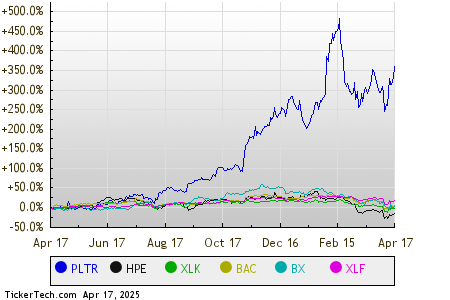

In comparing these stocks and ETFs on a trailing twelve-month basis, here is a relative Stock price performance chart, with each symbol displayed in different colors as defined in the legend at the bottom:

Here is a snapshot of how the S&P 500 components across various sectors are performing during Thursday’s afternoon trading session. Nine sectors registered gains, while none posted declines.

| Sector | % Change |

|---|---|

| Energy | +3.0% |

| Utilities | +1.7% |

| Consumer Products | +1.4% |

| Services | +1.2% |

| Materials | +0.9% |

| Financial | +0.8% |

| Healthcare | +0.4% |

| Industrial | +0.3% |

| Technology & Communications | +0.1% |

![]() Discover 10 ETFs Featuring Stocks Insiders are Buying »

Discover 10 ETFs Featuring Stocks Insiders are Buying »

Also see:

• Institutional Holders of ALXA

• OFS Next Dividend Date

• CLGX Market Cap History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.