When the closing bell rings on Wall Street, some sectors emerge as shining stars, guiding investors through the turbulent waters of financial markets. On Thursday afternoon, it was the Energy and Utilities sectors that took center stage, flexing their muscles as the best performing sectors of the day.

Energy Stocks Spark a Frenzy

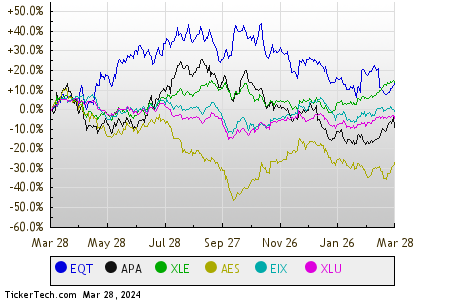

Leading the charge in the Energy sector were EQT Corp (Symbol: EQT) and APA Corp (Symbol: APA), showcasing gains of 3.3% and 2.3%, respectively. The Energy Select Sector SPDR ETF (Symbol: XLE) danced up by 1.0% during the day, boasting a 13.41% surge year-to-date. However, EQT Corp and APA Corp haven’t had the smoothest ride, down 3.20% and 3.15% year-to-date respectively.

Utilities Sector Brightens Up

Meanwhile, the Utilities sector wasn’t far behind, with AES Corp (Symbol: AES) and Edison International (Symbol: EIX) leading the pack with gains of 2.6% and 1.6%, respectively. The Utilities Select Sector SPDR ETF (XLU) saw a respectable 0.6% uptick in midday trading, with a solid 4.35% increase year-to-date. AES Corp and Edison International faced mixed fortunes, down 7.18% and 0.29% year-to-date respectively.

As investors compare these stocks and ETFs on a trailing twelve-month basis, the stock price performance chart provides a vivid illustration of the ebbs and flows of these market entities.

Turning to the broader market, a snapshot reveals a landscape where nine sectors painted the tape green, with none in the red. As the sun sets on the trading day, Energy and Utilities stand out as beacons of hope for the investor community.

| Sector | % Change |

|---|---|

| Energy | +1.2% |

| Utilities | +0.7% |

| Financial | +0.6% |

| Materials | +0.5% |

| Consumer Products | +0.4% |

| Industrial | +0.3% |

| Services | +0.2% |

| Technology & Communications | +0.2% |

| Healthcare | +0.1% |

![]() 10 ETFs With Stocks That Insiders Are Buying

10 ETFs With Stocks That Insiders Are Buying

Also see:

• Top Ten Hedge Funds Holding BNK

• GASX Split History

• BANC Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.