Technology & Communications: Micron Technology Inc. and Super Micro Computer Inc. Lead the Charge

The midday sun shines bright on the Technology & Communications sector, soaring by 1.4%. In this digital battleground, Micron Technology Inc. (MU) and Super Micro Computer Inc (SMCI) emerge as the knights in shining armor, galloping ahead by 16.4% and 8.2%, respectively. Meanwhile, the Technology Select Sector SPDR ETF (XLK) waves its banner up by 0.3% today and an impressive 9.48% year-to-date. Micron Technology Inc. and Super Micro Computer Inc. showcase their valor with year-to-date gains of 31.40% and a staggering 241.24%, respectively, elevating XLK with their combined strength, representing about 1.7% of its holdings.

Industrial Sector Gains Ground: Lam Research Corp and Stanley Black & Decker Inc Steady the Ship

Amidst the clang of machinery, the Industrial sector forges ahead by 1.1%. Lam Research Corp (LRCX) and Stanley Black & Decker Inc (SWK) emerge as the industrial giants, marching forward with gains of 4.0% and 3.1%, respectively. The Industrial Select Sector SPDR ETF (XLI) keeps pace, climbing by 1.0% today and an impressive 10.58% year-to-date. Lam Research Corp boasts a 26.26% gain in the year so far, while Stanley Black & Decker Inc faces a slight dip, down by 1.94% year-to-date, yet still holding strong with a 0.4% weight in XLI’s holdings.

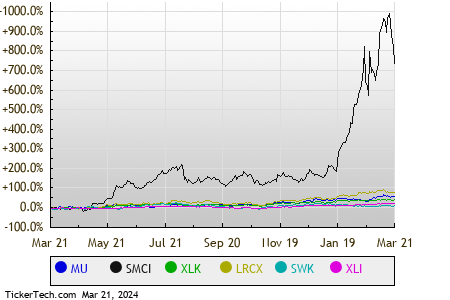

Comparative Analysis for Investors: Trailing Twelve-Month Stock Performance

For those navigating the volatile waters of the market, a visual aid can serve as a lighthouse. Below is a comparative chart reflecting the relative stock price performance of the mentioned symbols over the trailing twelve months, each hue telling a different tale as indicated in the legend.

| Sector | % Change |

|---|---|

| Technology & Communications | +1.4% |

| Industrial | +1.1% |

| Materials | +0.8% |

| Financial | +0.7% |

| Consumer Products | +0.6% |

| Services | +0.5% |

| Healthcare | +0.5% |

| Energy | +0.5% |

| Utilities | +0.3% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

SIZE YTD Return

CNQR Historical Stock Prices

KBLM market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.