Energy Sector Shines Bright in Thursday’s Trading

In afternoon trading on Thursday, energy stocks led the market, increasing by 0.6%. Notably, Kinder Morgan Inc. (Symbol: KMI) and Williams Cos Inc. (Symbol: WMB) were the standout performers, gaining 3.0% and 2.6%, respectively. Among energy ETFs, the Energy Select Sector SPDR ETF (Symbol: XLE) saw a 1.0% rise for the day and is up 13.68% year-to-date. Kinder Morgan’s remarkable performance stands at a substantial 66.41% increase year-to-date, while Williams Cos is up 69.98%. Combined, KMI and WMB account for about 5.3% of XLE’s underlying holdings.

Consumer Products Also Show Strength Amid Market Fluctuations

The next best performing sector is Consumer Products, climbing by 0.4%. Within this sector, Brown-Forman Corp (Symbol: BF.B) and Tesla Inc. (Symbol: TSLA) made headlines with gains of 10.2% and 3.0%, respectively. The iShares U.S. Consumer Goods ETF (IYK), which tracks these stocks, is up 0.5% during midday trading and has increased by 11.23% this year. However, it’s worth noting that Brown-Forman currently shows a year-to-date decline of 19.71%, whereas Tesla is enjoying a solid 48.42% rise.

Performance Insights Over the Past Year

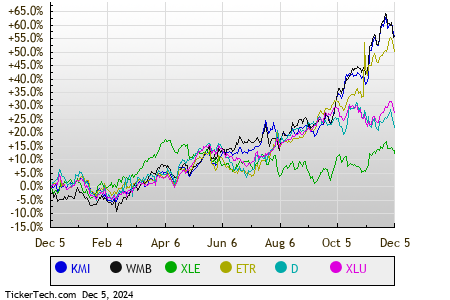

Analyzing these stocks and ETFs over the trailing twelve months provides valuable insights into their price performance. Below is a comparative chart depicting their performance, with each stock represented in different colors as indicated in the legend below:

S&P 500 Sector Performance Overview

Here’s a quick look at how the various sectors within the S&P 500 are performing in Thursday’s afternoon trading. As seen in the table below, four sectors are experiencing gains while the other four are seeing losses.

| Sector | % Change |

|---|---|

| Energy | +0.6% |

| Consumer Products | +0.4% |

| Utilities | +0.4% |

| Financial | +0.2% |

| Services | -0.0% |

| Industrial | -0.5% |

| Healthcare | -1.0% |

| Materials | -1.0% |

| Technology & Communications | -1.1% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

• VCLT Historical Stock Prices

• Berkley DMA

• EYES Split History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.