Consumer Products Sector Struggles as Utilities Show Mixed Results

During afternoon trading on Thursday, Consumer Products stocks are lagging, rising only 0.1%. Notably, LKQ Corp (Symbol: LKQ) and Pool Corp (Symbol: POOL) are underperforming, with losses of 11.5% and 5.9%, respectively. The iShares U.S. Consumer Goods ETF (Symbol: IYK), which tracks this sector, is down 1.5% for the day but has increased by 7.48% year-to-date. In contrast, LKQ Corp has gained 2.23% year-to-date, while Pool Corp has seen a decline of 14.29% in the same period.

The Utilities sector follows closely behind, with a modest increase of 0.5%. Among the larger companies in this sector, NextEra Energy Inc (Symbol: NEE) and Xcel Energy Inc (Symbol: XEL) both reported losses of 2.3% and 1.5%, respectively. The Utilities Select Sector SPDR ETF (XLU), which closely mirrors Utilities stocks, is experiencing a slight uptick of 0.2% today and is up 4.43% year-to-date. Year-to-date performance has NextEra Energy down 7.52%, whereas Xcel Energy has risen by 6.02%. Together, NEE and XEL represent approximately 14.7% of the XLU’s underlying holdings.

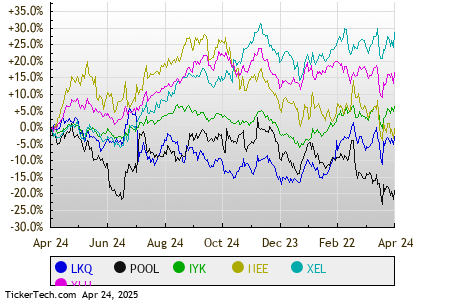

For a comparative analysis, below is a relative Stock price performance chart spanning the trailing twelve months, featuring each symbol in distinctive colors as detailed in the legend at the bottom:

Below is a snapshot of how S&P 500 components across various sectors are performing in afternoon trading on Thursday. You can note that while nine sectors are in the positive today, none are experiencing declines.

| Sector | % Change |

|---|---|

| Technology & Communications | +3.5% |

| Materials | +2.6% |

| Industrial | +2.1% |

| Energy | +1.7% |

| Healthcare | +1.3% |

| Financial | +1.3% |

| Services | +1.1% |

| Utilities | +0.5% |

| Consumer Products | +0.1% |

![]() 25 Dividend Giants Widely Held By ETFs

25 Dividend Giants Widely Held By ETFs

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.