NVIDIA Sees Upgraded Rating Amid Positive Market Trends

On January 28, 2025, Tigress Financial elevated their outlook for NVIDIA (NasdaqGS:NVDA) from Buy to Strong Buy.

Analyst Predictions Indicate Significant Growth

The average price target for NVIDIA is now set at $175.12 per share, reflecting a potential increase of 35.78% based on its most recent closing price of $128.98. Projections vary widely, with estimates ranging from a low of $76.15 to a high of $231.00.

Projected Financials Reflect Downward Trend

NVIDIA’s anticipated annual revenue is pegged at $36,874 million, marking a steep decline of 67.45%. The expected non-GAAP earnings per share (EPS) stands at 5.70.

Investor Interest Grows

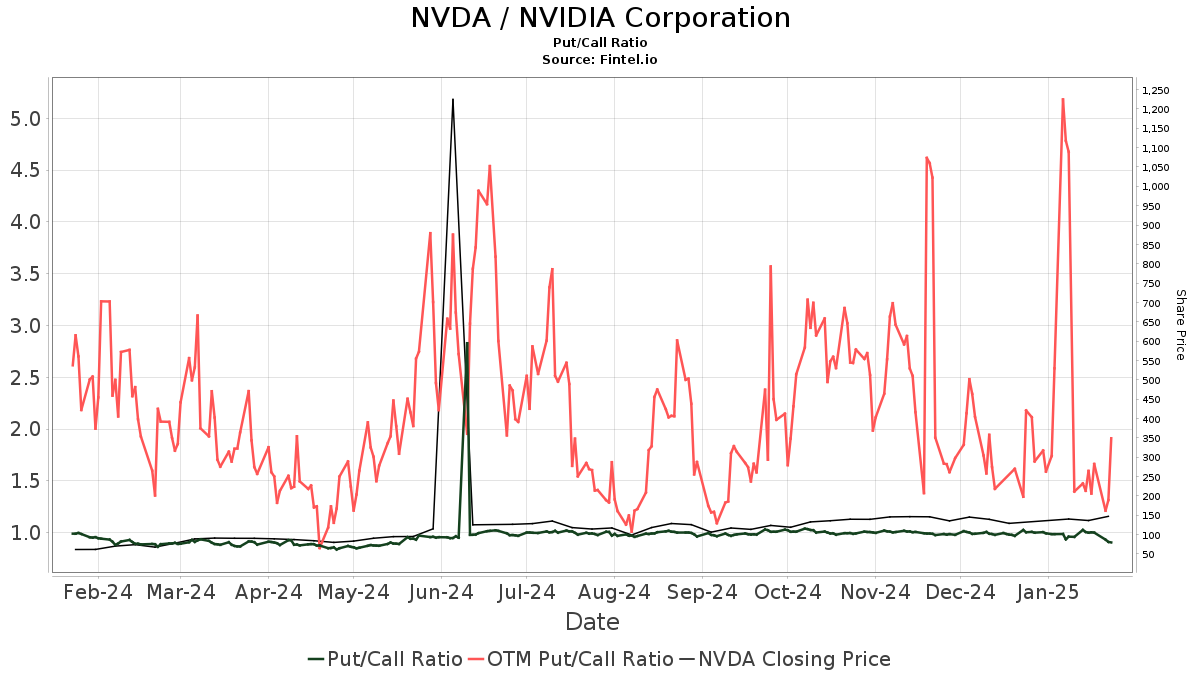

A total of 6,734 funds currently hold positions in NVIDIA, an increase of 202 institutions or 3.09% from the previous quarter. The average portfolio weight for all funds dedicated to NVDA is currently at 2.62%, up by 20.12%. Over the past three months, total institutional shares owned rose by 1.69% to 17,702,220K shares. Notably, the put/call ratio for NVDA sits at 0.91, suggesting a bullish outlook among investors.

Institutional Movements

Vanguard’s Total Stock Market Index Fund (VTSMX) holds 740,783K shares, accounting for 3.02% ownership. This reflects a minor increase of 0.34% from the last filing, although the fund reduced its allocation in NVDA by 7.36% over the last quarter.

Vanguard 500 Index Fund (VFINX) has a stake of 644,278K shares, representing 2.63% ownership, with a 2.01% increase from previous holdings, despite also decreasing its NVDA allocation by 7.68% last quarter.

Geode Capital Management owns 546,079K shares, or 2.23% of NVIDIA, indicating a 2.11% increase. However, they too have decreased their portfolio’s NVDA allocation by 7.41% recently.

JPMorgan Chase holds 409,280K shares, now 1.67% of the company, with a reported increase of 4.00% from earlier filings, although they reduced their investment in NVDA by 5.10% last quarter.

Price T Rowe Associates has 407,608K shares, making up 1.66% ownership. This fund saw a notable decline of 9.07% from previously reported holdings, alongside a drastic reduction of 56.71% in their NVDA allocation over the last three months.

NVIDIA’s Industry Position

NVIDIA is recognized as a leader in GPU-accelerated computing. The company focuses on products for the expanding sectors of gaming, professional visualization, data centers, and automotive technologies. Their innovations cater to demanding users such as gamers and scientists, placing them at the forefront of developing technology trends.

Fintel offers one of the most extensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

The platform encompasses global data that includes fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, and various trading insights. Furthermore, Fintel’s exclusive stock selections are supported by sophisticated, backtested quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.