As the financial sector gears up for the Q4 earnings season, multiple eyes are on big banks such as JP Morgan JPM and Bank of America BAC to set the tone. However, amidst these big players, consumer lending stocks like Ally Financial ALLY and Synchrony Financial SYF have been shining bright, standing out in the financial sector.

Both these companies are hovering near their 52-week highs and are scheduled to report their Q4 results later this month on January 19 and 23, respectively. Before diving into their reports, let’s analyze whether it’s the right time to consider investing in Ally or Synchrony stocks for further growth.

Recent Performance Overview

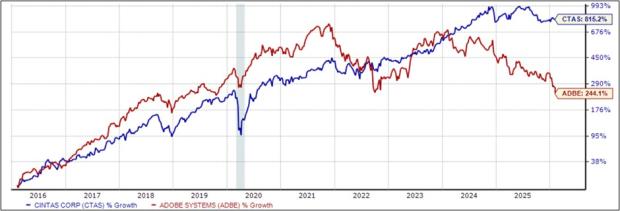

Ally and Synchrony are both diversified financial service providers. While Ally offers a broad range of financial products primarily to the auto industry, Synchrony provides credit products through various national and regional retailers and local merchants. Over the past year, Ally’s stock performance has been robust, with shares up by 36% compared to S&P 500’s 24% rise. Similarly, Synchrony has seen its stock surge by 17%, hitting 52-week highs of over $38 per share, indicating significant strength in the market.

Image Source: Zacks Investment Research

Q4 Previews & Outlook

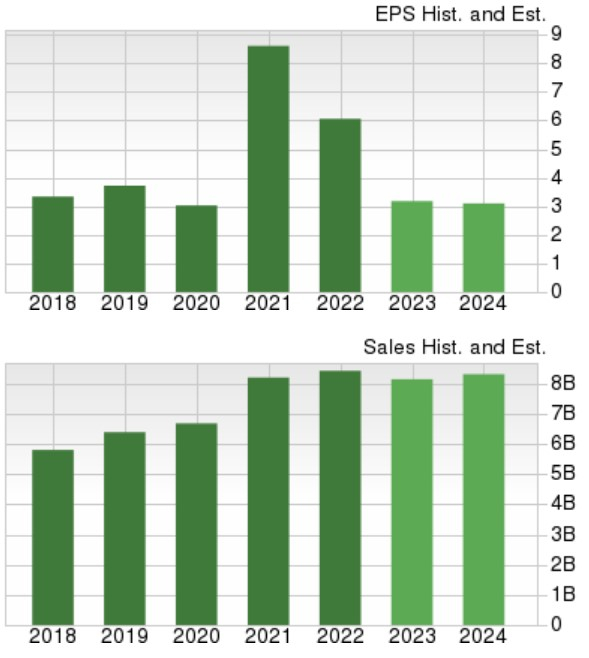

Ally and Synchrony face tough comparisons with their previous year’s Q4 earnings. For Ally, fourth-quarter earnings estimates currently stand at $0.51 per share compared to $1.08 per share in Q4 2022. On the other hand, Synchrony’s Q4 earnings are expected to decrease by 22% to $0.98 per share from $1.26 per share in the comparative quarter. Despite these challenging expectations, Synchrony’s fourth-quarter sales are projected to rise by 8% year-over-year to $4.45 billion.

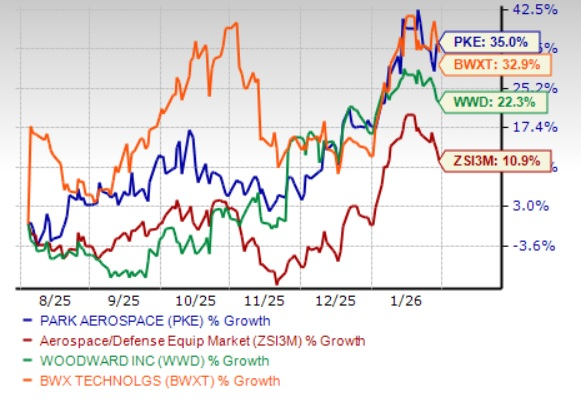

Image Source: Zacks Investment Research

Strong Value

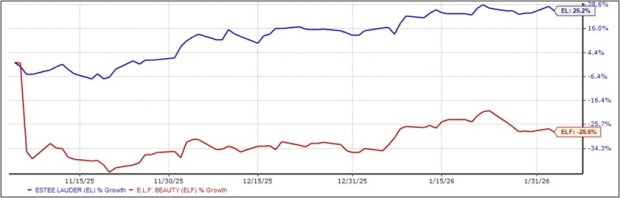

Even though Ally and Synchrony might appear to be losing their post-pandemic momentum in terms of bottom-line figures, their stock surge has mainly been driven by reasonable valuations. Currently, Ally’s stock trades at a very reasonable 10.8X forward earnings multiple, while Synchrony shares trade at just 7.3X. Additionally, Ally offers investors a generous 3.5% annual dividend yield, while Synchrony’s 2.67% yield surpasses the S&P 500’s 1.4% average.

Image Source: Zacks Investment Research

Takeaway

Both Ally Financial and Synchrony Financial stocks currently hold a Zacks Rank #3 (Hold). The possibility of reaching higher highs may hinge on their Q4 results, but retaining positions in these consumer finance leaders may continue to be rewarding at their present levels.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.